neon has restructured its offering: Individual services have been reduced in the entry-level model without a basic fee, while fee-based variants offer additional benefits. At the same time, neon is further expanding its ecosystem – including a newly launched pillar 3a solution that is fully integrated into the app.

In this review, we share our neon experiences – from paying, saving and saving for retirement to investing with ETFs, including a particularly exciting one with no purchase fees.

Short & sweet

neon is a Swiss neobank founded in 2017 with a focus on app-based payments, savings, investments and pensions via smartphone with around 240,000 customers.

-

Account models & costs:

-

Four variants: neon free, neon plus (CHF 20/year), neon global (CHF 80/year) and neon metal (CHF 150/year)

-

Favorable foreign card payments with 0% to 0.35% FX surcharge, depending on the account model

- No multi-currency account

-

-

Investing & ETFs:

-

No custody or exchange fees, trading currency always CHF

-

ETF trades at 0.5 % per transaction, particularly attractive for amounts up to around CHF 1,000

-

Selected ETFs in the savings plan without purchase commission

-

-

Pension provision: Pillar 3a solution fully integrated into the app with total costs of 0.39% to 0.45% p.a. – one of the cheapest on the Swiss market

-

Security: Swiss regulation with deposit protection up to CHF 100,000

Our neon experience shows: If you want to do your banking, investing and pension planning simply, digitally and cost-effectively via smartphone and don’t need a multi-currency account, neon is a convincing solution.

🎁With our neon promotion code neonSFB you benefit from 100 CHF trading credits.

Contents

- CHF 100 bonus – with promotion code neonSFB

- What is neon?

- What does neon offer?

- Our neon experience with payment transactions

- neon services and prices when paying WITHOUT a card

- neon free services and prices when paying WITH card

- Our neon experience with savings

- Our neon experience with investing

- neon pillar 3a – simple and affordable

- How good is neon’s support?

- How can I register with neon?

- How safe is neon?

- Why neon – and when rather Yuh?

- Conclusion from our neon experience

- This might also interest you

- Updates

- Disclaimer

CHF 100 bonus – with promotion code neonSFB

If you are convinced by neon’s offer, you can secure the following starting bonus:

🎁 100 CHF trading credits

This allows you to make investments of up to CHF 20,000 free of charge. You also support our blog.

👉 This is how it works:

- Download the neon app on your smartphone and register.

- Enter the promotional code neonSFB when registering.

- Transfer at least CHF 1 to your neon account to activate it.

- After activation, you will receive CHF 100 trading credits – valid for the first three trades within two months.

📌 The fees are debited normally after the trade and credited after two working days.

Let’s start with our neon experience.

What is neon?

The Swiss smartphone bank was founded in 2017 with the aim of being the first independent account app in Switzerland . The guiding principle behind it: unbeatably cheap, super simple and completely secure.

The four founders behind neon are Jörg Sandrock, Julius Kirscheneder, Simon Youssef and Michael Noorlander. The official launch took place in March 2019.

With around 240,000 customers, neon is now one of the largest neobanks in Switzerland. This market success is all the more astonishing given that neon – unlike other competitors such as Yuh or Zak – was not launched by wealthy, established banks, but by a handful of innovative minds with a comparatively small budget.

neon offers an attractive mix of banking services that can be individually expanded to suit your needs.

What does neon offer?

The neon product range essentially covers four basic financial functions:

- Figures

- Saving

- Invest

- Precautions

In this test report, we examine all four areas: We explain what services neon offers, assess their benefits – and put a price tag on each. In line with our mission, we pay particular attention to the topic of investing.

Unique variety: four neon plans…

With the comprehensive relaunch in May 2025, neon is focusing even more strongly than before on a range of products tailored to individual needs with no fewer than four different plans:

- neon free: “The digital everyday account for complete independence.” (without basic fee)

- neon plus: “The smart account with extra accessibility.”

- neon global: “The borderless account with extra protection online and on the move.”

- neon metal: “The exclusive account for an all-round carefree lifestyle.”

Despite all the variety, the fact is that the new, fee-based neon plus includes services that were previously included in the free neon free:

- No exchange rate fees for card payments

- Two free cash withdrawals per month

- Telephone service

neon free now charges an exchange rate fee of 0.35 % – still attractive compared to the market, but a deterioration on the previous, unrivaled offer. Cash withdrawals at ATMs now also cost CHF 2.50 per transaction. However, neon offers a valid alternative to the latter: free cash withdrawals are now possible at Coop, Aldi and Lidl from a minimum purchase of CHF 10.

Nevertheless, “neon free” is likely to remain the most popular plan, as it is the only one without a basic fee. The other three plans are subject to a charge and offer more service in return.

You can find more information on the current account models on the neon website.

…can be combined with two extensions

The following two optional extensions can be purchased for each of the four plans presented above:

- neon green: “For a climate-active everyday life.“

- neon duo: “The joint account for duos.“

Neon green” option

For all those who want to do something good for the environment when paying by card, the card is available in unvarnished cherry wood (!) or recycled plastic. For every CHF 500 spent with the neon green card, neon plants a tree. neon green can be combined with all the plans presented above and costs an additional CHF 3 per month.

You can find more information about the green offer on the neon website.

neon duo” option

neon also offers the neon duo joint account as an option. It can also be combined with all neon plans. neon describes it like this:

- For 2: The account for everyone who has a shared flat. In love, engaged, married, concubined – or just friends

