Free multi-currency account, free debit card, no custody account fees and ETF savings plans without purchase commissions: We were intrigued by the fact that Yuh offers attractive conditions not only for payments, but also for investments.

In addition to accounts, cards & co., we also took a closer look at Yuh’s ETF investment universe and came across some surprising findings. We have summarized our Yuh experience with the new high-flyer in the Swiss neobank scene in this detailed Yuh review.

Short & sweet

Yuh is a Swiss neobank founded in 2021 with over 300,000 customers. The 100% subsidiary of Swissquote focuses on simplicity: paying, saving, investing and making provisions conveniently via smartphone.

- Account models & costs:

-

Practical multi-currency account with up to 13 currencies free of charge (reduces FX costs)

-

Domestic transfers in 13 currencies and EUR transfers in Europe free of charge

-

Mastercard debit card without annual and transaction fees

-

Currency exchange fees relatively high (0.95%)

-

- Investing & ETFs:

-

No custody fees, trading fees of 0.50% (min. CHF 1)

-

All investment products can be saved in a savings plan, incl. Fractional Trading

-

Numerous ETFs in the savings plan without purchase fees, including global Vanguard classics

-

Significantly expanded investment universe with some attractive ETFs

-

- Pension provision: Digitally integrated pillar 3a solution with five investment strategies at 0.50% fees

- Security: Swiss regulation with deposit protection up to CHF 100,000

Our Yuh experience shows: Yuh is particularly interesting for digitally savvy, cost-conscious people – for payment transactions in various currencies as well as regular savings plan investments in fee-free ETFs. Thanks to the lack of account and custody account fees, it is also ideal as a second bank.

🎁With our promotional code YUHSFB you benefit from 50 trading credits and 250 Swissqoins.

Contents

- CHF 50 trading credits and 250 Swissqoins – with promotional code YUHSFB

- What is Yuh?

- What does Yuh offer?

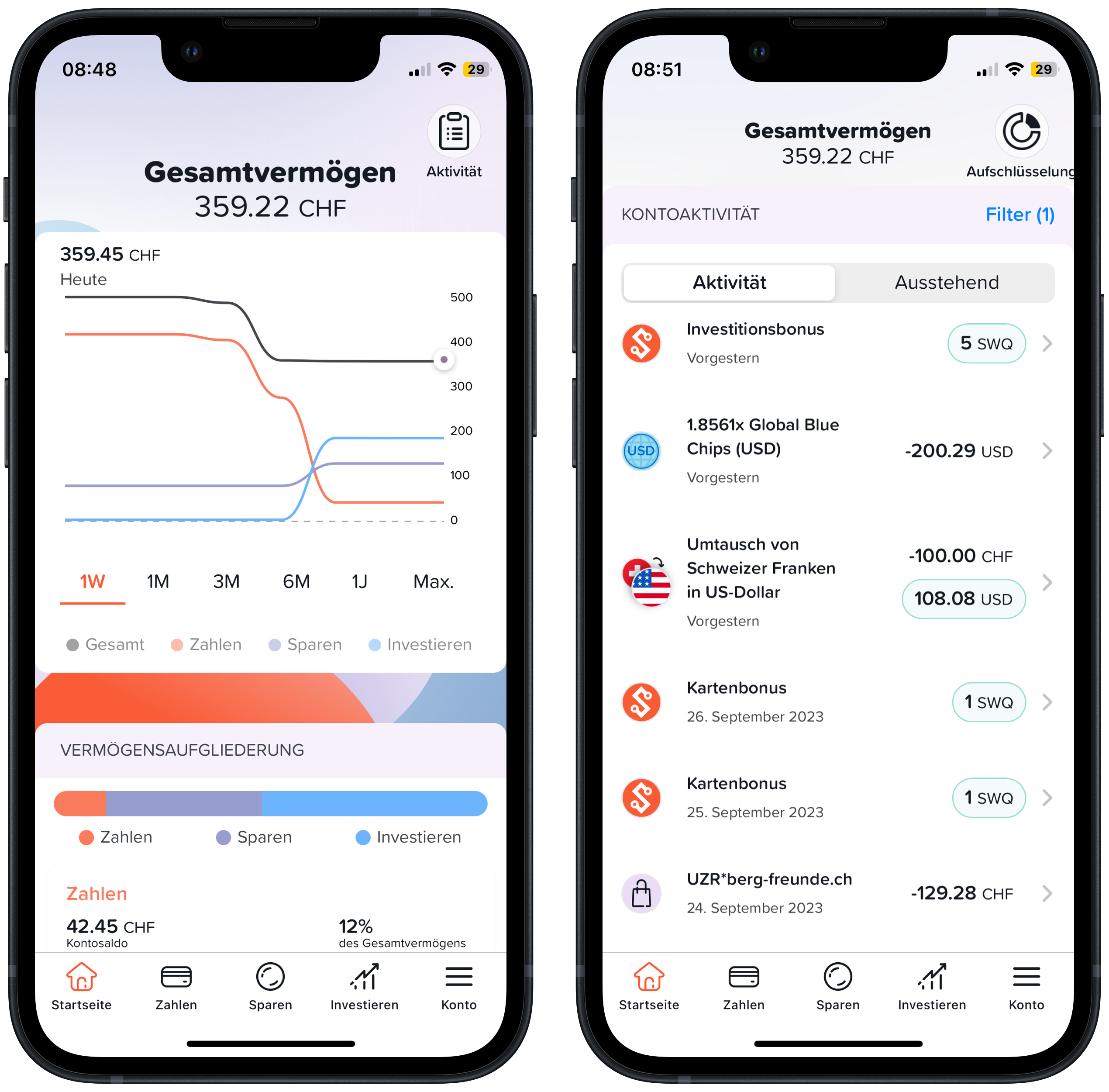

- Our Yuh experience with payment transactions

- Our Yuh experience with savings

- Our impressions of the Yuh 3a pension plan

- Our Yuh experience with investing

- ETF investment universe of Yuh

- How good is Yuh’s support?

- How does the registration work?

- How safe is Yuh?

- What on earth are Swissqoins?

- Advantages and disadvantages of Yuh

- Conclusion of our Yuh experience

- This might also interest you

- Updates

- Disclaimer

CHF 50 trading credits and 250 Swissqoins – with promotional code YUHSFB

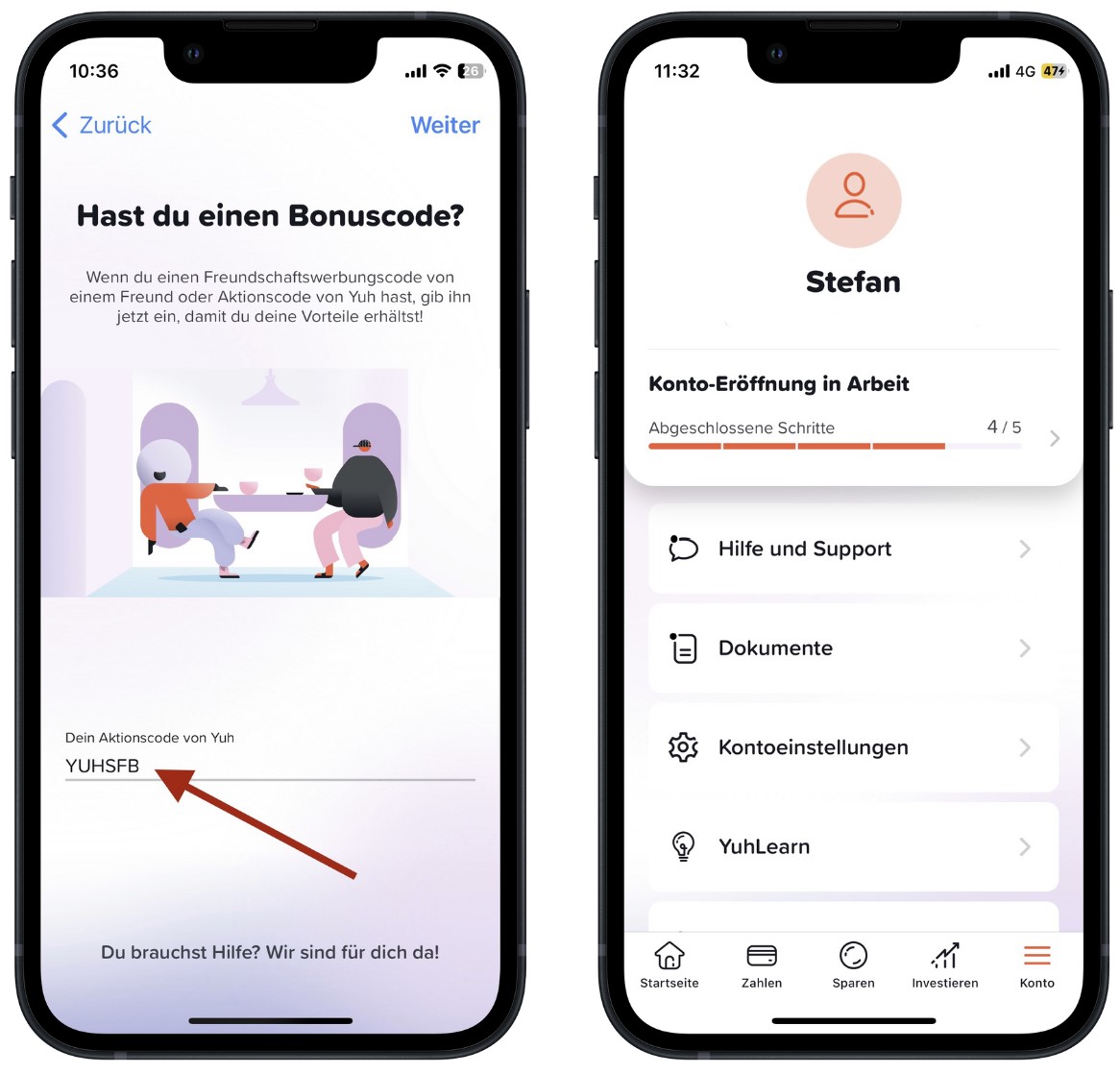

If you are convinced by Yuh’s offer, you can secure an attractive welcome package:

🎁 50 CHF trading credits

🎁 250 Swissqoins as a starting balance

With the bonus, you can invest up to CHF 10,000 free of charge and at the same time benefit from the potential price gain of your Swissqoins. You also support our blog.

👉 This is how it works:

- Download the Yuh app and register as a new customer.

- When registering, enter the bonus code YUHSFB in the “Your promotional code from Yuh” field (not in “Refer a friend”).

- Transfer at least CHF 500 to your new Yuh account.

- You will receive your trading credits and Swissqoins within 24 hours.

