Born in northeastern China, 3 hours’ drive from the border with North Korea, Charlene Cong is now an independent finance and investment coach based in Zurich. After a decade in banking – including a position at J.P. Morgan – she took the leap into building her own business. By her early 30s, she had already built a net worth exceeding one million Swiss francs – a milestone she attributes to a strong money mindset, discipline and a consistent investment strategy.

In this interview, Charlene shares why she left her comfort zone, how she invests today, and why financial independence means much more to her than simply having money in the bank.

Contents

At a Glance

Name: Charlene Cong

Location: Meilen (Zurich)

Profession: Independent financial and investment coach, 10 years in banking incl. J.P. Morgan

Qualification: CFA Charterholder

Financial milestone: First million by her early 30s

Motto: Start before you’re ready.

Part 1 – The Person

Charlene, you grew up in China, close to the North Korean border – not exactly the epicenter of capitalism. How did that background shape you?

I wasn’t unfamiliar with money talk growing up since my father is a chartered accountant and runs his own business. But most of the financial knowledge I was exposed to was more about making and saving money, not investing. From a young age, my dream was to become financially independent from my family. I saw that as the key to freedom and having real choices in life. (And finally don’t need to listen to them for everything haha!) That mindset has stayed with me ever since.

When did you first realize that finance and investing fascinated you?

Even though I was already fascinated by the idea of making money from money when I was young, I didn’t come from a traditional finance background. I had a bachelor’s degree in literature and a master’s in journalism.

The turning point came when I moved from Beijing to Hong Kong for my master’s degree. In one of the world’s financial centres, I was constantly surrounded by people talking about investments and markets. That really sparked something in me.

After graduation from Hong Kong University, I became a banking journalist. My first full-time job was interviewing multimillionaires, billionaires, and their bankers. That’s when finance and investing became more than just a curiosity, it became my full-time job.

How would you describe yourself in three words – and how do you think others would describe you?

Curious, ambitious, and action-taker. Some of my friends say I’m a little over-confident sometimes (haha!) – but I think that’s what you need when you’re building something new and stepping outside the norm.

Part 2 – Career and Turning Points

You had a well-paid job at J.P. Morgan – what was your role there, and why did you decide to leave corporate eventually?

At J.P. Morgan in Hong Kong, I worked in the Asset Management division serving private bank clients. Later, I moved to Zurich and joined a private banking technology firm in 2022.

«At some point, I felt like I was only making the rich even richer.»

After 10 years in corporate, I started questioning the meaning behind my work. Throughout my career – from being a private banking journalist to working at a bank and then a banking technology firm – I realized I was always serving the same group: high-net-worth individuals. It began to feel like I was just helping the rich get richer.

I thought, what if I could use my experience to help everyday people understand money and build wealth with confidence? That idea gave me a new sense of purpose.

And to be honest, I wasn’t happy in my last job either. Luckily, because I started investing early, by that time I had built a 7-figure portfolio. That gave me the freedom and security to take the risk and start something of my own.

What fears did you have when moving into self-employment – and how did you overcome them?

So many fears. What if I fail? What will other people think about me? What if I have to go back and look for a job again? How will my family, partner, friends react?

But at some point, I asked myself: I don’t have kids yet, I’ve built a financial safety net, and I don’t have any major financial burdens. Life is short and we will all die just in a few decades. If not now, when?

What was the most valuable lesson you took away from your corporate career?

I’ve interviewed over 500 multimillionaires and their bankers during my journalism career, and almost all of them said the same thing in one way or another: start investing early and make your money work strategically for you. That key lesson later became the foundation of my investment coaching.

Part 3 – Money Mindset, Wealth Building & Charlene’s Strategy

You reached your first million by your early 30s. How did you structure your wealth?

The majority of my portfolio is in globally diversified equities, with some limited exposure to fixed income. I also allocate a portion to alternative assets like cryptocurrency, real estate, and gold. In the early stages, I held a lot of single stocks, but I’ve been reducing that exposure over time.

My approach has always been goal-based – what am I trying to achieve, and which investment options best support my short-, mid-, and long-term goals? That’s exactly what I now teach: strategy before product.

How high is the impact of compound interest on your wealth growth – after about ten years or once you had reached your first million?

Over roughly ten years in corporate, I earned about CHF 1 million and saved a bit more than half. By investing consistently, that around CHF 500,000 grew to CHF 1 million. And now, most of the growth of the portfolio comes from compounding rather than saving. The money is growing faster on its own.

Broker selection is a topic passionately debated within our community. Which broker(s) did you choose – and why?