- One login, one app: switch between private and joint accounts with a swipe

- 2 cards, 1 IBAN

- An overview of your joint payments and transactions at all times

- 3 CHF per person and month

- Open an account directly in the app – without any paperwork or branch visits

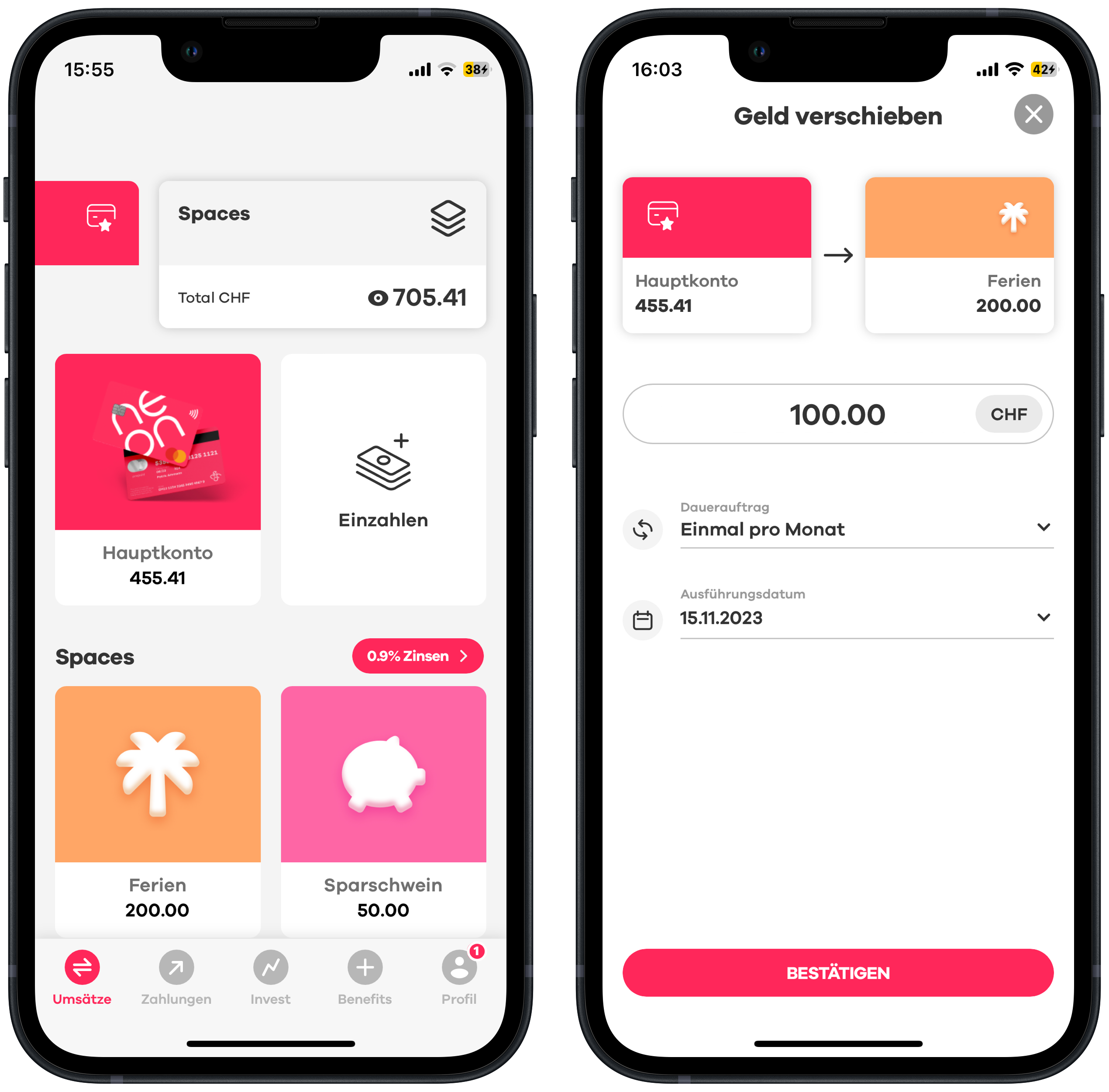

What we find particularly innovative about neon duo is that you can manage both the individual and the joint account in the same app and keep an eye on the finances of both worlds at all times with a single swipe. However, there is one downside: neon doesn’t offer this cool feature for free, but charges an additional CHF 3 monthly fee per person.

You can find more information about the joint account on the neon website.

Our neon experience with payment transactions

Payment functions and conditions are likely to be at the forefront of most people’s minds when choosing a smartphone bank.

In the following, we will break down the neon free offer into the individual services and provide them with the corresponding price tag (see also the neon price list).

neon services and prices when paying WITHOUT a card

- Free account management (any interest is only paid on the savings account)

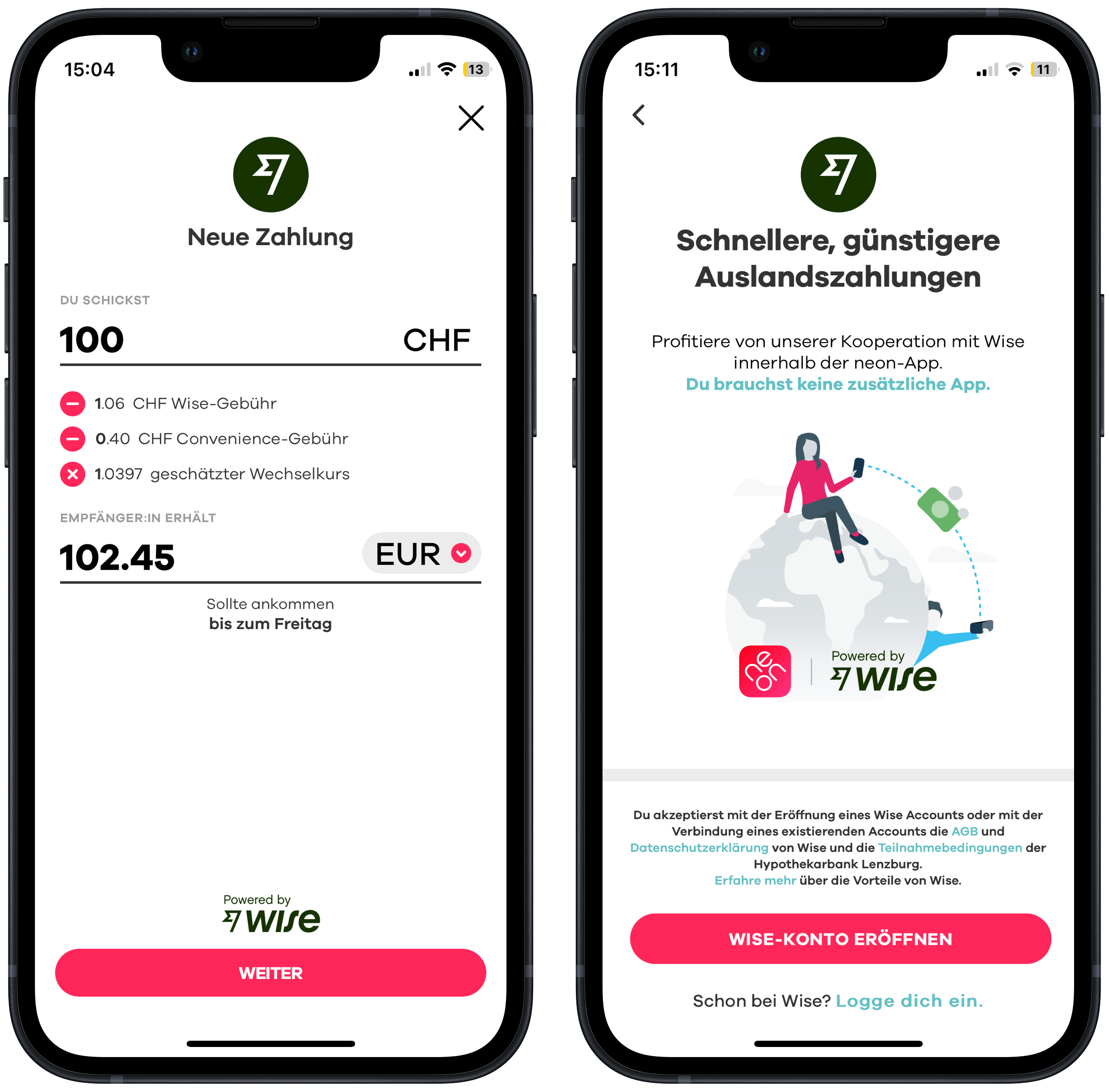

- Domestic IBAN transfers in CHF free of charge and in EUR with 1.5% exchange rate surcharge

- International transfers possible in 20 currencies including EUR; fees depending on amount and currency usually between 0.8 – 1.7%, consisting of the partner fee from Wise and the so-called convenience fee from neon, but without exchange rate surcharge

- Transfer types: one-off (manual), regular (standing order or LSV), eBill, TWINT