📌 Your trading credits are valid for four months – ideal for your first steps in investing (excluding cryptocurrencies & currency exchange).

What is Yuh?

The latest Swiss smartphone bank was launched in May 2021 as a joint product of the private Swissquote Bank and the state-owned PostFinance. Since July 2025, Yuh has been 100% owned by Swissquote after it bought the shares from PostFinance.

Despite its relatively late market entry, Yuh is the fastest growing neobank in Switzerland with over 300,000 customers – and has already made a profit after just four years. By comparison, Zak, which was launched three years earlier as a Swiss pioneer by Bank Cler, has around 60,000 customers. Yuh is therefore currently the undisputed high-flyer on the Swiss neobanking scene.

Judging by the flashy marketing and casual “you” culture, Yuh is obviously aimed at a younger audience. This is also supported by the fact that online banking at Yuh is only possible via cell phone .

Yuh also promises the greatest possible simplicity, not only when trading, but also when making payments, saving and making provisions. This makes Yuh probably the most comprehensive neobank in Switzerland. You can find out more about Yuh’s offering in the next section.

And yes, Yuh also showed a refreshing willingness to experiment at the top management level: from September to October 2025, Fin, an AI creation, sat in the CEO chair – not a real change of power, but certainly a successful and highly regarded marketing gag. Since November 2025, a traditional human has been back at the helm: Jan de Schepper, a long-standing member of Swissquote‘s Executive Board. All’s well that ends well: AI was allowed to have a brief go – now someone made of flesh and blood can make decisions again.

What does Yuh offer?

As already mentioned, Yuh’s range of services is diverse compared to other neobanks and includes the following four services:

- Figures

- Saving

- Pension provision (pillar 3a)

- Invest

In this Yuh Review, we will explain and assess all of these services and attach a price tag to each. True to our mission, we will of course take a particularly close and critical look at the topic of “investing”.

Our Yuh experience with payment transactions

While investing, saving and 3a pension provision are voluntary, the Swiss can’t avoid payment transactions. This fact is probably also the reason why previous Yuh tests have always focused on the less spectacular online banking with private account, cards and payment functions.

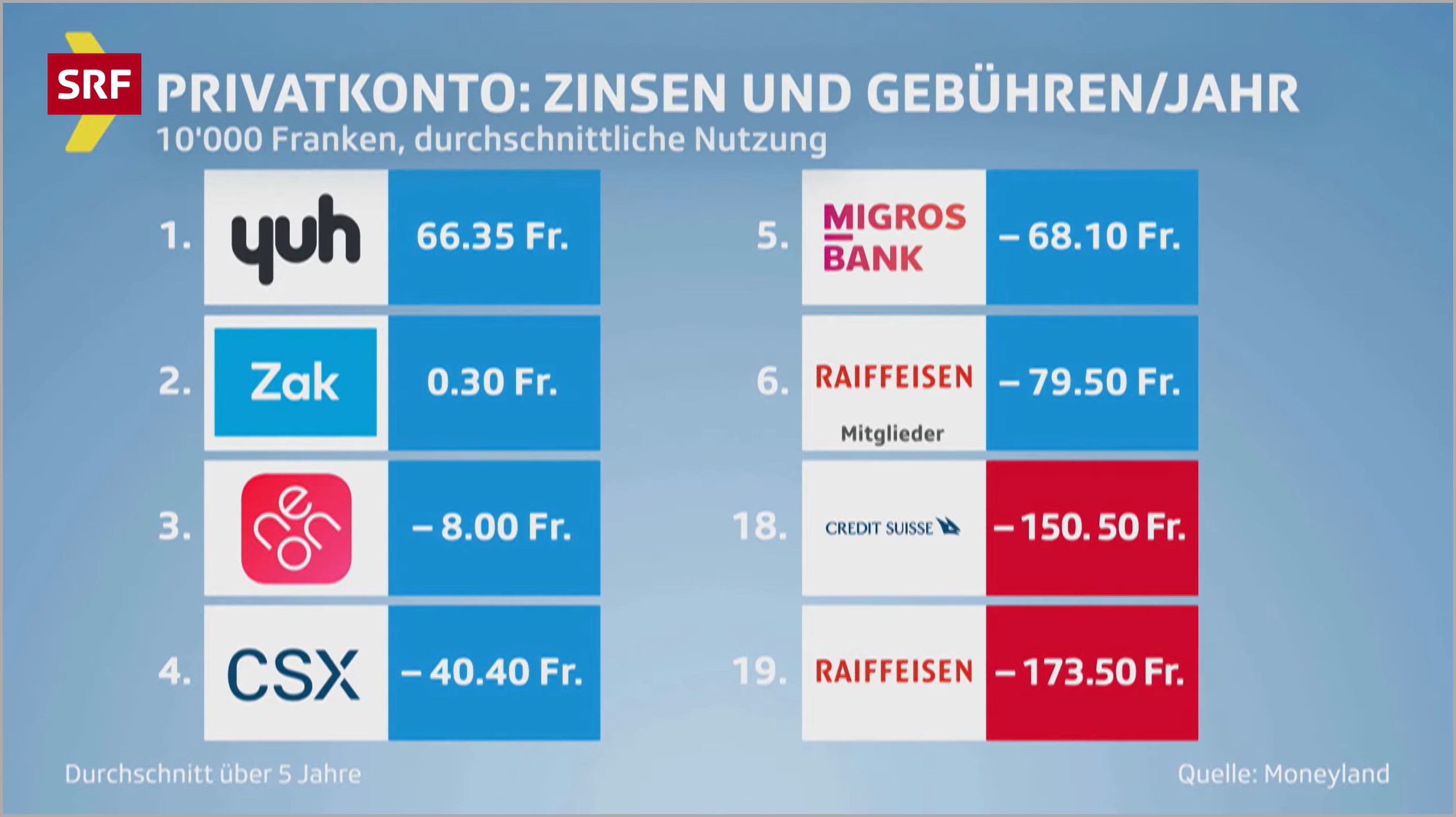

This was also the case with SRF’s Kassensturz, which made Yuh’s sensational performance in this discipline known to the general public in April 2023. At the time, Yuh had clearly prevailed against 18 other banks with a Swiss banking license.

SRF based its findings on the results of the Moneyland comparison portal. The comparison was carried out using the “average use” and “frequent use” profiles. The transactions examined are the same in each case, namely payment transactions in Switzerland and abroad, purchases and cash withdrawals with debit cards in Switzerland and abroad. The two profiles differ only in terms of intensity of use and average account balance.

Since this test is a snapshot and the underlying profiles do not match your real usage behavior, we will go into the individual services and conditions of Yuh below (see also Yuh’s price list).

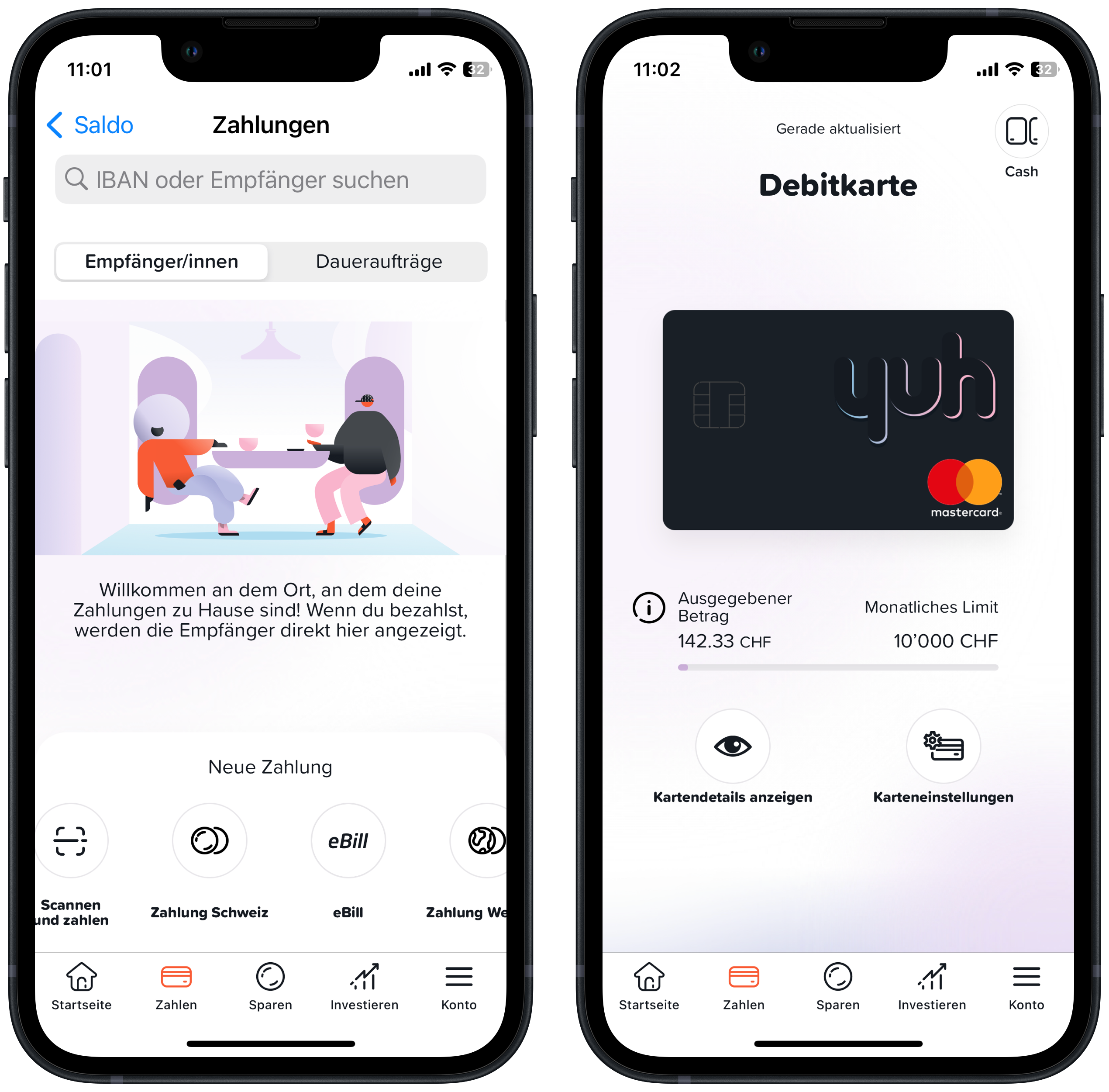

In terms of payment transactions, Yuh leaves little to be desired, with perhaps one exception: overdrafts are not permitted. Let’s start with the self-explanatory…

Yuh standard services when paying

- Free bank transfers in Switzerland and Liechtenstein in 13 currencies

- Free SEPA bank transfers in Europe in EUR

- 4 CHF for SEPA bank transfers in Europe in other currencies (plus any fees charged by third-party banks)

- Transfer types: one-off, regular (standing order), eBill, TWINT

- Free Debit Mastercard without transaction fees; card can also be used via smartphone: “Apple Pay”, “Google Wallet” and “Samsung Wallet”; monthly card limit of up to CHF 25,000 freely selectable in the app

- Free weekly cash withdrawals at Swiss ATMs / additional withdrawals for CHF 1.90 per withdrawal

- CHF 4.90 per cash withdrawal abroad

- Currency exchange 0.95% (see also next chapter)

…and continue with the (explanatory)…

Yuh special services when paying

We have noticed two interesting features in payment transactions, which we explain below.

