In the last article, you learned how you can structure your assets according to your individual risk profile using a broadly diversified global portfolio. In this article, we will look at how you can restore your original asset allocation simply and cost-effectively by rebalancing if the individual assets perform differently.

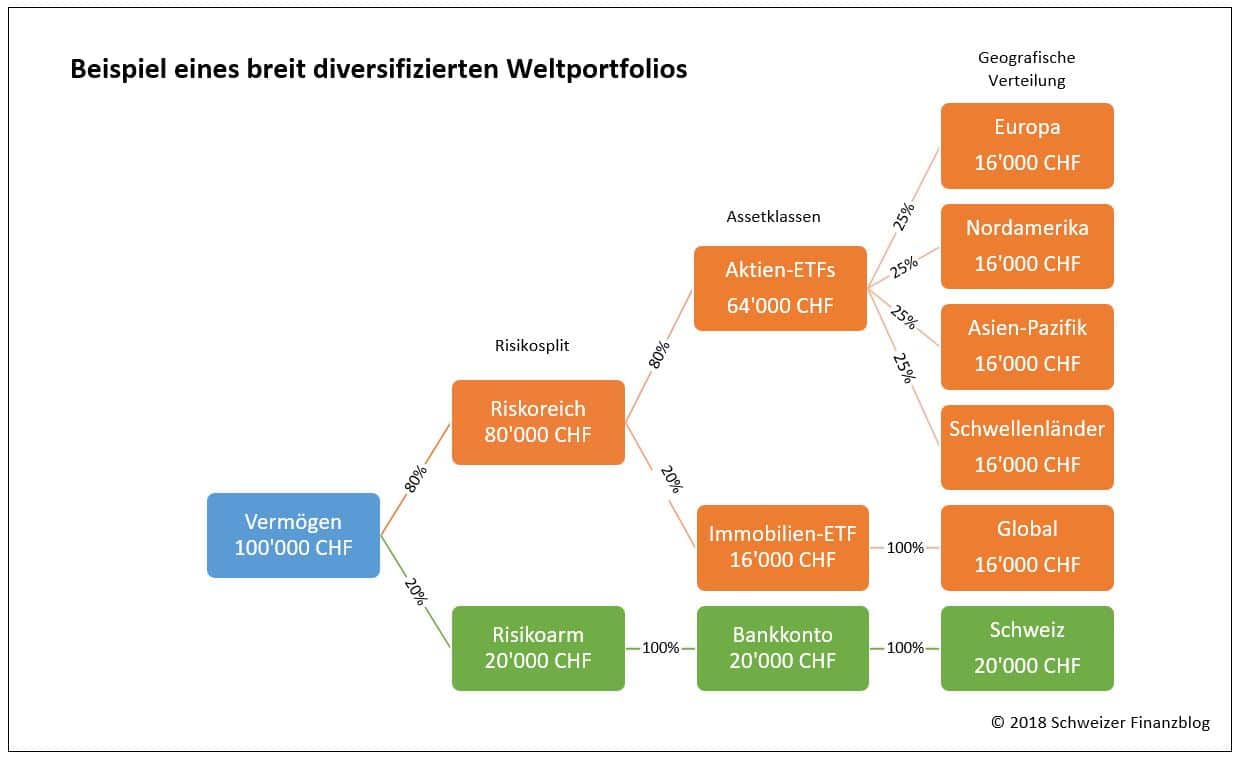

Before we get into the topic, let’s remind ourselves of the initial situation in the last article. We have put together a global portfolio with a risk split of “80% high-risk” and “20% low-risk” (see Figure 1):