- Cash deposits and overdraft not possible

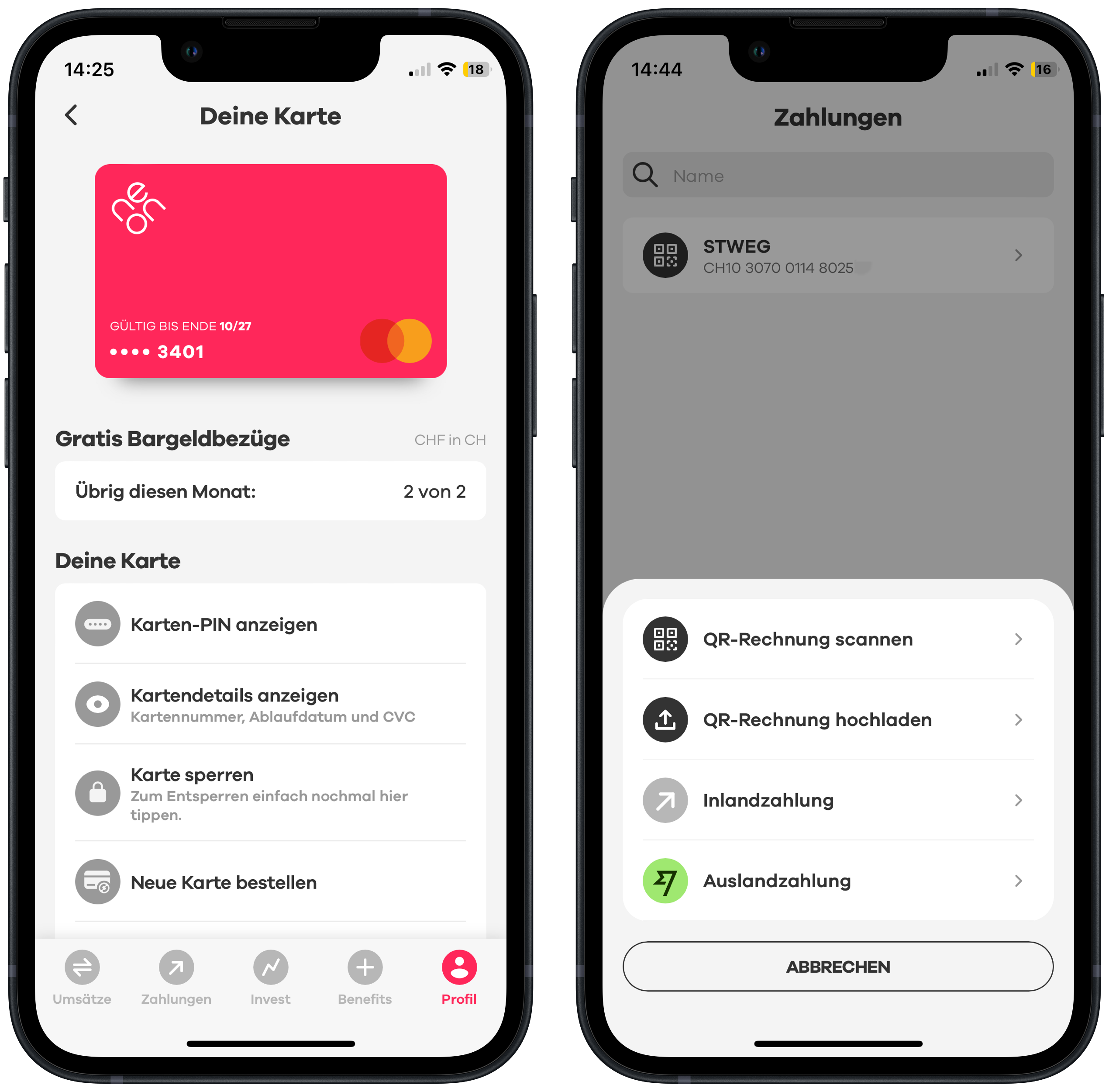

neon free services and prices when paying WITH card

- No basic fee, but a one-off fee of CHF 20 for debit card or neon Mastercard

- 0.35% exchange rate surcharge for card payments based on the Mastercard exchange rate

- Domestic ATM withdrawals: CHF 2.50 for withdrawals in CHF; CHF 5 for withdrawals in EUR

- Free cash withdrawals in Switzerland at Coop, Aldi and Lidl from a minimum purchase of CHF 10

- 1.5% per withdrawal abroad (regardless of currency; no exchange rate surcharge)

- Card can also be used via smartphone and watch: “Apple Pay”, “Google Pay”, “Samsung Pay” as well as SwatchPAY! and Garmin Pay

- Monthly card limit of CHF 10,000, CHF 5,000 each online and in-store

Note: In September 2024, neon replaced the previous Mastercard prepaid card with a new debit card from Mastercard. The conditions are the same, but the new card is even better accepted. For example, it can also be used at the post office. The new card will be issued to all new customers and all existing customers whose prepaid card needs to be replaced.

Conclusion on paying with neon

For everyday payments, neon free is an attractive choice: no basic fee, 0.35% exchange rate fee for card payments abroad and a user-friendly app for simple account management. Ideal for anyone who is cost-conscious when traveling and rarely needs cash.

If, on the other hand, you frequently pay by card abroad, occasionally withdraw cash from ATMs or appreciate personal telephone support, you’re better off with neon plus (CHF 20/year): the exchange rate fees for card payments are completely waived and two cash withdrawals per month are included – a worthwhile upgrade for frequent users with an affinity for travel.

The fee-based plans neon global (CHF 80/year) and neon metal (CHF 150/year) offer additional benefits such as insurance or exclusive cards. Whether this is worthwhile for you depends on whether you really need these extras – it’ s best to take a close look and weigh them up for yourself.

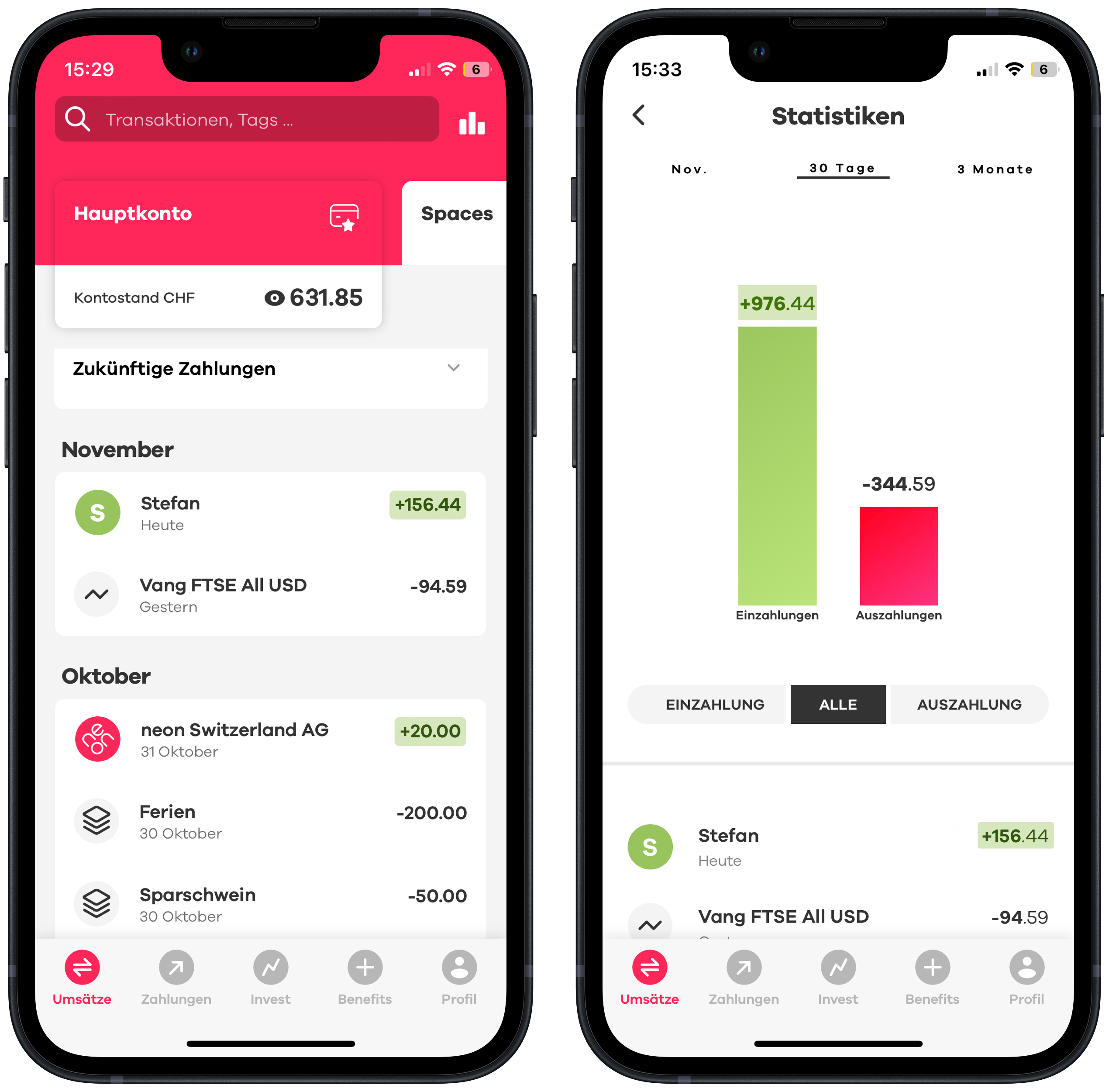

Our neon experience with savings

To save with neon and benefit from the interest rate, you must first set up a separate account with your own IBAN. This is done in just a few seconds using the “Spaces” app feature. You can then transfer money from your main account to your “Spaces” and back just as easily. Below we summarize neon’s most important services and conditions for saving:

- No more interest since December 2024

- Up to 10 individual savings goals (“Spaces”) can be defined with display of savings progress

- High liquidity thanks to a generous withdrawal limit of CHF 50,000 per month

- Regular, automatic saving possible

Conclusion on saving with neon

For us, the savings function plays a subordinate role, as we prefer to invest free funds. Hard-boiled savers will be particularly interested in the savings feature, which allows different projects to be saved not only manually but also automatically.

Unfortunately, neon’s interest rates on savings deposits have also been continuously reduced and are currently at 0%.

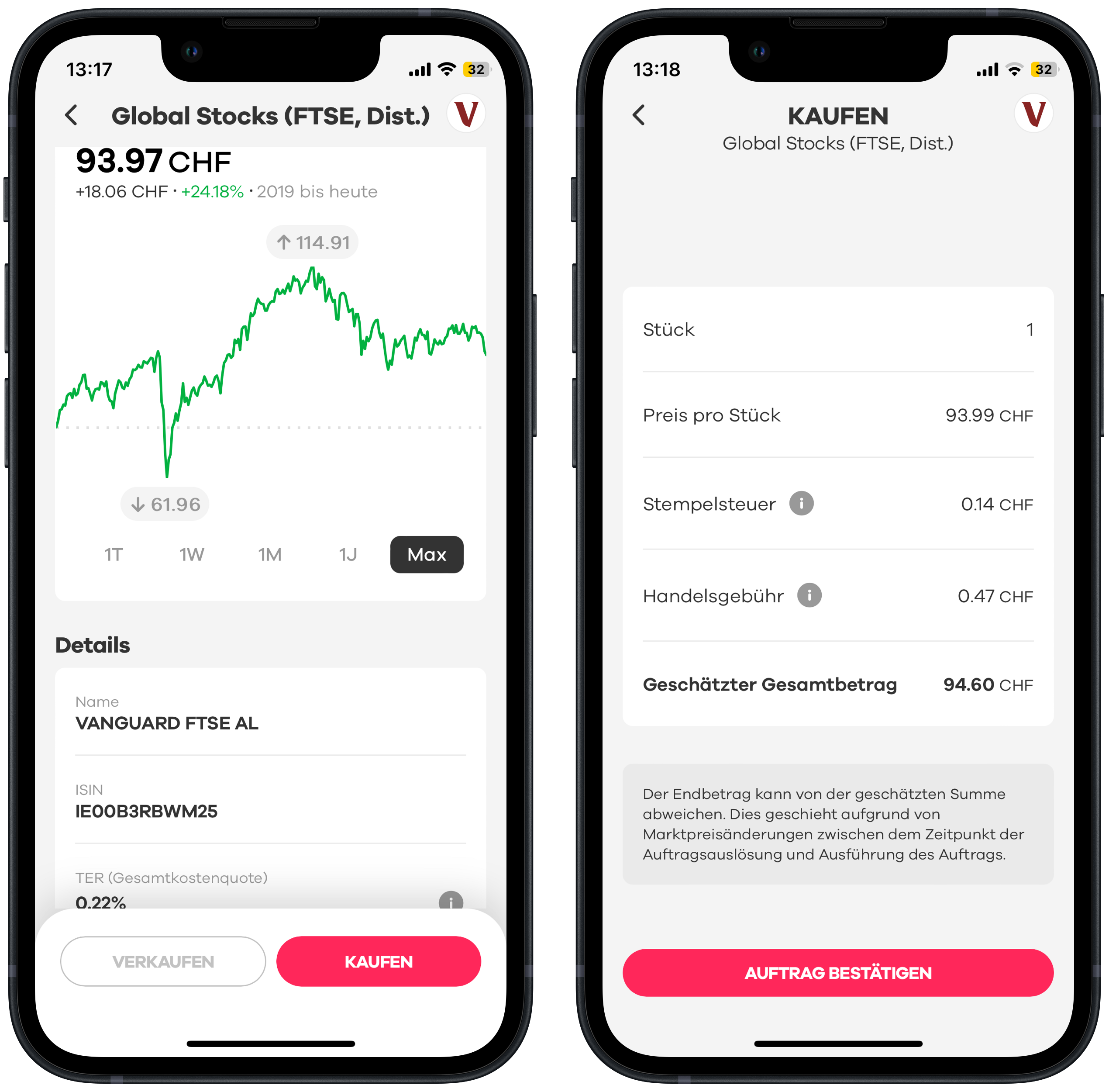

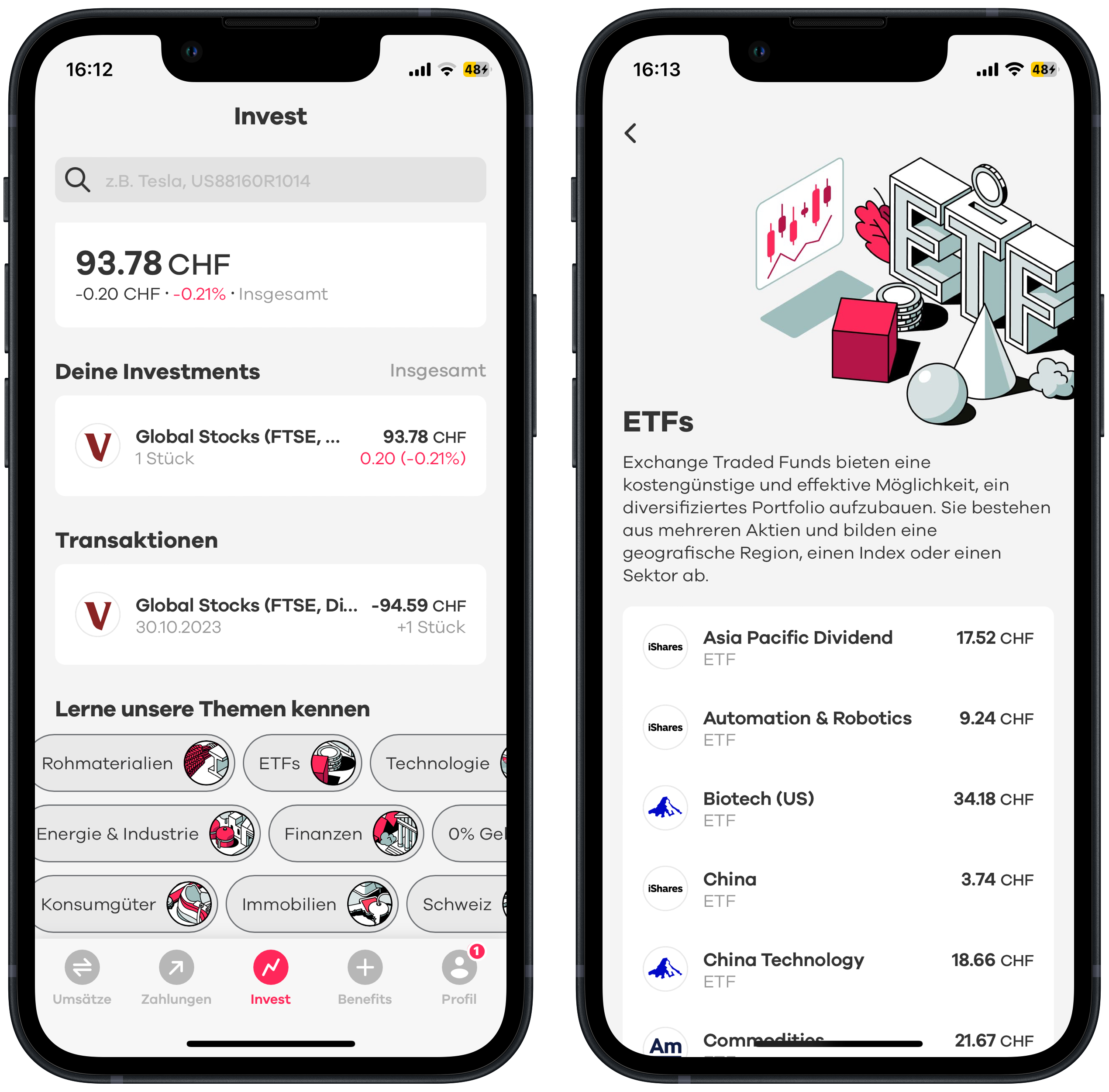

Our neon experience with investing

As passionate private investors, we are of course particularly interested in how neon performs as a securities broker. We have compiled the most important key data on neon Invest below:

- Investment universe limited to ETFs and individual shares

- No custody account fees

- 0.5% commission per trade with ETFs and domestic equities (no minimum fee)

- 0% commission on selected ETFs

- 1% per trade with foreign shares

- No currency exchange necessary, as all products are traded in CHF

- Real time prices: Orders are executed immediately during trading hours at the then current price

- Savings plan capable, but no fractional trading

- Bern Stock Exchange BX as the only trading venue

Trading with neon is only worthwhile for smaller amounts

The linear fee structure (i.e. always 0.5% of the transaction amount without a cost cap) makes neon particularly attractive for investors who wish to invest smaller tranches on a regular basis.

An example calculation: If you invest CHF 100, you pay a commission of only CHF 0.50 and for CHF 1,000 it is still an acceptable CHF 5. For trades of CHF 2,000 or more, however, you are definitely better off with a traditional online broker (see also our recommendation page).

neon invest is suitable for savings plans!

Anyone wishing to invest regularly and automatically in an ETF or share can set up a corresponding savings plan with just a few clicks at neon invest since 2024. The following key data:

- Savings plan for up to three ETFs or shares possible based on the entire neon investment universe (see next chapter)

- No additional fees

- Several commission-free ETFs (you only save the 0.5% commission in the savings plan)

- Amount lower limit is determined by the value of an individual share