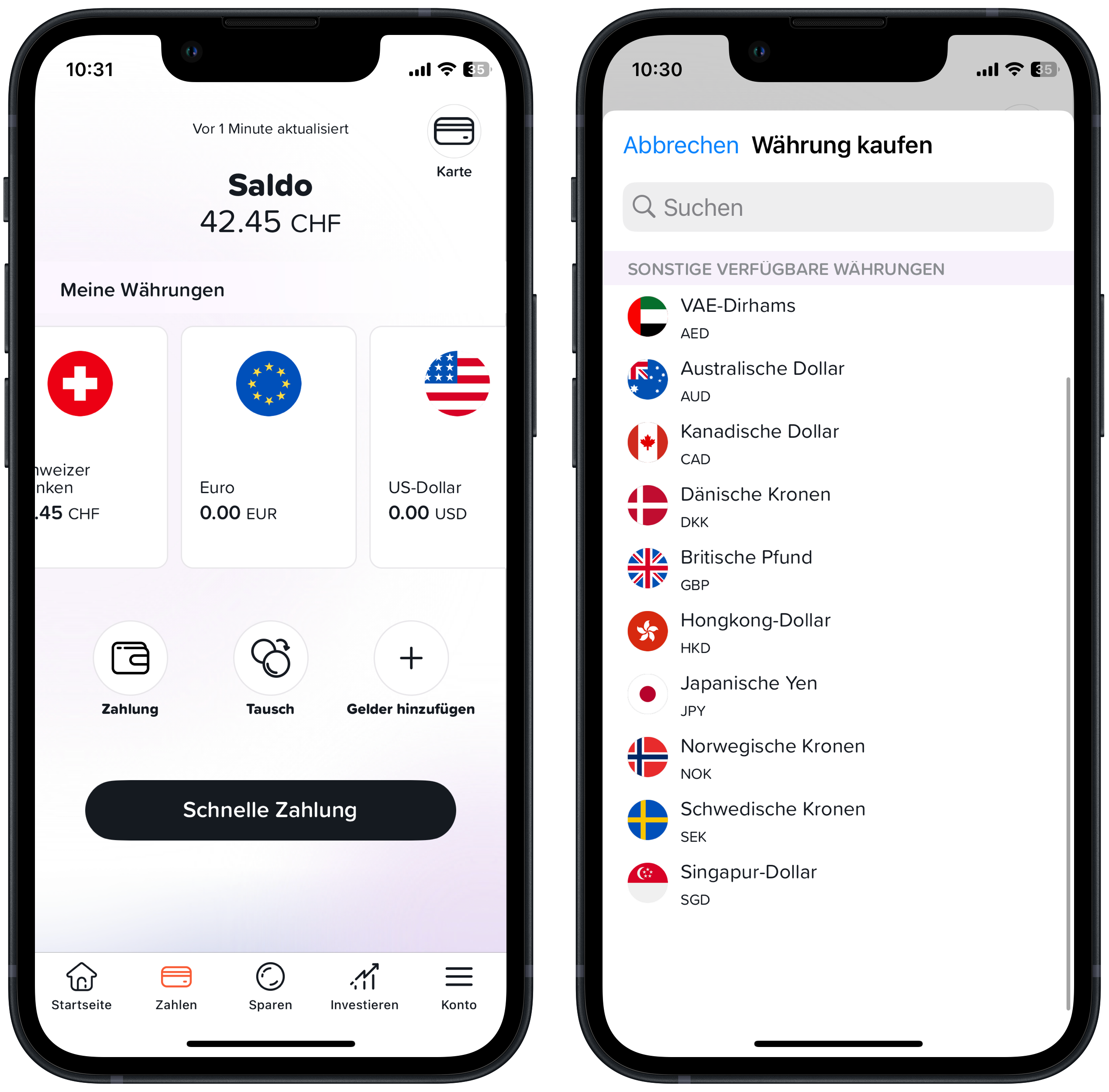

Multi-currency account

Yuh offers a so-called multi-currency account for no less than 13 currencies.

This allows you to benefit from two advantages: On the one hand, everything is processed via a single account or IBAN, which simplifies payment transactions in foreign currencies.

On the other hand, the multi-currency account allows you to transfer money without exchanging currencies (even abroad with your card). This saves you exchange fees, e.g. during your vacation abroad.

You also benefit from the multi-currency account with your investments. For example, if you receive dividends in US dollars, you can access these dollars again later without currency exchange fees, either by buying new securities or making payments in USD.

With competitors, you are usually offered either only one account in your home currency or a separate account with its own IBAN for each foreign currency.

Click on this link to find out how Yuh promotes its multi-currency account.

Currency exchange immediately or with target exchange rate

Despite having a multi-currency account, you will not be able to avoid one currency exchange or another. The relevant fees depend on the respective currency pair.

For the 13 standard currencies mentioned above, Yuh charges a conversion fee of 0.95% of the transaction amount. For other currencies, the conversion fee for using the debit card abroad is 1.5%.

Positive: Yuh does not charge any transaction fees. These can be up to 1.5% per foreign transaction with other card issuers. Incidentally, online shopping with a foreign provider is also affected by such a fee, even if the provider charges in CHF.

If you only want to exchange money at a specific exchange rate, you can optionally enter your preferred target exchange rate with Yuh. As soon as your desired exchange rate is reached, Yuh will arrange the exchange for you. This feature is also an interesting special feature of Yuh for us, even if it is of course only suitable for those who are not in a hurry to change money.

Conclusion on paying with Yuh

In terms of private account, payment transactions and card use, Yuh offers an extremely attractive overall package in terms of price. This has not only been confirmed by our Yuh experience and research, but also by third-party tests.

If online banking via cell phone is normal and easy for you, then Yuh could soon become your new, inexpensive house bank.

Our Yuh experience with savings

Saving using practical Yuh savings pots will greatly simplify your budget planning with regard to financing future purchases and projects. Apart from that, and of course a nest egg, we prefer investing to hoarding money in the bank account because it simply yields a higher return.

Below we summarize Yuh’s most important services and conditions relating to savings:

- Interest of 0.00% on CHF, EUR and USD (unlimited amount; as at 19.1.2026)

- Individual savings targets can be defined

- Automatic saving possible

- Savings motivation with updates and visualization (savings curve)

- Savings can be withdrawn at any time

Since 1.7.2024, interest has only been paid on “savings” balances – if at all. Depending on the interest rate situation, it may therefore be worth transferring cash that is not needed in the short term to “savings” . No interest is currently paid.

And this is how it works: You go to “Savings” and click on “Add funds”. The corresponding amount is then immediately transferred from “Pay” to “Save”, allowing you to define your savings projects.

The other way round is just as easy. If you want to use your savings for upcoming payments (or investments), then go back to “Savings”, click on “Add funds” (!) and then “Withdraw funds”. The balances for “Savings” and “Payments” are adjusted in no time at all.

Unfortunately, it is not (yet) possible to automatically transfer “Savings” to “Payments” using a stored date, e.g. in order to have sufficient funds in “Payments” by the deadline or to be able to pay the corresponding invoice.

You can choose your savings goal from around 15 predefined savings projects such as party, taxes or emergency. If your desired savings goal is not included in this selection, you can alternatively name your savings project individually, e.g. as in our example “photo camera”. Your savings balance in relation to your savings project is calculated and visualized by Yuh.

Practical: In addition to manual saving, you also have the option of automatic saving with Yuh. In this case, you define your desired savings interval (daily, weekly or monthly) and the recurring savings amount. Based on this, Yuh calculates the date on which you will have reached your savings target. If you want to take a break, you can interrupt the automatic saving at any time.

Unfortunately, the reverse process from “savings” to “payments” is not (yet) automated. This would also be practical in order to have sufficient liquidity on “Pay” at all times or so that corresponding invoices can be paid on time.

Conclusion on saving with Yuh

If you would like to work systematically towards one or more savings goals and benefit from a relatively good interest rate, Yuh offers a useful feature.

Our impressions of the Yuh 3a pension plan

Private pension provision via pillar 3a is attractive from a tax perspective. You need a separate 3a account at a Swiss bank for this. With Yuh, you can open such an account in around five minutes via the app.

Saving for retirement is often associated with a long investment horizon. We therefore prefer solutions with the highest possible proportion of equities, globally diversified and passively managed based on low-cost ETFs or index funds.

So let’s take a look at whether Yuh would meet our requirements.

The total annual costs for Yuh are fixed at 0.50% of the 3a pension assets, making it one of the cheaper providers in Switzerland.

We are also impressed by the equity allocation of between 20% and 99%, based on five freely selectable strategies. Likewise the fact that the investment universe consists of passive index fund products. Incidentally, all products are offered by Swisscanto.

Conclusion on 3a pensions with Yuh

A passive investment approach and the option of investing up to 99% in the “equities” asset class are convincing arguments for us. Nevertheless, due to the greater flexibility in portfolio composition and the somewhat more favorable prices, we will not consider switching from Viac at this time (see our detailed test report Our VIAC experience with the 3a pension pioneer: These 5 strong arguments convince us).

Our Yuh experience with investing

As passionate private investors, we are naturally most interested in how Yuh performs as a securities broker.

For Yuh, too, the investing function is likely to be by far the most interesting on their app. Because unlike payments, the cash register rings after every transaction when trading.

Yuh advertises investing accordingly aggressively: “Invest with the Yuh factor”, “The best of the best” or “Love your trades”.

The message behind it is clear and should be aimed primarily at stock market beginners: “Invest super easy (and as often as possible) and put together your personal securities portfolio now”.

Our recommendation: Consistently ignore all trading messages from Yuh! They are just meant to encourage you to trade frequently. From Yuh’s point of view, and of course that of all other brokers, this business practice is understandable: After all, trades are one of their most important sources of income. So instead of letting yourself be influenced by the loud stock market noise, as a rational investor you should heed the following stock market rule: “Back and forth empties your pockets”. So you and Yuh are pursuing conflicting interests here. It’s better to stick to your own rules based on your investment strategy and risk profile (you can find out more about these investment basics in our Learn to invest – in eight lessons section).