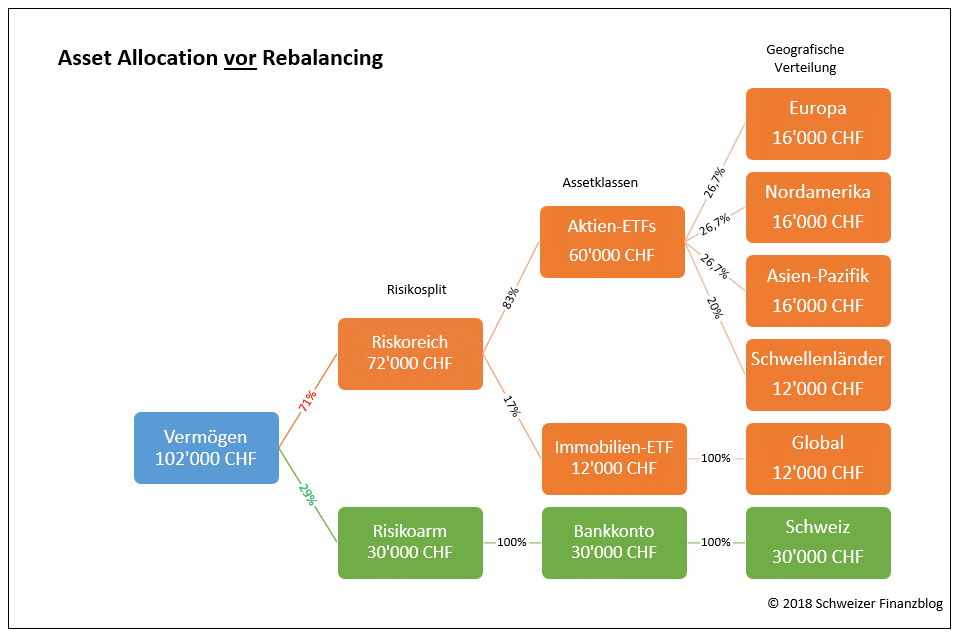

Let’s now assume that your bank account grows by CHF 10,000 to CHF 30,000 thanks to additional income and/or greater savings efforts. At the same time, the market value of your ETF investments is 72,000 francs, which corresponds to a loss of 8,000 francs or 10 percent.

Let’s further assume that only your investments in emerging markets and real estate are affected by the price loss, half each (i.e. minus CHF 4,000 each). The other ETF investments have therefore not changed in value. Figure 2 illustrates the new asset situation.

Your original asset allocation has thus changed significantly, in favor of the low-risk portion. This now amounts to 29% (instead of 20%), while the high-risk portion now only amounts to 71% (instead of 80%).

In other words, your current asset allocation no longer matches your risk profile. We now want to restore the original balance by means of rebalancing.

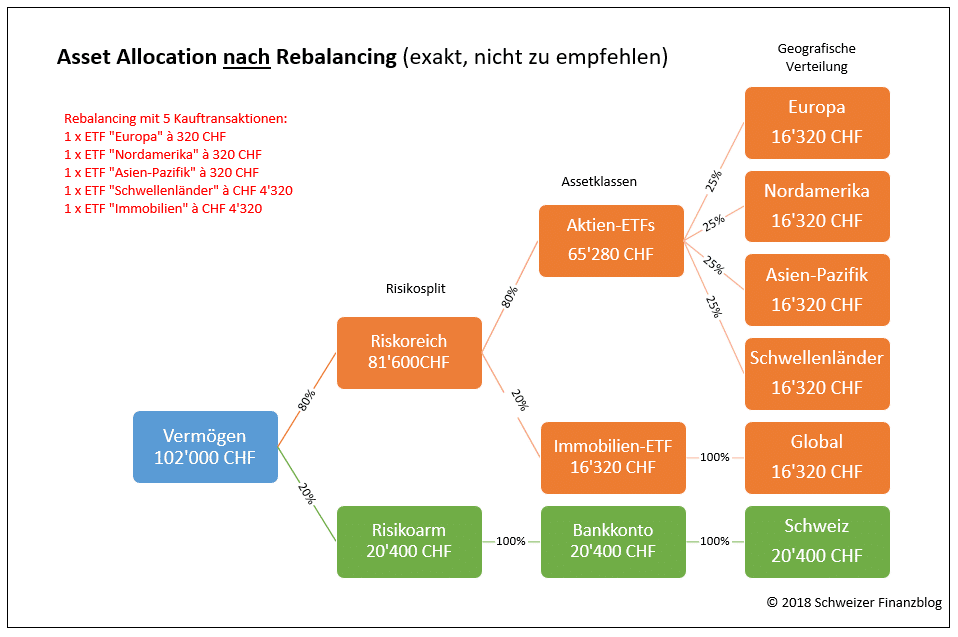

After carrying out an exact rebalancing, your asset allocation would look like Figure 3.