- No fractional trading, i.e. no fractions of ETFs and shares possible

Purchase fees play a central role in regular investments. Accordingly, the ETFs without purchase commission in the neon savings plan are particularly interesting. There are currently 19 free ETFs from Invesco, Swisscanto, WisdomTree and Xtrackers available (as at 16.1.2026).

We find the Invesco FTSE All-World UCITS ETF Acc particularly attractive. The low running costs (0.15% TER), the broad global diversification and the high fund volume of over CHF 2 billion are decisive factors. The accumulating ETF should be of interest to long-term investors, even if its history is still relatively short (launched in June 2023).

The investment universe of neon

The investment universe consists of the following product categories and products (as at 16.1.2026, based on the filter function of neon invest):

- 285 shares: e.g. Apple, Nestlé, Netflix, Spotify, Starbucks, Tesla, UBS, Zurich

- 119 ETFs

If you are not yet a neon customer, you can find the securities currently on offer in the neon product list. New additions are highlighted in red. In contrast to the app, this list lacks meaningful information such as the product costs (TER).

After all, neon has included the product name, including provider and index, as well as the dividend distribution in the ETF list, which means that you can at least make a pre-selection without further research.

How good is neon’s ETF selection?

Whether you are a beginner or a stock market professional, equity ETFs are equally suitable for return-oriented and risk-averse investors with a longer investment horizon.

ETFs are our preferred investment vehicle, which is why we want to focus on them in this neon review.

Let’s start with the quantitative offering: With 119 ETFs, neon offers a solid selection for a neobank. This means that neon is more broadly positioned than its main rival Yuh, but still lags well behind traditional trading platforms such as Swissquote, which cover several thousand ETFs.

But even this currently still somewhat limited offer from neon can be absolutely sufficient for you. Ultimately, the only decisive factor is that your desired ETFs are included.

So let’s move on to the qualitative assessment:

As a rational investor, you are aiming for a broadly diversified global portfolio. Depending on your approach, this can be achieved with one ETF, two ETFs (industrialized and emerging markets) or several regional ETFs.

So much for the theory. How well can this be implemented with neon?