The key figures for investing with Yuh are very positive:

- No custody account fees

- Yuh commission of 0.50% per trade (min. CHF 1)

- Real time prices: Orders are executed immediately during trading hours at the then current price

- Savings plan: all products, from CHF 10, weekly or monthly, in each case 10 minutes after the stock exchange opens, a selection of ETFs is free in the savings plan or the purchase commission of 0.50% is waived.

- Fractional trading: all products can also be traded in fractions – from CHF 10

- Ethical rating: Yuh automatically determines the ESG score of your investment

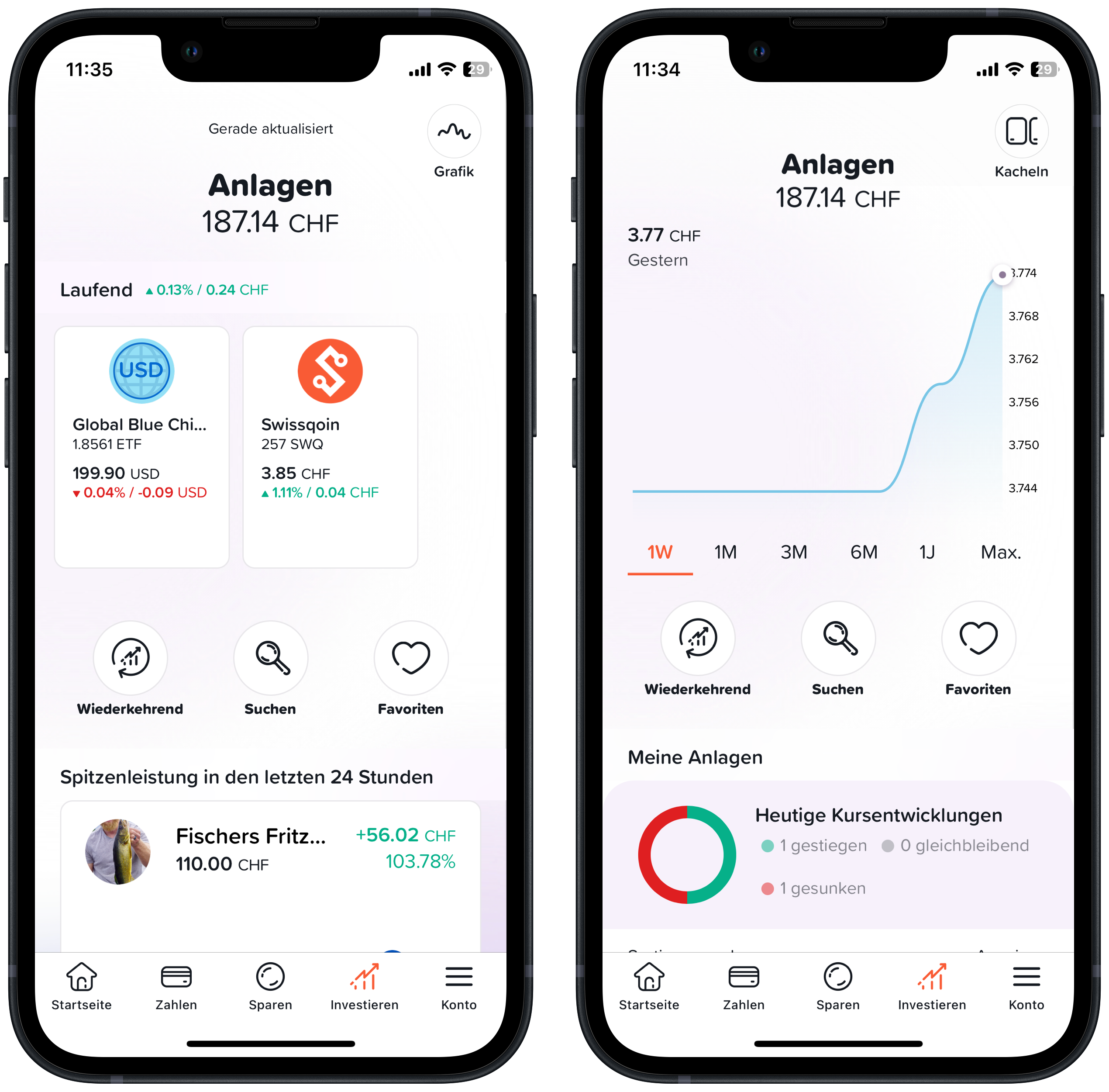

There’s no doubt about it: it all reads very attractively and, as we expected, handling via the Yuh app is very intuitive and child’s play. Bravo Yuh, you have delivered!

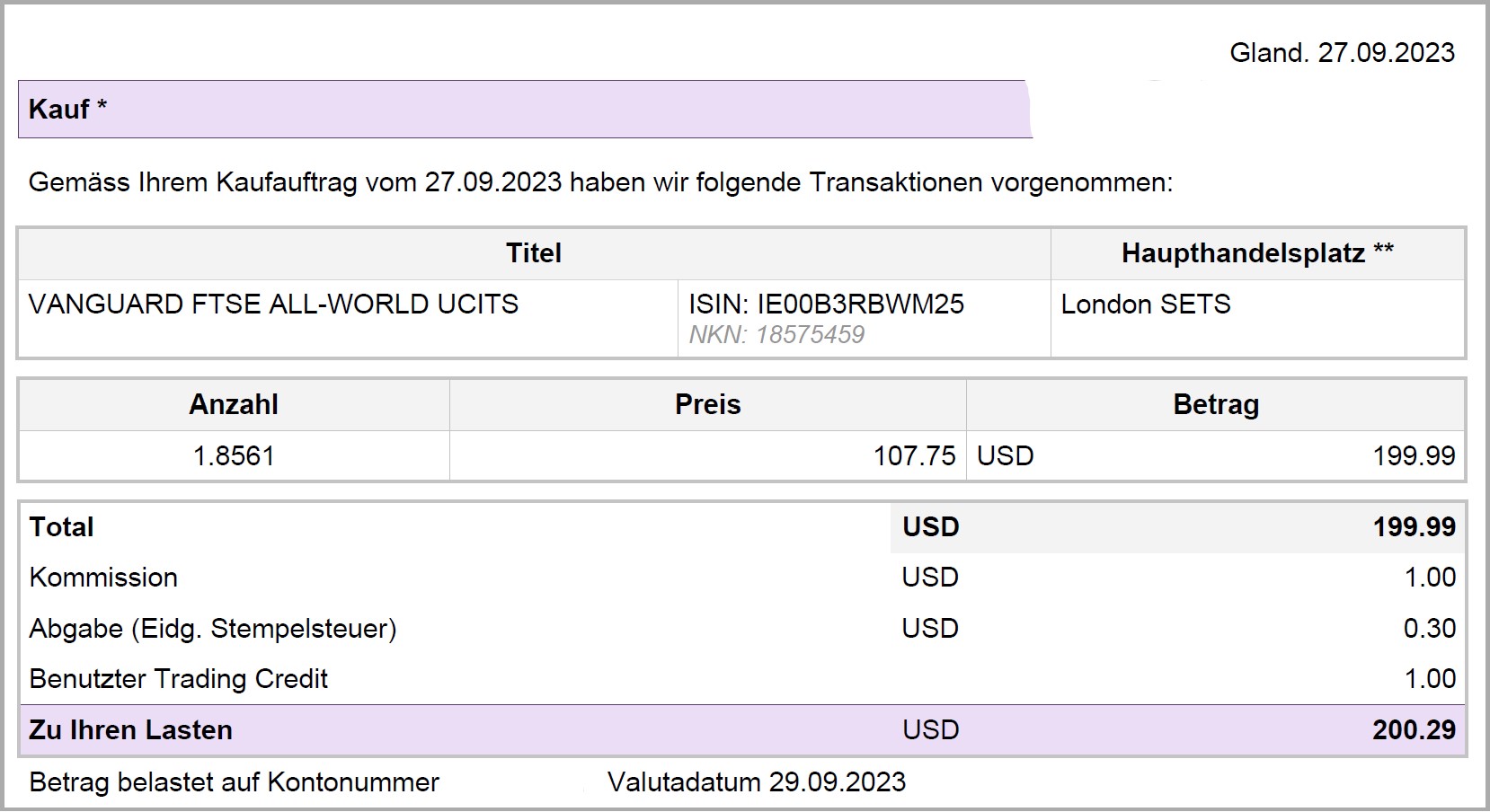

According to the chart above, for Stefan’s first ETF purchase from Yuh worth USD 200, the fees were estimated at USD 1.30, consisting of Yuh commissions (0.50%) and stamp duty.

The actual costs, including the consideration of any credit balances (50 CHF trading credits with our promotional code “YUHSFB”) will only be shown after the trade in a detailed transaction receipt. This does not include any exchange rate fees.

Trading with Yuh is only worthwhile for smaller amounts…

However, with Yuh’s linear fee structure (i.e. always 0.50% of the transaction amount without a cost cap, minimum CHF 1), you should always be aware of the following rule of thumb: The smaller your invested tranche, the more attractive Yuh is compared to the competition. (Please note that the Yuh minimum commission of CHF 1 always applies for investment amounts of less than CHF 200, i.e. in percentage terms you pay more than 0.50% commission in these cases).

An example calculation: If you invest CHF 200, you only pay the minimum fee of CHF 1, for CHF 1,000 it is a moderate CHF 5 and for CHF 2,000 it is still an acceptable CHF 10.

However, if you prefer to invest larger tranches, you are definitely better off with other brokers. At the parent company Swissquote, for example, you pay a flat fee of CHF 9 for many ETFs. For a trade worth CHF 10,000, you are therefore more than five times cheaper at Swissquote than at Yuh (CHF 9 vs. CHF 50).

…or with ETFs without purchase commissions in the Yuh savings plan…

Great news! Yuh currently offers 21 ETFs without purchase commissions (as of January 2026). So if you choose such an ETF in the Yuh savings plan, you can halve the average Yuh commissions to 0.25%, because the sales commissions of 0.50% will continue to accrue and at some point, even if perhaps in the distant future, you will want or have to sell your ETFs again.

…or at the Fee-Free Trading Days

The regular Fee-Free Trading Days, which Yuh has offered every year so far, are a positive highlight. During a clearly defined time window, all trading fees are waived.

The most recently communicated offer for 2026 is valid from March 2 (12:00 noon) to March 6 (12:00 noon) and includes:

- Shares

- ETFs (incl. bond ETFs)

- Cryptos

The decisive factor is the execution time of the order within the action window.

Such actions put the linear 0.50% price structure of Yuh into perspective at certain points – especially when trades are deliberately bundled. However, there is no guarantee for future offers.