Cool, a precision landing! The weightings match the defined risk profile to the exact franc. On the one hand.

On the other hand, such an approach would probably be too costly due to the high transaction fees. After all, you would have to make five purchases, three of which would only amount to 320 francs each.

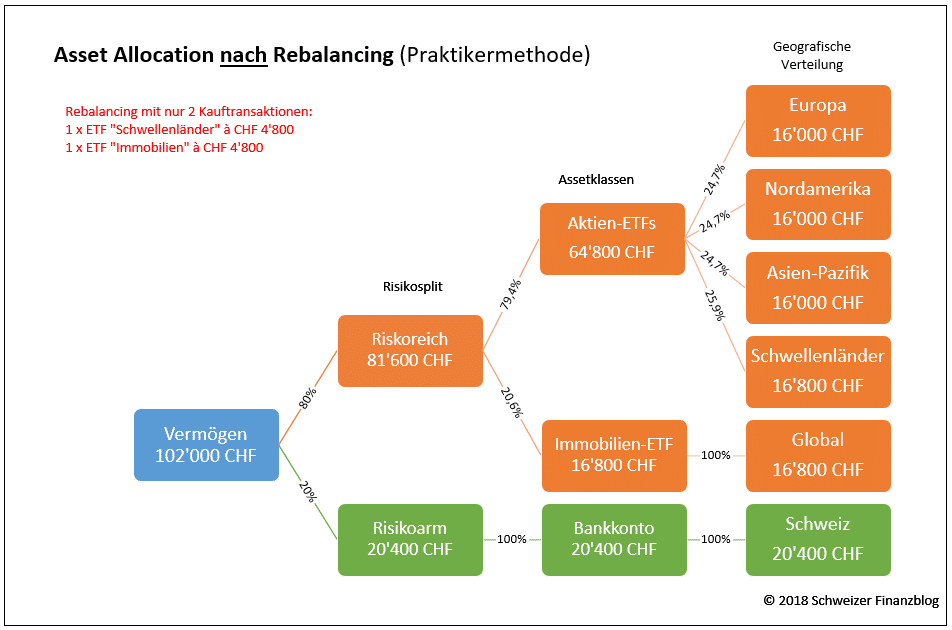

For this reason, a different, more cost-effective approach is preferable in such cases. We suggest the following practical method:

Rebalancing is the reallocation of investments in order to restore your predefined asset allocation.

One positive effect after rebalancing is that the asset allocation corresponds to your risk profile again. In addition, you generally do not buy at the highest prices.

A potential disadvantage, on the other hand, is that frequent rebalancing incurs high fees. This reduces your return unnecessarily and runs counter to the scientifically preferred buy-and-hold strategy.

Therefore, our tip: If the weighting of the low-risk part (bank account) grows significantly , as in the example above, rebalance or invest promptly. This will allow you to benefit from equity returns and compound interest, which are likely to be significantly more generous than the bank account in the long term.

If the weightings change only slightly, wait and see or avoid reallocations altogether. This approach will save you transaction costs.

If you are already in the de-savings phase, rebalancing means that you first sell investments whose weight has increased.

Scientific studies show that additional returns can also be expected when rebalancing within asset classes with roughly the same return prospects. The literature also refers to the “rebalancing bonus” in this context.

Gerd Kommer writes in the current 5th edition of his book “Souverän Investieren mit Indexfonds und ETFs”: “Rebalancing increases the annual return of a well-diversified portfolio by up to half a percentage point in the long term, while the risk hardly changes or decreases minimally.”