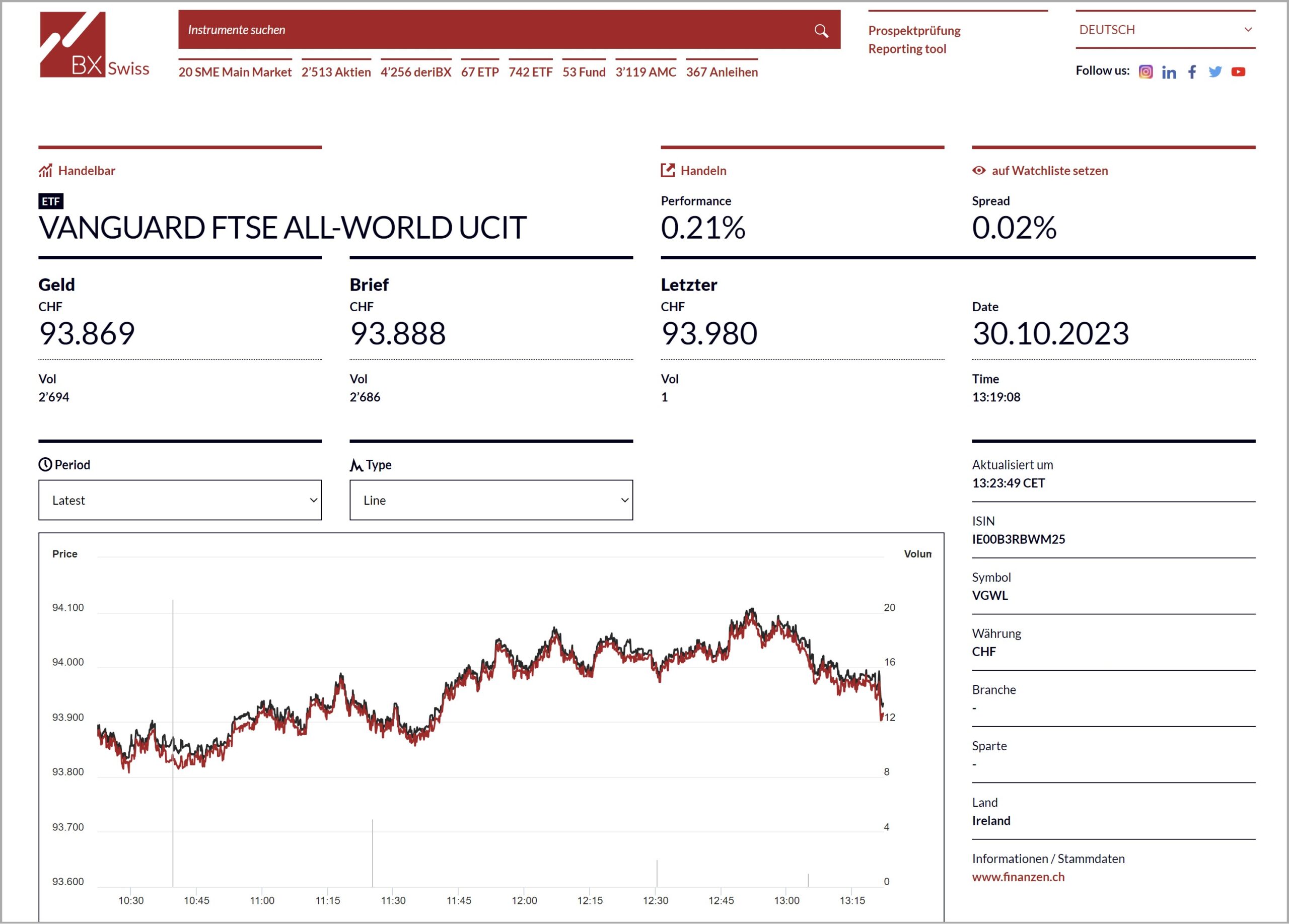

The good news is that neon’s investment universe makes it easy to map both a global portfolio with one ETF and a two-ETF solution (industrialized and emerging markets). We have linked each of the following ETFs directly to the BX Swiss – neon’s only trading venue – where you can find additional product details.

Variants with 1 global ETF (selection):

- Vanguard FTSE All-World UCITS ETF (distributing)

- iShares MSCI ACWI UCITS ETF USD (accumulating)

- Invesco FTSE All-World UCITS ETF Acc (accumulating, commission-free in the savings plan!, see section above)

Variants with 2 ETFs (industrialized and emerging markets):

Industrialized country ETFs (selection):

- Xtrackers MSCI World UCITS ETF 1C (accumulating)

Emerging markets ETFs (selection):

- Vanguard FTSE Emerging Markets UCITS ETF USD (distributing)

- iShares Core MSCI Emerging Markets IMI UCITS ETF USD (accumulating)

- iShares MSCI EM SRI UCITS ETF USD (sustainable; accumulating)

It should be noted that a currency exchange fee of approx. 1.5% is payable on foreign dividends that are converted from a foreign currency into CHF.

In terms of fees, investments with neon are therefore particularly worthwhile in accumulating and/or domestic ETFs.

In addition to the broadly diversified and market capitalization-weighted “bread-and-butter” ETFs mentioned above and a fairly large selection of ETFs with a focus on “Switzerland”, the neon range also includes various special ETFs. These cover themes such as “real estate”, “energy”, “technology” and “commodities”.

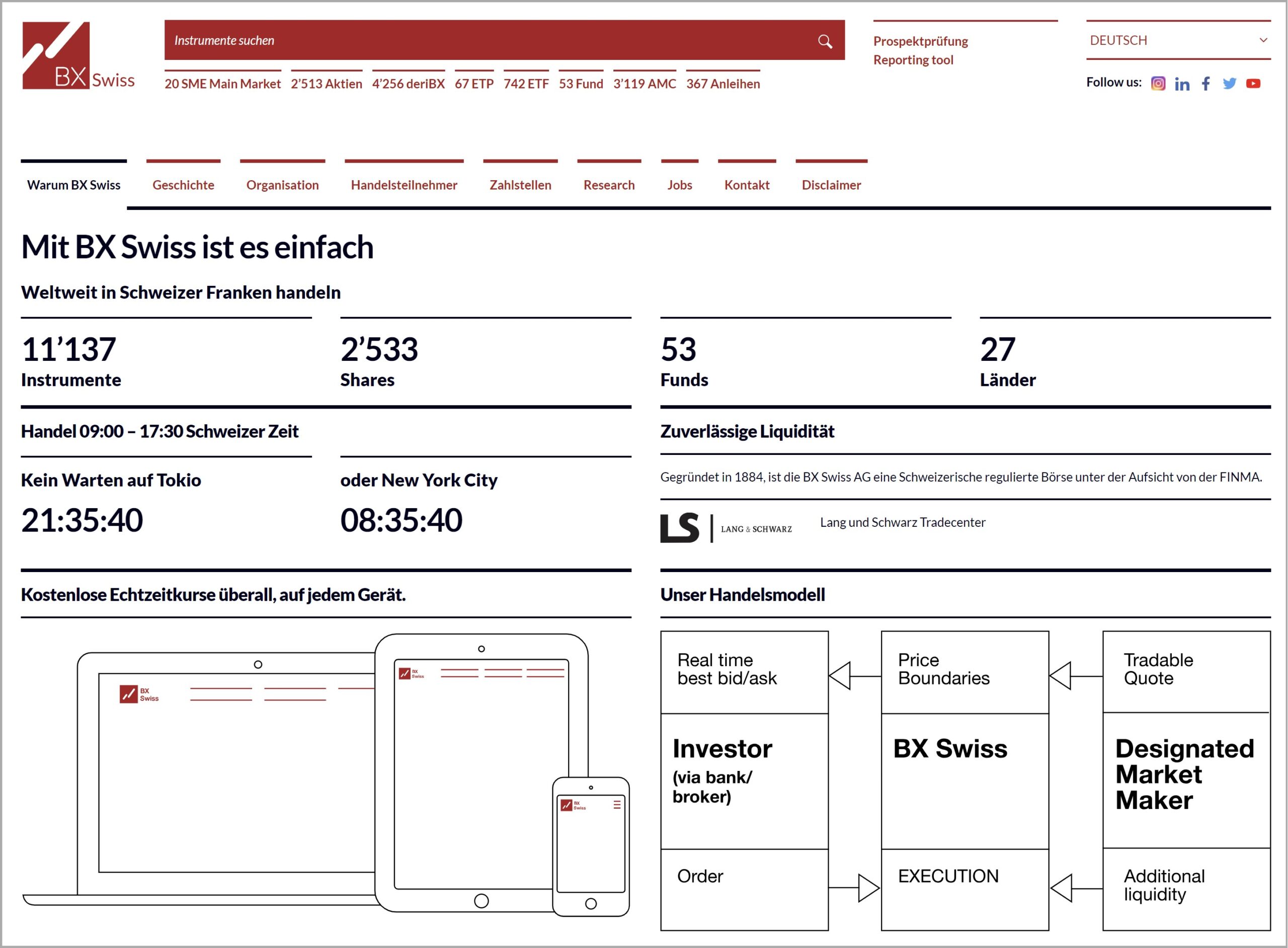

Small exchange BX Swiss – a disadvantage?

As unknown as the BX Swiss (colloquially known as the “Bern Stock Exchange” or “BX”) is to many investors, it was founded in 1884 and is now a regulated stock exchange under the supervision of the Swiss Financial Market Supervisory Authority FINMA. It lost its independence in 2018 and has been a wholly owned subsidiary of Börse Stuttgart GmbH ever since.

One of neon’s special features is that all of its investment products can only be traded via a single exchange, the BX Swiss. In turn, all products offered, including around 750 ETFs, can be traded exclusively in the domestic currency CHF via the BX Swiss.

Positive: This eliminates the currency exchange for you, but not the currency risk. To minimize this risk, you would have to invest exclusively in Swiss equities or in ETFs with only Swiss equities, which in our opinion would not sufficiently diversify your portfolio.

As we lacked experience with the BX Swiss prior to this neon review and in order to obtain more clarity about this secondary exchange, we contacted Mr. Erhard Rüttimann, Market Controller BX Swiss, and asked him the following two questions in writing:

Swiss Finance Blog: The volume of ETF trading is often low on the small BX. Historically speaking, what trading spread should an investor expect to see with you, or is the spread comparable with the major exchanges thanks to market makers?