I use both Swissquote and Interactive Brokers. Swissquote for local convenience and safety, and IB for its low fees and global market access. What really matters is choosing a broker that fits your needs: things like costs, user experience, additional services, and tax reporting should all be considered.

(More about Charlene’s preferred brokers in our reviews: Swissquote | Interactive Brokers)

Your financial credo is: «Earn money, save money, invest money.» Let’s start with the first part – earn money: You made several career moves as an employee – to what extent did financial advancement influence your decisions?

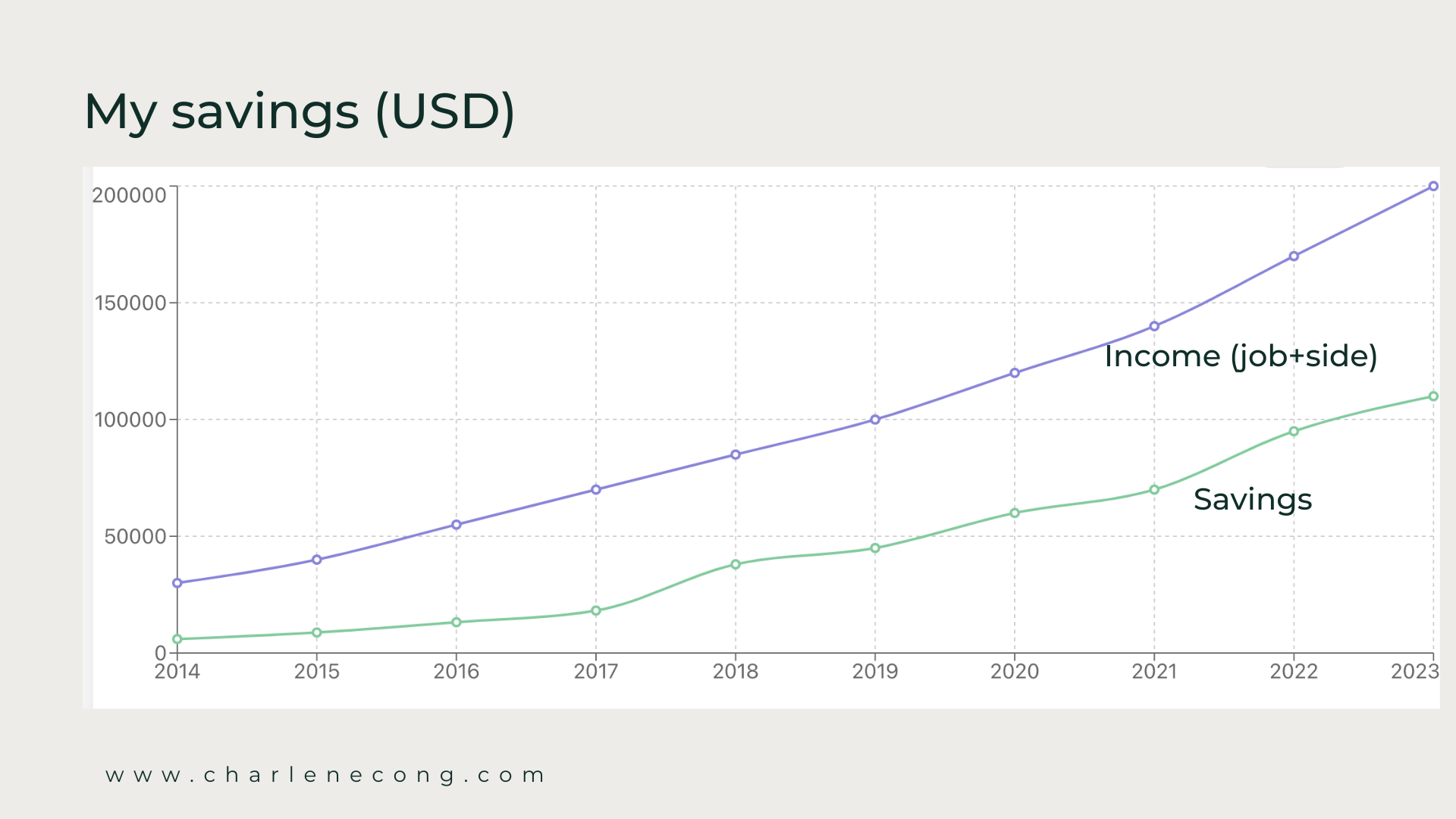

Absolutely. I’m actually quite transparent about the numbers – how much I earned, saved, and invested over the past 10+ years. I’ve been quite intentional about choosing roles where I could both learn and grow my income. I started with a job earning around USD 30K, and by the time I left corporate, I was making around USD 200K – including a few small side businesses along the way.

And when it comes to the second part – save money: How do you ensure that you consistently stick to your savings goals?