Rebalancing can be implemented particularly well with a low-cost online broker.

– Partner Offer –

In our experience and due to the low costs for ETFs, a particularly attractive broker at present is “DEGIRO” (link to the DEGIRO Review). Bei Interesse kannst du dich bei DEGIRO über unseren partner link which will give you Trading Credits of 100 CHF (with conditions) and support our blog at the same time.

– – – – –

One of the reasons he gives for this excess return is the so-called regression to the mean value.

If the actual values deviate significantly from the target values, you should rebalance your investments promptly back to the original weighting that corresponds to your risk profile.

This approach is particularly recommended if, for example, the low-risk portion is growing much faster than the high-risk portion thanks to additional income and/or a high savings rate.

With appropriate investments in the risky part, you can expect a higher return in the long term or the risk/return ratio will again correspond to your risk profile.

Rebalancing for small deviations of less than CHF 1,000 is often not worthwhile because the transaction fees are then disproportionately high. In these cases, it is therefore better to wait and avoid rebalancing.

In the next article, we will take a closer look at the (rightly) increasingly popular investment vehicle “ETF”, which in our opinion represents nothing less than a revolution in private investment.

You can get a complete overview of the topic of “Investing” here: Learning to invest – in eight lessons.

Disclaimer: Investing involves risks of loss. You must decide for yourself whether you want to bear these risks or not.

Errors excepted: We have written this article to the best of our knowledge and belief. Our aim is to provide you as a private investor with the most objective and meaningful financial information possible. However, should we have made any errors, forgotten important aspects and/or no longer have up-to-date information, we would be grateful if you could let us know.