Erhard Rüttimann, BX Swiss: It is true that our trading volumes are often lower. Nevertheless, we can offer competitive prices thanks to the support of our market maker (MM). The quality of the price remains unaffected by this. Our spreads are not wider because our MM is also active on other exchanges and offers competitive prices. Otherwise nobody would trade with us. Due to the activity of our MM, we can often also provide more liquidity.

If all products on the BX can only be traded in CHF, investors do not need to change currencies. However, the fund currency for ETFs that cover foreign markets is generally not CHF. Are there any fees for investors when changing currencies? If so, what are they?

Correct, trading in CHF eliminates the need for investors to exchange currencies, which is one of the advantages. When converting into another currency for the purchase of an ETF whose fund currency is USD, for example, our market maker always uses the interbank exchange rate as a basis. The risks and costs incurred by the market maker are taken into account in the spread and are therefore already included in the price you see as an investor. The fees that are reflected in the spread by the MM are significantly lower than the costs that would be incurred if a bank made the purchase directly on a foreign exchange.

Conclusion on investing with neon

Due to the linear cost structure (0.5% commission) and the still somewhat limited ETF offering, we believe that neon is particularly suitable for newcomers to the stock market who want to gain their first experience with securities trading with smaller amounts and low fees.

However, neon is also likely to appeal to more experienced investors. For example, people who want to invest in their desired ETF in smaller tranches in addition to traditional online brokers and thus benefit from the competitive prices.

No minimum fee and no currency exchange or related fees when trading are positive aspects.

The investment universe of neon convinced us, at least in part. In terms of costs (TER), market performance (fund assets) and diversification, it contains absolute top ETFs.

The small BX Swiss as the sole trading venue is certainly not a plus point. However, if liquidity is still guaranteed at all times thanks to market makers and the trading spread is only a few basis points, this is not a co-criterion for us.

Finally, we consider it positive that neon enables regular, automated investing in ETFs or shares by means of a savings plan, in some cases even without purchase commissions, but so far without fractional trading.

neon pillar 3a – simple and affordable

With the new pillar 3a solution, neon offers a pension solution that is fully integrated into the app. It can be opened digitally in just a few minutes, without additional accounts or paperwork. Partners of the neon 3a solution are the simply3a pension foundation and Descartes Finance.

The fees are transparent and are among the lowest on the market: 0.45% p.a., falling to 0.39% p.a. from CHF 50,000. Investments are made passively in index funds from Swisscanto. There is a choice of five investment strategies with equity components between 25% and 100%, optionally with a focus on Switzerland or sustainability.

In addition to the relatively low costs, another advantage is the simple, clean integration into the existing neon banking system: everything in one app, clear structure, simple operation. On the other hand, those looking for maximum individual investment scope will find more choice with pure robo providers such as VIAC.

How good is neon’s support?

Personal contact is not planned at neon. The branches are simply not available as meeting places for such exchanges. Telephone contact is also handled restrictively at neon.

According to our neon experience, there are basically three different toll-free channels available to you for questions:

- Online help portal: There you will find numerous FAQs, clearly organized by topic.

- AI-supported support: This AI feature is offered in the beta version instead of the previous telephone support.

- Written support: The more specific your request is, the more likely you are to reach your goal by sending an e-mail to service@neon-free.ch. According to our neon experience in this regard, the answers were always of good quality and the waiting times were pleasingly short, i.e. the same day or the following working day.

The telephone service is only available with the fee-based plans neon plus, neon global and neon metal.

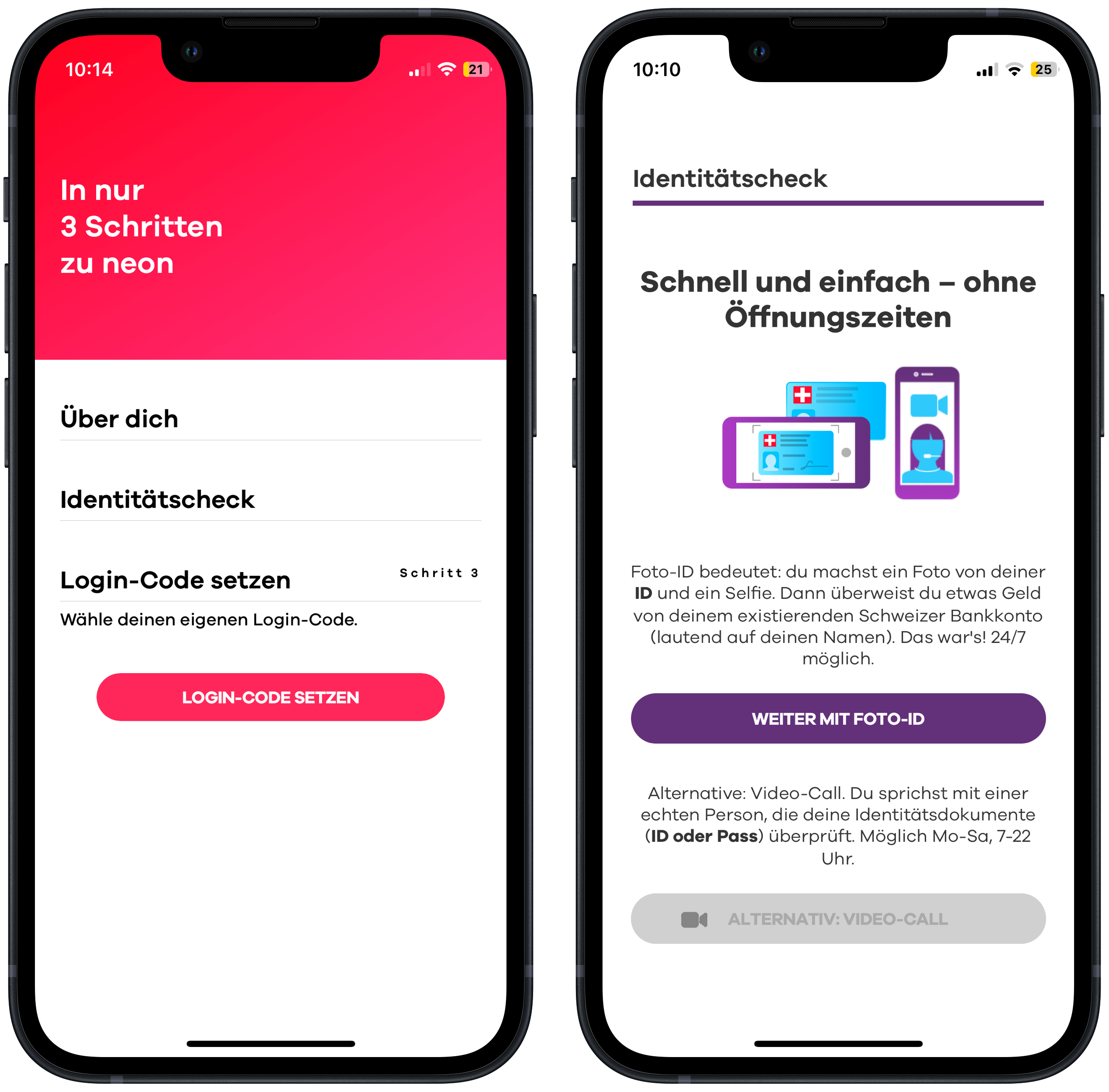

How can I register with neon?

Before you register with neon, check whether you meet all the requirements:

- Minimum age 15

- Swiss residence

- Exclusive tax liability in Switzerland

- a valid identity card from one of these countries (in combination with a B/C foreigner’s permit for non-Swiss nationals).

In a second step, download the neon app and follow the instructions with your passport or ID (and B/C foreigner’s ID).

It takes around 10 minutes to enter your personal details (don’t forget the promotional code “neonSFB”!), confirm them via the free video call or photo ID (we recommend this as it’s possible around the clock) and set your login code.

As soon as you have transferred some money from a Swiss bank account in your name, your identity check (with the photo ID option) is complete and your neon account is activated!