The investment universe of Yuh

However, low fees and cool trading features are of absolutely no use to you if the products you can trade on the app are poor.

The investment universe at Yuh on 4.1.2026 consists of the following products:

- 349 shares: e.g. Apple, Nestlé, Nvidia, Roche, Sony, Starbucks, UBS, Zalando

- around 80 ETFs, including

- 21 ETFs without purchase fees in the savings plan

- 28 thematic ETFs

- 10 Bond ETFs

- 2 precious metal ETFs

- 48 cryptocurrencies and three crypto ETPs

- 2 tracker certificates: “Yuh Conservative Portfolio” and “Yuh Growth Portfolio”

The last two investment categories are structured products, which require particular caution due to a lack of transparency and high costs.

How good is Yuh’s ETF selection?

In contrast to other testers, who barely or only superficially examine trading in the Yuh app, we want to close this gap and provide an in-depth analysis with a focus on ETF equity investments. Is the offering really the “best of the best”?

In quantitative terms, the range is still manageable with around 80 ETFs. However, this is not necessarily a disadvantage – the decisive factor is whether the relevant ETFs are included, as additional products do not automatically create added value for you

Positive: Yuh has replaced the previous ETF list with a dynamic product overview. The provider, index and key figures such as TER and fund volume can be viewed at the click of a mouse. The data comes from TradingView.

Existing customers can of course also get an overview of the Yuh investment universe directly via the app.

Either way, our sortable custom creation below gives you an even better comparison of Yuh’s most important ETFs.

ETF investment universe of Yuh

| Description | ETF | Symbol | Index | TER | Trading currency | Stock exchange | Replication method | Div.* | 0% savings plan** |

|---|---|---|---|---|---|---|---|---|---|

| Dividendentitel Europa | SPDR S&P Euro Dividend Aristocrats UCITS ETF (Dist) | SPYW | S&P Euro High Yield Dividend Aristocrats | 0,30% | EUR | XETRA | Physisch | d | |

| Dividendentitel Global | Vanguard FTSE All-World High Dividend Yield UCITS ETF | VHYA | Vanguard FTSE All-World High Dividend Yield | 0,29% | CHF | SIX | Physisch | a | x |

| Dividendentitel Global | Vanguard FTSE All-World High Dividend Yield UCITS ETF | VHYL | Vanguard FTSE All-World High Dividend Yield | 0,29% | CHF | SIX | Physisch | d | x |

| Dividendentitel Schweiz | iShares Swiss Dividend (CH) | CHDVD | SPI Select Dividend 20 | 0,15% | CHF | SIX | Physisch | d | |

| Dividendentitel USA | SPDR S&P US Dividend Aristocrats UCITS ETF | UDVD | S&P High Yield Dividend Aristocrats Index | 0,35% | USD | London SETS | Physisch | d | |

| Edelmetalle: Gold | Swisscanto Gold ETF AA CHF | ZGLD | - | 0,40% | CHF | SIX | Physisch | d | x |

| Edelmetalle: Silber | Swisscanto Silver ETF AA (CHF) | ZSIL | - | 0,60% | CHF | SIX | Physisch | d | |

| Entwickelte Welt | iShares MSCI World CHF Hedged UCITS ETF | IWDC | MSCI World | 0,55% | CHF | SIX | Physisch (Sampling) | a | x |

| ESG Entwickelte Welt | Invesco MSCI World ESG Unversal Screened UCITS ETF Acc | ESGW | MSCI World ESG Universal Select | 0,19% | USD | SIX | Physisch | a | |

| ESG Entwickelte Welt | Swisscanto (IE) ESGen SDG Index Equity World UCITS ETF | SWCSW | Swisscanto ESGen SDG World | 0,35% | CHF | SIX | Physisch | a | x |

| ESG Global | Vanguard ESG Global All Cap UCITS ETF | V3AA | FTSE All Cap Choice Index | 0,24% | CHF | SIX | Physisch | a | x |

| ESG Schweiz | Swisscanto (CH) ESGen SDG Index Equity Switzerland ETF | SWCSS | Swisscanto ESGen SDG CH | 0,35% | CHF | SIX | Physisch | d | x |

| ESG USA | Invesco MSCI USA ESG Universal Screened UCITS ETF Acc | ESGU | MSCI USA ESG Universal Select | 0,09% | USD | SIX | Physisch | a | |

| Global | Vanguard FTSE All-World UCITS ETF | VWRA | FTSE All-World | 0,19% | CHF | SIX | Physisch | a | x |

| Global | Vanguard FTSE All-World UCITS ETF | VWRD | FTSE All-World | 0,19% | USD | London SETS | Physisch | d | |

| Global | Vanguard FTSE All-World UCITS ETF | VWRL | FTSE All-World | 0,19% | CHF | SIX | Physisch | d | x |

| Global CHF hdg | Invesco FTSE All-World UCITS ETF CHF PfHdg Acc | FWCA | FTSE All-World Index | 0,20% | CHF | SIX | Physisch | a | x |

| Global min. Volatilität | iShares Edge MSCI World Minimum Volatility UCITS ETF | MVSH | MSCI World Minimum Volatility | 0,35% | CHF | SIX | Physisch (Sampling) | a | |

| Global Momentum | iShares Edge MSCI World Momentum ETF | IWMO | MSCI World Momentum | 0,25% | USD | London SETS | Physisch (Sampling) | a | |

| Immobilien Schweiz | UBS ETF (CH) SXI Real Estate Funds (CHF) A-dis | SRECHA | SXI Real Estate Funds Broad | 0,97% | CHF | SIX | Physisch | d | |

| Land: Australien | iShares MSCI Australia UCITS ETF | SAUS | MSCI Australia | 0,50% | AUD | SIX | Physisch | a | |

| Land: Brasilien | Xtrackers MSCI Brazil UCITS ETF 1C | XMBR | MSCI Brazil | 0,25% | CHF | SIX | Physisch | a | |

| Land: China | Xtrackers CSI300 Swap UCITS ETF 1C | XCHA | CSI 300 | 0,50% | CHF | SIX | Swap-basiert | a | |

| Land: Deutschland | Xtrackers DAX UCITS ETF 1C | XDAX | DAX | 0,09% | EUR | XETRA | Physisch | a | |

| Land: Italien | iShares FTSE MIB UCITS ETF (Acc) | CSMIB | FTSE MIB | 0,33% | EUR | Borsa Italiana | Physisch | a | |

| Land: Japan | Xtrackers Nikkei 225 UCITS ETF 1D | XNJP | Nikkei 225 | 0,09% | JPY | SIX | Physisch | d | |

| Land: Kanada | UBS ETF (LU) MSCI Canada UCITS ETF A-dis | CANCDA | MSCI Canada | 0,33% | CAD | SIX | Physisch | d | |

| Land: Schweiz | iShares Core SPI ETF (CH) | CHSPI | SPI | 0,10% | CHF | SIX | Physisch (Sampling) | d | |

| Land: Schweiz | iShares SMI ETF (CH) | CSSMI | SMI | 0,35% | CHF | SIX | Physisch | d | x |

| Land: Spanien | Xtrackers Spanish Equity UCITS ETF 1C | XESP | Solactive Spain 40 Index | 0,30% | EUR | XETRA | Physisch | a | |

| Land: UK | Vanguard FTSE 100 UCITS ETF Distributing | VUKE | FTSE 100 | 0,09% | GBP | London SETS | Physisch | d | |

| Land: USA | Vanguard S&P 500 UCITS ETF | VUSD | S&P 500 | 0,07% | USD | London SETS | Physisch | d | |

| Land: USA | Xtrackers S&P 500 UCITS ETF 4C | XDPU | S&P 500 | 0,05% | CHF | SIX | Physisch | a | x |

| Mid Cap: Schweiz | UBS ETF CH SMIM | SMMCHA | SMI Mid Index | 0,25% | CHF | SIX | Physisch | d | |

| Region: Europa | Lyxor EURO STOXX 50 (DR) UCITS ETF | MSE | EURO STOXX 50 | 0,20% | EUR | Euronext Paris | Physisch | a | |

| Region: Euro-Raum CHF Hdg | Xtrackers MSCI EMU UCITS ETF 3C CHF Hedged | XDUE | MSCI EMU CHF Hdg | 0,17% | CHF | SIX | Physisch | a | x |

| Region: Lateinamerika | Amundi MSCI Emerging Markets Latin America UCITS ETF | AMEL | MSCI EM Latin America | 0,20% | EUR | XETRA | Swap-basiert | a | |

| Region: Nordische Staaten | Xtrackers MSCI Nordic UCITS ETF 1D | XDN0 | MSCI Nordic Countries | 0,30% | EUR | XETRA | Physisch | d | |

| Region: Pazifik | Shares Core MSCI Pacific ex-Japan UCITS ETF (Acc) | CSPXJ | MSCI Pacific ex-Japan | 0,20% | USD | SIX | Physisch | a | |

| Region: Schwellenländer | Xtrackers Emerging Markets UCITS ETF 1C | XMME | MSCI Emerging Markets | 0,18% | CHF | SIX | Physisch | a | x |

| Region: Schwellenländer Asien | iShares MSCI EM Asia UCITS ETF | CSEMAS | MSCI Emerging Markets Asia | 0,20% | USD | SIX | Physisch | a | |

| Sektor: Finanzen USA | Invesco US Financials S%P | XLFS | S&P Select Sector Capped 20% Financials | 0,14% | USD | SIX | Swap-basiert | a | |

| Sektor: Gesundheit USA | SPDR S&P U.S. Health Care Select Sector UCITS ETF | SXLV | S&P Health Care Select Sector Daily Capped 25/20 | 0,15% | USD | SIX | Physisch | a | |

| Sektor: Grundstoffe USA | Invesco Materials S&P US Select Sector UCITS ETF | XLBS | S&P Select Sector Capped 20% Materials | 0,14% | USD | SIX | Swap-basiert | a | |

| Sektor: Infrastruktur global | iShares Global Infrastructure UCITS ETF | INFR | FTSE Global Core Infrastructure | 0,65% | USD | SIX | Physisch | d | |

| Sektor: Tech USA | Invesco EQQQ NASDAQ-100 UCITS ETF | EQCH | NASDAQ-100 | 0,35% | CHF | SIX | Physisch | a | x |

| Sektor: Tech USA | Invesco EQQQ NASDAQ-100 UCITS ETF | EQQQ | NASDAQ-100 | 0,30% | USD | SIX | Physisch | d | |

| Sektor: Tech USA | SPDR S&P U.S. Technology Select Sector UCITS ETF | SXLK | S&P Technology Select Sector Daily Capped 25/20 | 0,15% | USD | SIX | Physisch | a | |

| Small Cap: Entwickelte Welt | SPDR MSCI World Small Cap UCITS ETF | WOSC | MSCI World Small Cap | 0,45% | CHF | SIX | Physisch (Sampling) | a | |

| Thema: KI & Big Data | Xtrackers Artificial Intelligence & Big Data UCITS ETF | XAIX | NASDAQ Global AI & Big Data | 0,35% | CHF | SIX | Physisch | a | x |

Thanks to this hard work, we have analyzed Yuh’s ETF product range in detail. After a thorough update (as of 5.1.2026), our Yuh experience leads us to the following conclusions:

- Yuh’s ETF investment universe has visibly evolved since our first analysis: In addition to a gap that was criticized at the time – a broadly diversified emerging markets ETF – other previously criticized points have also been rectified, which means that the offering is now much more coherent .