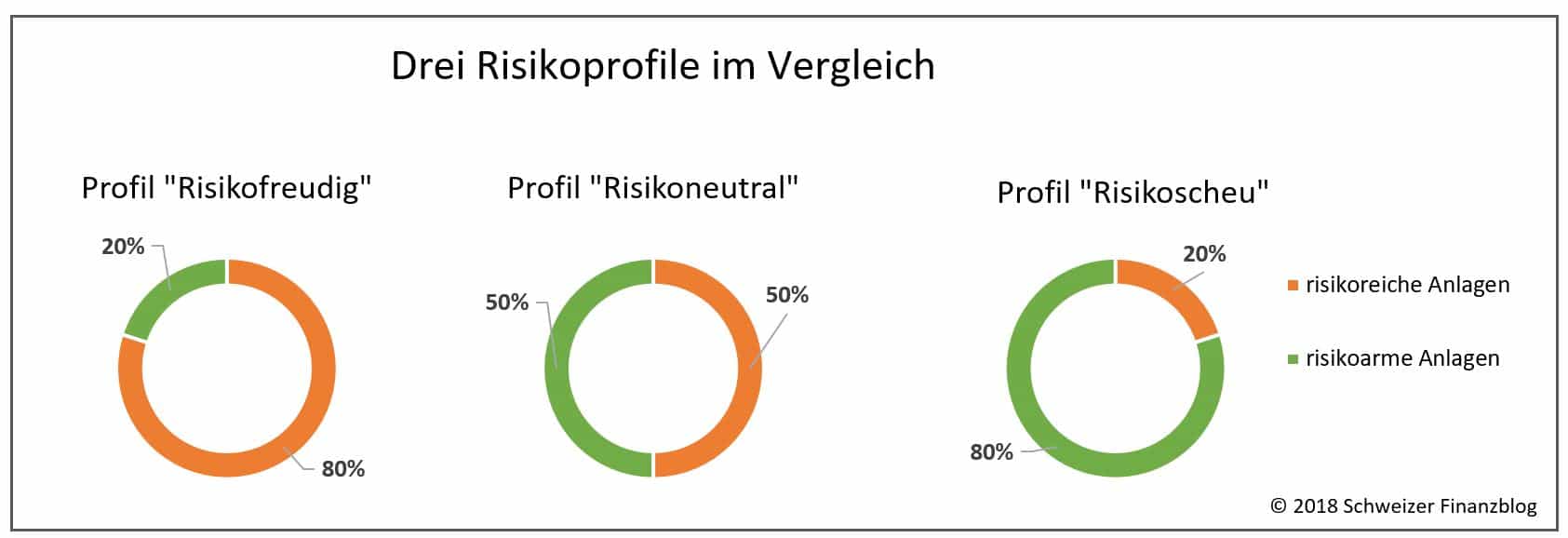

In the last article, you learned about the positive effects of smart diversification when investing. In this article, we want to take this topic a step further and focus on asset allocation: the key success factor for your investment! In this article, you will find out how to structure your assets according to your needs and risk profile.

Asset allocation depends on your individual risk profile. This in turn is influenced by the following three factors:

Basically, the longer your investment horizon, the riskier and therefore more profitable you can invest your money. This is because, as we have already shown in this article, price fluctuations and stock market corrections can generally be better balanced out with longer-term investments. You also benefit from the powerful compound interest effect with a long investment horizon.

– Partner Offer –

In our experience and due to the low costs for ETFs, “DEGIRO” is currently a particularly attractive broker (link to DEGIRO review). If you are interested, you can register with DEGIRO via our partner link , which will earn you trading credits worth CHF 100 (with conditions) and support our blog at the same time.

– – – – –

It is also important that you are aware of how much risk you want to take. Even the broadly diversified MSCI World share index with around 1600 shares lost over 57% (= maximum drawdown) in value in the course of the so-called subprime crisis between October 31, 2007 and March 9, 2009 (see MSCI World factsheet).

If you can still sleep peacefully (and don’t sell) even with such heavy price losses, you are clearly the risk-taking investor. But perhaps you are more risk-averse and your primary aim is to preserve the value of your investment.

Risk capacity expresses the fluctuations in value and losses you can cope with without getting into financial difficulties. The less you are dependent on the invested capital to meet your obligations, the greater your risk capacity.

To clarify: a well-off childless dual-earner couple generally has a much higher risk capacity than, for example, a single mother.