«As my income grew, I saved 50% – sometimes even more.»

I tried to automate everything. The moment my salary lands, a fixed percentage goes straight into my investment account. I treat saving like paying a non-negotiable bill. In the beginning, when I was earning just USD 30K, I couldn’t save much, but I still saved a fixed percentage. As my income grew, I was able to save 50%, sometimes even more.

Finally, the third part – invest money: How do you implement your investment strategy in practice?

I follow a goal-based investing approach. My portfolio is divided into 3 buckets: short-term, mid-term, and long-term goals. Each has its own allocation. I normally rebalance and review annually.

My honest view is this: for most normal 9–5 professionals (not talking about successful entrepreneurs), the most realistic and sustainable way to build wealth is very simple – earn money, save money, and invest money. That is exactly how I did it and you can too.

How do you deal with the lifestyle inflation – a widespread phenomenon that keeps many people from achieving financial freedom?

I definitely enjoy a better lifestyle than I did 10 years ago, but I wouldn’t say I’ve fallen into serious lifestyle inflation. One tip that really helps me is to always ask myself: Is this spending going to bring long-term value or just short-term pleasure?

«I don’t even get my hair cut in Zurich – it’s too expensive!»

For example, I’m always happy to invest a few thousand every year in fitness and business coaching, because it boosts my energy and productivity, and that’s a long-term return. But I usually skip things like designer handbags (I do have one Gucci bag though) or fancy Michelin-star dinners. And I don’t get my hair cut in Zurich, because it’s so expensive here! I always wait to have haircut when I travel in Asia. haha

Full financial freedom would mean being able to stop working altogether – living solely off passive income and wealth drawdown. Could you do that tomorrow?

Technically I could stop working now and live off investments if I kept my lifestyle in check. But honestly, I love what I do now. For me, financial freedom isn’t about lying on a beach and retiring early. It’s about having freedom and choices. And right now, my biggest goal is to help others reach that same point through investing early and strategically.

Part 4 – Life in Switzerland

You’ve been living in Switzerland for several years. What do you particularly appreciate about Switzerland?

The nature, the security, the lifestyle balance, it’s hard to beat.

Is there anything specific you miss from your Asian home country?

Food!! I love seafood and spicy Sichuan food. Oh gosh… I really miss it!

Part 5 – Outlook, Learnings & Special Offer

Where do you see yourself in five years – both personally and professionally?

Personally, I see myself splitting my time between Switzerland and somewhere tropical. Professionally, my goal is for our VISION Investment Academy to become the go-to investing educational program for people who live in Switzerland – especially for those with no finance background who want to finally take control of their money.

What advice would you give to people striving for financial freedom?

Start investing early and start strategically! Don’t just follow some financial gurus who tell you to buy a few ETFs or stocks or cryptocurrency.

If you had to summarize your most important learnings in the investment journey in three points, what would they be?

1. Don’t wait, take action now.

2. Start with your goals, not hot stock tips.

3. Automation beats willpower every time.

Aside from good English skills, what else people need to attend your financial coaching sessions?

With an open mind and a willingness to learn, that’s really all you need. I’ve had students and clients with multiple PhDs, CEOs, and heads of departments at global firms and I’ve also had students and clients who work as chefs, electricians, and people from refugee backgrounds who never finished primary school. Your background doesn’t define your financial future.

And where do they struggle – what are, in your experience, the biggest stumbling blocks on their path to financial independence?

Overwhelm. There’s too much noise – YouTube, Reddit, TikTok. Everyone says «just follow my strategy» or «just buy these ETFs and hold» but nobody shows how to build a plan around your specific life goals. That’s what I am trying to fix.

And for anyone who’d like to learn more about your approach and course, where they can find you?

To be fully transparent, we offer both a free training and a paid program. But my honest recommendation is to start with the free session first. If it resonates with you and you feel ready to go deeper, then you’ll have the option to join our signature VISION Investment Academy later. No pressure, just your choice.

– P a r t n e r O f f e r –

- Sign up for the free training: https://charlenecong.com/free-training/

- Schedule a free clarity call with Charlene and join VISION Investment Academy: https://charlenecong.com/vision/

- If you decide to continue after the free training, you can use the code sfbfriends to get a CHF 520 discount for the VISION Investment Academy – and we, at Schweizer Finanzblog, receive a small commission at no additional cost to you.

– – – – –

Charlene, thank you very much for the insightful and inspiring conversation.

(The interview took place on 27 October 2025. Charlene and Stefan first met at a Swissquote event and later continued their conversation at Restaurant Ruby in Zurich – the foundation for this interview.)

This might also interest you

Newsletter

Newsletter