Positive: neon only asks you for the data required by law and does not ask detailed questions about your income and assets or your workload. Once your account has been activated, the physical neon card (Mastercard debit card) will be sent to you separately by post within a few days. You can call up the corresponding PIN code directly in the app. Before you can use the card, you must activate it in the app.

How safe is neon?

Your cash, whether for payments or savings, is invested with the state-regulated Hypothekarbank Lenzburg and is protected by a deposit guarantee of CHF 100,000 in the event of bankruptcy.

ETF investments are of course subject to market risk, but are considered special assets and therefore do not fall into the bankruptcy estate.

For effective protection against fraud and unauthorized access, neon relies on two-factor authentication, which it claims is the most widely used security standard in online banking and is considered secure.

This verifies your cell phone after opening an account (factor 1). In addition (factor 2), you can only access your account using a six-digit login PIN or (more simply) using biometric authentication with facial recognition (Face ID) or fingerprint.

Once you have successfully logged in, you can only authorize account transfers using a six-digit transfer PIN, which offers you additional protection.

The same applies to card payments: On the one hand, you need the neon card, whether physical or digital on your cell phone (factor 1). On the other hand, the transaction can only be authorized with a PIN or biometric authentication (factor 2).

Finally, if fraud is suspected, the card can be blocked quickly directly via the app.

Why neon – and when rather Yuh?

The best way to compare neon ‘s profile with that of its biggest competitor and market leader Yuh: neon’s significantly lower fees for card payments abroad are particularly impressive – 0.35% for neon free compared to 0.95% for Yuh. Another plus point: neon does not charge any exchange rate fees when investing, as all investment products are traded in the domestic currency CHF.

Yuh, on the other hand, scores with multi-currency accounts and fractional trading.

One noticeable difference lies in the account model: while Yuh offers a standardized account for everyone, neon offers a differentiated account selection – from free (neon free) to premium variants such as neon metal.

As there are no ongoing account management or custody account fees with either neon free or Yuh, the two offers can be easily combined. This means you can benefit from the best of both providers at no extra cost – whether you want to pay, save, invest or make provisions.

Regardless of the comparison with Yuh, we have summarized the main advantages and disadvantages of neon free below.

Advantages and disadvantages of neon free

Conclusion from our neon experience

neon is aimed at anyone who wants to handle banking and investing simply, digitally and at low cost. neon is particularly strong when it comes to card payments abroad: with neon free there is only an exchange rate fee of 0.35%, with neon plus (CHF 20/year) there is no fee at all. Two cash withdrawals per month are also included.

When investing, neon impresses with its clear price structure: no custody account fees, 0.5% commission on ETFs and Swiss shares (1% for foreign shares). A plus point: all trades are made in CHF via the BX Swiss – there is no need to exchange currencies. Savings plans are available, and selected ETFs are even commission-free. neon is very attractively priced, especially for investment amounts of up to around CHF 1,000.

We are also positive about the new neon-3a solution, which is fully integrated into the app and, with total costs of 0.39 – 0.45% p.a., is one of the more favorable offers.

neon is less suitable for traditional savers with high balances and/or those who want to use a multi-currency account are better off with Yuh – neon currently only offers a CHF account.

As a free second account without obligation, neon free can be easily combined with a house bank, another smartphone bank or an online broker – for more flexibility at no extra cost.

This might also interest you

Updates

2026-01-16: Article comprehensively updated.

2025-11-25: New neon pillar 3a solution presented.

2025-05-21: Comprehensive revision due to introduction of new neon plans and conditions.

2025-01-31: New promotional code “neonSFB” with up to 100 CHF trading credits mentioned.

2025-01-14: Comprehensive update: Functionality of the new joint account clarified, investment universe updated, savings interest rate adjusted and other selective improvements added.

2024-10-31: Reference to further interest rate cuts inserted.

2024-10-03: Information that the previous prepaid card from Mastercard has been replaced by the better accepted new debit card from Mastercard.

2024-07-01: Interest rate for savings reduced to 0.5% (from 0.75%).

2024-06-13: New chapter on the neon savings plan and note that selected ETFs are only commission-free in the savings plan.

2024-05-22: Interest rate for savings reduced to 0.75% (from 0.9%).

2024-04-23: Introduction of joint account “neon duo” mentioned.

2024-04-05: Minimum age lowered to 15 years (from 16).

2024-01-09: Fees for foreign distributing dividends pointed out.

2023-11-13: Minor adjustments made: Google Pay (instead of Google Wallet): EUR and USD deleted for interest

Disclaimer

Transparency note: We were impressed by neon’s overall package, which is why we have entered into a partnership with neon. With the promotion code neonSFB you can secure a starting bonus in the form of trading credits worth CHF 100 and support our blog at the same time. In order to report credibly and realistically at first hand, Toni and Stefan have become new neon customers in the course of this neon review.

Disclaimer: Investing involves risks of loss. You must decide for yourself whether you want to bear these risks or not.

Errors excepted: We have written this article about our neon experience to the best of our knowledge and belief. Our aim is to provide you as a private investor with the most objective and meaningful financial information possible. However, if we have made mistakes, forgotten important aspects and/or are no longer up to date, we would be grateful if you could let us know.

Newsletter

Newsletter

6 Kommentare

Ganz neu ist auch ein Fondssparplan (FSP) mit 1-3 Fonds möglich. Gebührenstruktur und Fondsauswahl sind m.E. top für kleine Sparbeträge (100-500.- p.m.). Was mich nun nach weiteren Alternativen umschauen lässt: Keine Fraktionen, nur ganze Titel/Anteile. Da verpufft der DCA bei Kleinstbeträgen, was m.E. ein grosser Mehrwert eines FSP’s darstellt. Ich warte gespannt auf die Antwort vom Support, wann sie das ändern mögen…

Merci für den Hinweis. Wir haben soeben diese neue neon Sparplanmöglichkeit genauer unter die Lupe genommen und den Artikel entsprechend aktualisiert.

Bei ausländischen Dividenden fallen 1.5 % Wechselgebühren an. Das ist eine hohe Gebühr. Oder wie siehst du das?

Einverstanden, das ist eine hohe Gebühr. Wir nehmen diesen Punkt im Artikel auf und schlagen vor: bei neon vorzugsweise nur in thesaurierende und/oder inländische ETFs investieren.

Auf unsere Anfrage schreibt uns neon am 8.1.2024 zur Gebühr auf ausländischen Dividenden: “Dividenden, Nennwertrückzahlungen, etc. werden direkt von unserer Partnerbank auf deinem neon-Hauptkonto gutgeschrieben. Wenn es bei einer ausländischen Wertschrift (z.B. US-Aktie in US-Dollar) zu einer Ausschüttung wie etwa einer Dividende kommt, dann nimmt unsere Partnerbank die Umrechnung in CHF vor und schreibt den CHF-Betrag deinem neon-Hauptkonto gut. Der Wechselkurs für die Umrechnung wird von unserer Partnerbank mindestens zwei Mal am Tag aktualisiert und beinhaltet eine Interbankenkursmarge von ca. 1.5%.”

Vielen Dank für die Erklärung. Ist es also korrekt, dass die Kurswechselgebühr im Vergleich zu Saxo, wo sie 0.25% beträgt, relativ hoch ist? Obwohl viele ETFs in USD aufgelegt sind, werden sie in der neon-App in CHF gekauft und verkauft. Sind da jedes Mal noch die 1.5% versteckt?

Vielen Dank für eine Einschätzung deinerseits und liebe Grüsse

Flo

Hoi Flo

Korrekt, bei neon werden alle ETFs in Handelswährung CHF gehandelt. Dies erachten wir aber als einen Vorteil, denn der Währungswechsel beim Kauf und Verkauf von ETFs entfällt so bei neon.

Beste Grüsse

SFB