- The ETF investment universe analyzed by Yuh differs primarily in terms of its geographical focus. In addition to some global and regional ETFs, there are still quite a few country-specific products, albeit to a lesser extent, which we consider to be of limited use due to the low geographical diversification.

- The companies included in the respective index are predominantly weighted according to market capitalization, which corresponds to the market standard.

- Some ETFs pursue specific investment strategies such as “dividends” or “momentum”, while others are limited to individual sectors such as real estate or infrastructure.

- Yuh’s ETF offering is rounded off by two special ETFs on the precious metals gold and silver.

- ETFs that are offered in the savings plan without purchase fees are particularly interesting in terms of price.

- The overall offering also includes three crypto ETPs, ten bond ETFs and no fewer than 28 thematic ETFs focusing on trend themes such as AI & big data, biotechnology and solar energy.

Our ETF favorites in the Yuh investment universe

We consider the following ETFs to be particularly worth examining and are partially invested in them ourselves:

- Vanguard FTSE All-World UCITS ETF (VWRA and VWRL):

If diversification and simplicity are important to you, this global flagship ETF is an obvious choice. Yuh offers it in trading currency CHF in two variants: accumulating as VWRA and distributing as VWRL. In the Yuh savings plan, these Vanguard classics are available without purchase commissions. - Xtrackers Emerging Markets UCITS ETF 1C (XMME):

Accumulating emerging markets classic with low product costs and trading currency CHF. Long a gap in the Yuh offering – now available and without purchase commissions in the savings plan. - iShares Edge MSCI World Momentum ETF (IWMO):

If you’re hoping for an outperformance, take a closer look at this broadly diversified factor ETF. - SPDR MSCI World Small Cap UCITS ETF USD (WOSC):

Another interesting, broadly diversified factor ETF that focuses on companies with low market capitalization. - iShares Core SPI ETF (CHSPI):

If you want to focus on the domestic market (in addition to your global portfolio) and thus reduce the currency risk, this ETF with the 200 largest Swiss companies by market capitalization could convince you.

In our view, the above selection shows attractive ETFs, but is limited to the Yuh investment universe. If you want to delve deeper, you can find further analysis in our articles Best ETFs Switzerland and globally: And the Winner is… and Is factor investing worthwhile? The best 5 factor premiums in the yield check .

Conclusion on investing with Yuh

Thanks to its simple, linear cost structure and manageable ETF offering, Yuh remains particularly suitable for newcomers to the stock market who want to gain their first experience in securities trading with smaller amounts.

At the same time, the ETF investment universe has improved noticeably since our first analysis and now appears more coherent overall. Yuh is thus increasingly appealing to more experienced investors. The steadily growing number of ETFs without purchase fees in the savings plan are particularly attractive.

– Partner offer –

In contrast to Yuh, its parent company Swissquote offers Swiss investors a huge range of ETFs, many at a fair fixed price of CHF 9 (click here for our Swissquote experience).

– – – – –

How good is Yuh’s support?

Of course, Yuh does not have any expensive old-school bank branches where you could discuss your concerns at the counter. Yuh does not provide for personal contact. On the other hand, a relaxed “you” culture is upheld.

There are basically three different channels available to you for questions at Yuh:

- Online help portal: There you will find numerous FAQs, clearly organized by topic. This service is also available via the app.

- Chatbot: Alternatively, you can also communicate with the digital assistant Yulia in an uncomplicated way. However, your expectations should not be too high. Yulia seemed to us to be overwhelmed relatively quickly (e.g. with the keywords “security” or “dividend distributions”). On really simple topics such as “fees”, however, she really blossoms and delivers useful answers. You can access this automated response service via the app under “Message center” / “Write to us”.

- Telephone support: The more specific your request, the sooner you will reach your goal with the Yuh support team made of flesh and blood. Our experience: helpful, competent and in Swiss German. The waiting time for our five calls was an acceptable two to five minutes. The telephone helpdesk, which is free of charge for Yuh, can be reached on 044 825 87 89 (Mon. – Fri. / 08:00 – 22:00). The fact that the support is also perceived as inadequate or overloaded, as can be seen in some of the comments below, is probably mainly due to the rapid influx of customers and the incredible success of Yuh.

How does the registration work?

Before you can become a new Yuh customer, you have to register once. The process only takes around 10 minutes and is purely digital. Important: If you want to benefit from the bonus worth 50 CHF Trading Credits plus the 250 Swissqoins, enter our promotional code YUHSFB in the “Your promotional code from Yuh” field and not in “Refer a friend” or similar.

The following five steps must be completed when registering with Yuh:

- Verify your e-mail (via confirmation e-mail from Yuh in your mailbox)

- Verify identity (using passport or ID; selfie)

- Sign the contract (using an electronic signature)

- Proof of residence including entry of the tax identification number (=AHV no.) in the settings under “Tax residence”

- Make your first deposit (Please note that you can only benefit from the trading credits and 250 Swissqoins once you have transferred at least CHF 500 to your new Yuh account).

Positive: Yuh limits itself to the legally required data from you: i.e. no detailed questions about your income and assets, your workload, etc. There is a shortened procedure for Swissquote or PostFinance customers.

The physical Yuh card (Mastercard debit card) and the corresponding PIN code will be sent to you separately by post a few days after registration. Important: Before you can use the card, you must activate it in the app.

How safe is Yuh?

Your cash, whether for payments or savings, is invested with the state-regulated Swissquote Bank and is protected by a deposit guarantee of CHF 100,000 in the event of bankruptcy. So if you are already a Swissquote customer, you would also have to add the corresponding cash and make sure that it does not exceed CHF 100,000 in total.

ETF investments are of course subject to market risk, but are considered special assets and therefore do not fall into the bankruptcy estate.

Biometric authentication with facial recognition or fingerprint offers you effective protection against fraud and unauthorized access to your Yuh account. You can also activate push notifications for your transactions in the settings.

After logging out, you will be granted access to your Yuh account again with the Yuh Key. The Yuh Key is a six-digit number that you define when you open your account.

There is also a four-digit PIN code for your Yuh card. You will receive this separately by post.

Finally, Mastercard and Yuh offer 3-D Secure, a secure procedure for paying online. After confirming your purchase, you authorize the transaction with your smartphone and thus protect yourself against fraud when shopping online. You can activate 3-D Secure in the Yuh app.

Conclusion on safety with Yuh

Apart from the usual market risks that you always take when trading securities, we rate Yuh as a secure Swiss online bank.

What on earth are Swissqoins?

Yuh describes Swissqoin (SWQ) as an innovative crypto token whose value is steadily increasing as Yuh puts money back into it every month. In addition, the more you use the app, the more Swissqoins you receive and the more you can benefit from Yuh’s rewards.

You can earn 5 SWQ for trades and 1 SWQ for card payments. (Condition: Transaction must be worth at least CHF 1.) Positive: You can sell Swissqoins at any time, which will credit you with CHF.

Your starting balance is 250 SWQ, which was worth exactly 3.74 CHF on 20.9.2023. This means 1 SWQ = 0.01496 CHF. As at 4.1.2026, the selling price for 1 SWQ was already CHF 0.02045 – an increase of 37%.

Conclusion on the Swissqoins

Swissqoins are like Cumulus points from Migros: a nice gimmick that can bring you constant monetary added value, especially if you pay many smaller amounts from CHF 1 with your Yuh card. However, the prerequisite is that you remain rational and never allow yourself to be tempted into ill-considered transactions because of a few extra Swissqoins.

Advantages and disadvantages of Yuh

Before we end this Yuh review with a final conclusion, we would like to summarize the most important advantages and disadvantages of this youngest and probably most innovative neobank in Switzerland based on our Yuh experience.

Conclusion of our Yuh experience

For digitally savvy and cost-conscious people who already do a lot of business via their cell phone, Yuh is likely to be very popular for payment transactions.

If you already have a foreign currency balance, there are no fees for card payments abroad – thanks to the multi-currency account. Otherwise, the currency exchange fees at Yuh are not exactly cheap at 0.95%.

We generally recommend investing with Yuh – with two restrictions:

Even though Yuh offers very attractive ETFs, the selection is still limited compared to traditional online brokers. In addition, the costs for higher investment sums have a greater impact due to the linear price structure.

Conversely, this also means that if one or other of your favorite ETFs is offered at Yuh and you trade smaller tranches of up to around CHF 1,000, investing with Yuh can be a very attractive choice. All the more so as you currently receive 50 CHF trading credits and 250 Swissqoins as a gift.

A clear advantage of Yuh is the automatic savings plan: 21 ETFs without purchase commissions can be saved for the first time, including two globally diversified Vanguard classics.

So whether it’s for paying, saving and/or investing, Yuh could be your preferred banking solution.

However, Yuh is definitely also suitable as a supplement to your house bank and your online broker. You can’t really go wrong with such a “double solution”, because Yuh is risk-free in that you don’t incur any ongoing fees for account management and securities custody accounts.

This might also interest you

Updates

2026-02-23: Fee-Free Trading Days offers explained by Yuh.

2026-01-19: Comprehensive update carried out.

2025-09-05: New CEO Fin introduced.

2025-07-08: Indicated that Yuh is 100% owned by Swissquote following the purchase of the PostFinance shares.

2025-06-20: Additional bonus of 250 Swissqoins mentioned, Swissqoin performance chart added and savings interest (0.00%) updated.

2025-05-27: New image with fee-free EUR card payment added.

2025-04-01: Savings interest (0.10%) updated.

2025-03-27: It is pointed out that Yuh is already making a profit after four years and that in the event of dissatisfaction with the support, Yuh CEO Markus Schwab can be contacted directly by e-mail (makurs.schwab@yuh.com) as an additional option.

2025-01-12: Savings interest and investment universe updated. Note that automatic transfer from “Savings” to “Payments” is not possible. Calculation example with increase in value of a Swissqoin added.

2024-10-14: Yuh investment universe updated and pointed to new, more informative Yuh product overview.