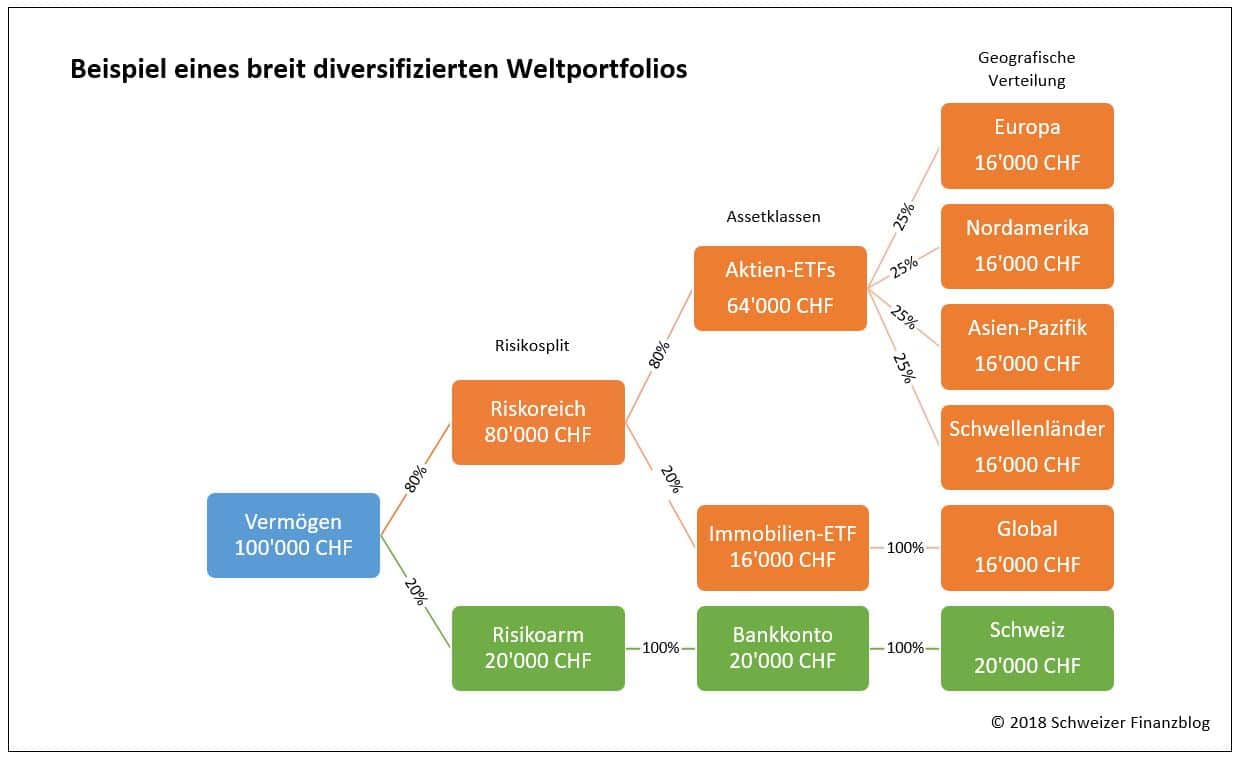

Let’s assume that you have fictitious assets of CHF 100,000, which are interest-free and available at all times in your private account. We also assume that you have a regular income and that you have your running costs under control. Finally, you are not planning any major purchases for the next 10 years, such as buying a home.

Based on Markowitz’s scientifically oriented portfolio model (see also this article), we recommend first dividing the CHF 100,000 into a low-risk and a high-risk portion based on your risk profile (see Figure 1).

Important: No matter what type of risk you are, within the “low-risk” and “high-risk” investment categories mentioned above, the composition of the investments is basically the same.

“You can’t avoid equities in the risky part.”

Figure 2 shows an example of a broadly diversified global portfolio for the risk-averse or yield-oriented investor with a long investment horizon.

In the risky part, you cannot avoid equities. ETFs, which track broad market indices from all regions of the world, are very suitable investment vehicles. You can find out why we consider ETFs to be particularly attractive when investing in a separate article.

For an even broader diversification or a more advantageous risk/return ratio, real estate as an additional asset class is an interesting option. But here too, instead of taking on unnecessary bulk risk with individual securities or even individual properties (“concrete money”), it is better to invest in an ETF that contains numerous real estate companies or real estate investment trusts (REITs) worldwide.

In the low-risk part, on the other hand, your money will primarily be in your private account, which you can access at any time. We do not consider bonds to be an interesting option in times of historically low interest rates.

“Defining your individual asset allocation tailored to your risk profile is the be-all and end-all of your investment.”

Determining your individual asset allocation tailored to your risk profile is the be-all and end-all for a successful investment.

Based on your risk profile, your assets are first divided into a “high-risk” and “low-risk” part. The individual asset classes are then weighted.

The high-risk portion corresponds to a broadly diversified global portfolio consisting of the asset classes “equities” and, for example, “real estate”.

The investment vehicle“ETF” (exchange-traded fund) is particularly suitable for these asset classes.

The low-risk portion essentially corresponds to bank balances (“private account” investment vehicle).

In the next article, we will look at the topic of “rebalancing” and the question of how you can easily and cost-effectively restore your original asset allocation if the individual asset classes perform differently.

You can get a complete overview of the topic of “Investing” here: Learning to invest – in eight lessons.

Disclaimer: Investing involves risks of loss. You must decide for yourself whether you want to bear these risks or not.

Errors excepted: We have written this article to the best of our knowledge and belief. Our aim is to provide you as a private investor with the most objective and meaningful financial information possible. However, should we have made any errors, forgotten important aspects and/or no longer have up-to-date information, we would be grateful if you could let us know.