2024-10-03: Interest conditions adjusted.

2024-07-26: Additional chapter incl. visualization about the new Yuh savings plan offer with 6 “free ETFs” added.

2024-07-21: Reference to new Yuh savings plan offer with “free ETFs”.

2024-07-01: Amendment that only savings deposits earn interest added.

2024-06-20: Temporary offer for free currency exchange mentioned.

2024-06-12: Minor adjustments made, including links to suitable third-party articles.

2024-04-23: Referred to the more meaningful ETF names in the Yuh App.

2024-01-09: Registration procedure clarified with an explanation of the conditions under which the bonus of CHF 50 trading credits is activated. Conclusion supplemented with the special feature of Yuh that cash for payment transactions also benefits from savings interest.

2023-11-02: Originally, based on the FAQs at the time, we assumed an active investment approach for Yuh’s 3rd pillar solution. We also criticized the lack of transparency in the relevant investment universe. Both aspects have now been corrected in the article: passive investment approach and product transparency (i.e. the corresponding index funds are linked on the Yuh website).

Disclaimer

Transparency note: The overall package from Yuh convinced us, which is why we have entered into a partnership with Yuh. With the Yuh promotion code “YUHSFB” you can secure trading credits worth CHF 50 and support our blog at the same time. In order to report credibly and realistically at first hand, Toni and Stefan have become new customers of Yuh in the course of this article.

Disclaimer: Investing involves risks of loss. You must decide for yourself whether you want to bear these risks or not.

Errors excepted: We have written this Yuh review based on our Yuh experience to the best of our knowledge and belief. Our aim is to provide you as a private investor with the most objective and meaningful financial information possible. However, if we have made any mistakes, forgotten important aspects and/or are no longer up to date, we would be grateful if you could let us know.

Newsletter

Newsletter

36 Kommentare

Ich hab YUH schon einige Jahre. Ob der Kundendienst Kindergarten jetzt erwachsen geworden ist seit PoFi nicht mehr drin ist? Ich hatte letztes Jahr 3 Monate keinen Zugang wegen technischer Gründe (wir sind dran, bitte Geduld). Als ich wieder rein kam verkaufte ich alle Investitionen. Ein Investitionskonto mit Zufallszugang passt mir nicht. 100% Abhängigkeit von 1 Telefonapparat ist ebenso schlecht. Es gibt keinen Zugang via Computer als Alternative. Die Grundidee von YUH ist gut, aber es gibt zu viele Unsicherheiten, somit Einsatz beschränken, z.B. kein Lohnkonto.

Auf keinen Fall ! Richtig schlimme Erfahrung gemacht mit yuh. Beginnt bei Belastungen von Gebühren und FX Kurse die intransparent sind. Dazu kommen falsche Aktienkurse und massive Probleme bei volatilen Tagen/Titeln die Kurse nachzuführen.

Saldierung und Rückzahlung von Geldern (4 Stellig) dauert seit 3 Monaten an, ohne dass man den Support erreichen kann. Weder Briefe, noch Emails, noch Telefonate helfen.

Bei uns läuft mit Yuh bisher alles reibungslos, weshalb wir auch den Support nicht beüben müssen:-) Wie im Artikel erwähnt, wende dich doch direkt an den Yuh CEO, wenn du mit dem Support nicht weiterkommst: markus.schwab@yuh.com

Nachdem ich die ganzen negativen Beurteilungen gelesen habe, möchte ich gerne meine Erfahrungen seit 2023 mit YUH teilen.

Habe keinerlei Probleme mit sämtlichen Funktionen bis dato gehabt und mir ist aufgefallen, dass meistens, wenn es ein Problem gibt, dies davorsitzt. Also nicht immer gleich negativ alles bewerten, bin der Meinung, dass YUH das Beste ist, was die letzten Jahre auf den Markt kam. Natürlich kommt es auch darauf an, was ich erwarte.

Das Yuh ist gar nicht Juhu. Schon bei der Registrierung hat es nicht geklappt, weil das Selfie nicht gemacht werden konnte. Nach 10 Minuten probieren habe ich aufgegeben, die Sache ist für mich erledigt.

Also, nun nutze ich die YUH App schon seit 02.12.2024 , habe Beträge eingezahlt, Spar-Pots angelegt, Währung gewechselt, – funktioniert alles.

ABER !!! :

Ich muss vor jedem erneuten Aufrufen der APP diese erst mal deinstallieren und dann wieder neu installieren – ansonsten funktioniert sie nicht : Endlosschleife bei der Anmeldung ! !!!

UND :

Ich habe deshalb schon 3 mal den Kundenservice angemailt (‘Social.media@yuh.com und contact@yuh.com) – bis jetzt KEINE REAKTION !

Anrufen werde ich nicht noch mal – der erste und letzte Anruf wegen der Kontoeröffnung hat mich über 7 € gekostet !

Es fällt mir zunehmend schwer mein Geld einer APP zu überlassen bei der Kundensupport nicht zu erreichen ist ! ich denke ich werde es dabei belassen .

Schade .

Du kannst dich – falls noch ein Interesse an Yuh besteht und dein Anliegen vom Yuh Support noch nicht zufriedenstellend gelöst wurde – direkt an den Yuh CEO Markus Schwab wenden. Dies hat er uns bei einem persönlichen Austausch am 26.3.2025 selber vorgeschlagen. Hier ist seine E-Mail: markus.schwab@yuh.com

Viel Erfolg und beste Grüsse

SFB

Ich habe vor 2 Tagen mein YUH Konto eröffnet und alles verlief schnell und reibungslos. Auch die Kommunikation war völlig in Ordnung als ich ein kleines technisches Problem hatte (was an meinen Handy-Einstellungen lag ). Bisher kann ich mich nicht beschweren – weder über den Service, noch über die Kontoeröffnung.

Leider kann ich nur von Problemen berichten. Anfragen werden nicht beantwortet bzw. mit dem Hinweis beantwortet, dass das Problem an die relevante Stelle weitergeleitet worden ist und dann hört man 3 Wochen lang gar nichts

Seit 1 Woche warte ich nun auf die Kontoeröffnung. Die Überprüfung durch einen Mitarbeiter sollte ja eigentlich nur 1-3 Minuten dauern. Ich warte mal weiter ab und werde wenn nichts passiert einfach die Anmeldung neu starten.

Ich habe bereits am 13. Juli einen Kommentar verfasst und “liebäugle”

Mit einem YUH Konto.

Was mich aber abschreckt sind die vielen schlechten Bewertungen auf Trust****!

Es werden wohl (aktuell) willkürlich Konten gesperrt (teils sofort nach der 1. Überweisung) und die Kontenbesitzer können teilweise bis zu 3 Monate nicht mehr über ihr Geld verfügen. Auch sehr viele weitere Probleme werden beschrieben.

Der Kundendienst ist nicht erreichbar, gibt keine Antwort, kann nicht weiterhelfen usw.

Sind Ihnen solche Probleme bekannt?

Können Sie YUH weiterhin empfehlen?

Also ich habe da ein mulmiges Gefühl…

Nein, solche Probleme mit Yuh sind uns nicht bekannt. Insbesondere Stefan nutzt die Yuh App bzw. die Features “Sparen” und “Zahlen” regelmässig. Es lief bisher alles reibungslos, auch mit dem Yuh Support.

Hallo und danke für Ihre Antwort. Ich habe bei YUH (zeitgleich wie hier) direkt per Email nachgefragt und um Stellungnahme zu den Vorwürfen gebeten.

Antwort ist noch keine erfolgt. Mal schauen ob eine kommt.

Keine Antwort ist auch eine Antwort… scheint was dran zu sein, dass der Yuh Kundendienst nicht antwortet…

Vorsicht: Das Gesülze im Artikel entspricht in keiner Weise dem Service von yuh. Mir wird seit 14 Tagen eine 5-stellige Überweisung NICHT gutgeschrieben, selbst veranlasste Überweisungen werden nicht ausgführt, bevor am angiebt, um was für Geld es sich handelt und wie man zum Empfänger steht. In einer dieser Anfragen spricht mich der Support mit einem falschen Vornamen an. Für mich ist yuh das exakte Gegenteil vom Schweizer Bankwesen, wie ich es zuvor kennengelert hatte.

Ich kann Michaels Aussage nur bestätigen. Überweisungen werden nicht durchgeführt. Funktionen wie Überweisungen in der Schweiz oder International, sind auf einmal in der APP grau hinterlegt und können nicht durchgeführt werden.

Yuh ist hochgradig unzuverlässig, der Kundendienst existiert nicht, lasst einfach die Finger davon.

Hoi Frank

Du kannst dich – falls noch ein Interesse an Yuh besteht und dein Anliegen vom Yuh Support noch nicht zufriedenstellend gelöst wurde – direkt an den Yuh CEO Markus Schwab wenden. Dies hat er uns bei einem persönlichen Austausch am 26.3.2025 selber vorgeschlagen. Hier ist seine E-Mail: markus.schwab@yuh.com

Viel Erfolg und beste Grüsse

SFB

Alles in allem eine gute Bank für Trading mit Benutzerfreundlichen APP.

War vorhin 10 Jahre bei Swissquote – als Normalanleger ist das Angebot aber bei Yuh für mich ausreichend, auch sind die wesentlichen Funktionen vorhanden.

Dafür hat man auch viele Vorteile.

+ Gratis Kredidkarte mit mehreren Währungen

+ Keine Depotgebühren

+ Ausreichendes Anlageangebot

+ Wettbewerbsfähige Zinsen auf Bargeld

+ Übersichtliche App ohne viel Schnick Schnack

Nachteile

– Hohen Wechselgebühren (0.95%)

App ist sicher noch ausbaufähig (Performanceanzeige fehlt zu Beispiel)

Nachdem ich jahrelang sehr zufrieden mit dem Service und den Konditionen von Revolut (UK) war und immer noch bin, habe ich vor 2 Jahren mit den Schweizer Digitalbanken YUH und neon als Alternative App-basierte Onlinebanken gestartet.

Leider ist meine Erfahrung insbesondere mit YUH im Vergleich mit Revolut mehrfach negativ.

Für Zahlungsverkehr CHF – EUR sind die Wechselkurse durchwegs schlechter und bei Revolut bis CHF 1250.- pro Monat gebührenfrei. Die Zahlungen z.B. von Revolut auf N26 in EUR erfolgen international in wenigen Sekunden. Bei YUH werden Zahlungen zum Teil erst mehrere Tage später angezeigt. Aktuell sieht man in der App auf den CHF und EUR Konten die letzten Buchungen vom 30. Juli 2024, obwohl heute bereits der 5. August 2024 ist. Es gebe angeblich ein technisches Problem in der IT, wird man informiert beim Anruf auf (nicht gebührenfreie Nummer) 044 825 87 89 (Mo-Fr von 08:00 – 19:00 h) und langem Warten in der Warteschlaufe. Eine proaktive Information an die betroffenen Kunden gibt es nicht.

Ich bleibe definitiv bei Revolut, hier funktioniert es zuverlässig und schnell, auch wenn die Schweizer Banklizenz von der FINMA nach Litauen vergeben wurde, spielt mir als Kunde keine Rolle.

Die Schweizer Anbieter sind wesentlich langsamer, teurer und leider auch unzuverlässiger.

Was ich bis jetzt nicht kapiere: ist das ein Lohnkonto, also muss man regelmässig Geld überweisen oder ist es ein Sparkonto?

Ich lese und Google aber es wird immer von Sparen und Traden und was weiss ich geschrieben, aber man meine Fragen kann ich nirgends richtig klären.

Wobei ja jetzt wohl nur noch “Sparbeträge” verzinst werden, dann muss es doch so etwas wie ein Privat/Lohnkonto geben? Und wieviel Geld muss da dann drauf sein, oder kann man alles nach Sparen verschieben? Und muss regelmässig Geld eingehen?

Kann das jemand beantworten? Ich werde auf der Webseite von yuh nicht schlau diesbezüglich.

Danke.

Es ist ganz einfach: Möchtest du deine Barmittel bei Yuh verzinst haben, dann musst du sie einfach von “Zahlen” in den “Spartopf”, d.h. auf “Sparen” verschieben. Das machst du bequem per App in wenigen Sekunden. Benötigst du dieses Geld wieder für laufende Zahlungen, transferierst du es einfach wieder zurück. Vor dem 1.7.2024 wurden bei Yuh alle Barmittel verzinst. Und nein, es muss nicht regelmässig Geld eingehen, damit dieses verzinst wird.

Huhu.

Ich würde gerne dort ein Konto eröffnen (natürlich gerne mit Eurem Code).

Aktuell kann ich das nicht tun, da ich zu folgenden Fragen keine Antworten finden konnte.

1. Bekomme ich einen ordentlichen Steuerbericht für mein deutsches Finanzamt (ich bin Deutscher und wohne in Deutschland)?

2. Die Aktienauswahl von 276 habe ich nur hier auf der Website gefunden, die ist mir natürlich zu gering. Vor allem weil ich mir ein Dividendendepot dort aufbauen möchte und auch gerne in unbekanntere Unternehmen investieren möchte (Grupo Orsero, Olvi, Frosta, …)? Kann mir jemand mitteilen, wie ich dies prüfen kann?

Schon mal vorab ein großes Dankeschön.

zu 1) als Schweizer Finanzblog können wir uns wenig unter einem “ordentlichen Steuerbericht für (m)ein deutsches Finanzamt” vorstellen. Empfehlung: Direkt den Yuh-Support kontaktieren. (Grundsätzlich bist du als Deutscher in Deutschland berechtigt, ein Yuh-Konto zu eröffnen.)

zu 2) Die Aktienauswahl ist so gering, wie beschrieben. Das heisst, Yuh scheint, was die Aktien-Trades betrifft, für dich nicht geeignet zu sein.

Wozu es nirgends eine Auskunft gibt: taugt Yuh für ZahlungsEINGÄNGE aus dem nicht-SEPA-Ausland? Man kann nicht nach Japan oder Australien oder den USA überweisen. OK, aber kann man von dort Überweisungen erhalten? Was sind die Gebühren? Keine Informationen dazu. Nirgends. Ich finde auch kein bankenübliches Preisverzeichnis, das solche Informationen enthalten würde. Weiß jemand etwas dazu?

Wir haben soeben kurz den Yuh Support bezüglich deinem Anliegen telefonisch angefragt. Demnach ist es a) möglich ausserhalb des SEPA-Raums (also bspw. USA oder Japan) Gelder aufs Yuh Konto zu empfangen und b) werden bei eingehenden Zahlungen seitens Yuh generell keine Gebühren belastet. Bei der überweisenden Bank und allfälligen Zwischenbanken können jedoch Gebühren entstehen, welche ausserhalb des Einflussbereichs von Yuh sind.

Habe nun das YUH Konto seit etwa einem Jahr und bin auch recht zufrieden mit dem Umgang.

Eines finde ich recht merkwürdig: die Kontoauszüge als pdf sind für jede weitere Verarbeitung für eigen Auswertungen (z.B. Excel) unbrauchbar, im Jahreswechsel wurde das Format auch noch umgestellt. Liegt das an der alleinigen App Lösung?

Wir denken, dass Kontoauszüge im PDF-Format bei vielen Finanzanbietern mittlerweile Standard sind. Und ja, möglicherweise bieten Neobanken wie Yuh, welche sehr kosteneffizient und auf das Wesentliche fokussiert wirtschaften (müssen) bezüglich der Reports und deren Formate weniger Wahlmöglichkeiten als finanzstarke, globale Finanzplayer wie beispielsweise Interactive Brokers, welcher nicht nur unterschiedliche Reports und Formate zur Verfügung stellt, sondern auch mehrere Plattformen anbietet.

Also ich kann nur raten, Finger weg von YUH. Zum ersten , man erreicht niemden in der Hotline. Zum zweiten, der seltsame KI Support funktioniert ja schon gar nicht. Zum dritten, es verschwinden einfach mal so 10000,00 USD die nach zwei Tagen immer noch nicht auf meinem YUH Konto sind. Bei Nachfrage Swissquote, wo ja das Geld auch hin geht, kommt nur der lapidare Verweis man soll YUH anrufen. Gesagt getan, was passiert????????? NICHTS!!!!!!!!!

Ich finde das alles eine Frechheit, dass ganze auch noch hier in der Schweiz. Schämt euch YUH!!

Ich werde wohl die Polizei, Blick und Kassensturz darauf aufmerksam machen.

Danke für die Erfahrungen die hier geteilt wurden mit Yuh. Leider stecke ich einer unangenehmen Situation, dass ich keine entsprechende Anleitung bekomme, wie ich meinen persönlichen PIN zurücksetzen kann. Ich bekomme wenn ich anrufe einen Yuh key, danach sollteich meine Identität

bestätigen. Da kann ich entweder ein Bild oder einen PIN eingeben. Den PIN habe ich vergessen nun weiss ich nicht wie ich das wiederherstellen kann? Hat jemand eine Idee oder kann weiterhelfen? Ich danke für alle eure Empfehlungen.

In diesem Fall ist es wohl am besten, wenn du den Yuh-Support kontaktierst, z.B. via Tel. 044 825 87 89.

Leider scheint es derzeit weitere technische Probleme zu geben. So kann wird man aufgefordert sich neu einzuloggen. Der hierfür erforderlichen Token (Code) kommt aber nicht per SMS/ Mail? In der Hotline wartet man Minimum über 30 Minuten – um dann zu erfahren, dass es derzeit ein technisches Problem gibt. Und aufs Konto/ Geld zugreifen klappt nicht. Sehr harzig im Moment und passt nicht zur früheren guten Erfahrung.

Yuh ist übrigens auch deshalb etwas “Besonderes”, weil man auch ohne Wohnsitz in der Schweiz (u.a. als Deutscher oder als ausgewanderter Schweizer) ein kostenloses Schweizer Konto kriegt. Das hat leider Seltenheitswert. Auch wenn ich mir als Deutscher, der sein Schweizer Gehalt nach Hause kriegen will, die Finger nach einem Neon Konto lecken würde ist der kostenlose Bargeld-Bezug und die Möglichkeit, meine Schweizer Krankenkasse zu bezahlen ein wahrer Lebensretter, denn in Deutschland bieten erschreckend viele Banken keine Transaktionen in Fremdwährung an.

Danke für den sehr ausführlichen und tollen Bericht! Wie mein Kommentar-Vorredner bin ich auch bei Neon. Ich war vorher bei Yuh. M.E. beisst sich da nix bzw. schlussendlich ist es schon fast Geschmackssache. CHF 1 Franken Mindestgebühr, dafür Teilkäufe bei Yuh (ist bspw. bei Aktien und ETF mit Stückpreis über CHF 200.00 für den Kleinanleger lohnender). Leider Wechselkursaufschläge gegenüber Neon, dafür wieder die besagten Fremdwährungskonten. Warum ich gewechselt habe? Die verwirrenden, schon fast kindlichen Bezeichnungen der ETF’s und das kleine ETF Angebot von Yuh… und die sagenhafte Prepaidkarte von Neon ohne Aufschläge für Zahlungen im Ausland. Schlussendlich – im gesamten – tun sich wohl beide nix und es kommt auf die eigene Präferenz an. Ich bin allerdings sehr gespannt, wer von den beiden als Erster Limitaufträge anbietet. 🙂

Merci für deine Eindrücke, Claudio. Auch neon hat unbestritten sehr interessante Vorzüge, insbesondere die, wie du schreibst, “sagenhafte” Debitkarte. Grund genug für uns, bald auch einen neon-Review zu publizieren. Die wichtigsten Eigenschaften von neon haben wir bereits auf unserer Empfehlungsseite zusammengestellt, einschliesslich Aktionscode “SFB20” mit Startbonus von 20 CHF.

Feedback zu: “Investieren ohne Depotgebühren und tiefen Kommissionen von 0.50% (mind. 1 CHF) macht Yuh vor allem für Kleinanleger:innen interessant.”

Eher ein Winderspruch da man pro Trade mind. 200 CHF investieren sollte sonst sind Tradinggebühren prozentual viel höher durch die Mindestgebühren von 1 CHF und die 0.95% Wechselgebühren für Anlangen im Fremdwährungen kommen dazu. neon ist da viel günstiger. Keine Mindestgebühr, keine Wechselgebühren!

Danke für dein Feedback. Deine Punkte bezüglich Yuh haben wir jedoch alle in unserem Review thematisiert. Bezüglich der 0.50% Kommissionen schreiben wir beispielsweise: “Zu beachten ist, dass bei Investitionssummen von weniger als 200 CHF immer die Yuh Mindestkommission von 1 CHF zum Tragen kommt, d.h. prozentual zahlst du in diesen Fällen mehr als 0.50% Kommission.” In diesem Zusammenhang haben wir offensichtlich eine andere Auffassung: Denn für uns gehören CH-Personen, die in Tranchen à 200 CHF investieren, immer noch zu den Kleinanleger:innen. Deshalb sehen wir in der von dir aus unserem Review zitierten Formulierung auch keinen Widerspruch. Und was die (relativ hohe) Wechselgebühr von 0.95% betrifft, so empfehlen wir, diese mittels Multiwährungskonto wenn immer möglich zu vermeiden.