Fees down, functions up: Following a comprehensive realignment, Saxo Bank is now waiving custody account fees and offering all ETF savings plans without purchase commissions for the first time.

Discover how the platform impresses with attractive conditions, modern trading solutions and Swiss regulation – and where it still has room for improvement. We also compare the up-and-coming Saxo Bank with the established Swiss market leader Swissquote and show which platform is best suited for whom.

You can find out this and much more in this big review – well-founded and based on our Saxo Bank experience.

Short & sweet

With a substantial reduction in fees and new functions such as ETF savings plans without purchase commissions, Saxo Bank is repositioning itself – for the smart ETF investor as well as for the active trader. The most important points at a glance:

- CH banking license & deposit protection: Regulated in Switzerland with protection up to CHF 100,000.

- No custody fees: The annual custody account fee has been completely abolished.

- Moderate trading fees: From 0.03%, 0.05% or 0.08% depending on the account model, with a minimum fee (e.g. CHF 3 / USD 1), depending on the trading venue.

- ETF savings plans without purchase commissions: All ETF savings plans are executed free of charge.

- No fractional trading: Only whole ETF units are purchased – residual amounts remain unused.

- Automatic savings plan (“AutoInvest”): ETFs can be saved monthly, individually weighted.

- Foreign currencies & FX costs: Flat currency exchange fee of 0.25 %; foreign currency accounts (sub-accounts) can be set up.

- Modern trading platforms: Intuitive trading interfaces tailored to investor type, also ideal for mobile use.

- Efficient support – multilingual by phone, email, chatbot or ticket system

- Free e-tax statement: available free of charge via the platform from tax year 2025.

Our Saxo Bank experience shows: Anyone looking for a cost-efficient, regulated Swiss platform – with a focus on long-term investing and flexible trading – will find a convincing solution here.

🎁 About our partner link you can open an account and secure a starting bonus worth CHF 200.

Contents

- CHF 200 trading fees for free – our Saxo partner offer

- Our focus: Passive ETF investment with Saxo

- Saxo Bank – a brief portrait

- How secure is Saxo as a broker?

- What account models does Saxo offer?

- Fees redefined – attractive after the drop in fees

- This is how good the app & trading platforms are

- Investment products & services

- Our Saxo Bank experience with support

- How does the custody account opening process work?

- Saxo vs. Swissquote: The direct comparison

- Conclusion and recommendations on our Saxo Bank experience

- This might also interest you

- Update

- Disclaimer

CHF 200 trading fees for free – our Saxo partner offer

If our Saxo Bank experience convinces you, you can now take advantage of this generous offer – and support our blog at the same time:

Click on the ad below to open a free investment account with Saxo Bank including CHF 200 trading fees for free!

📋Conditions of participation:

- You are a natural person over the age of 18 and resident in Switzerland.

- You make your first deposit within 30 days of opening your account. (After the deposit, your bonus will be activated within three working days. Trading fees for ETFs, stocks, bonds, futures and options are refunded daily directly to your account).

- The offer is valid for 90 days. Unused credits expire thereafter. Other fees will be charged as normal.

🔍 Transparency notice:

We only recommend products that we have tested ourselves and whose quality we are convinced of. If you open an account via our partner link, we will receive a commission – there are no additional costs for you

Our focus: Passive ETF investment with Saxo

Anyone familiar with our blog knows that we follow a passive, low-cost, broadly diversified “buy and hold” investment strategy. We are convinced that the best way to implement such a strategy is with ETFs. In this review of our Saxo Bank experience, we therefore assess the provider primarily from the perspective of a passive ETF investor.

Saxo Bank – a brief portrait

Saxo Bank was founded in Copenhagen (Denmark) in 1992 and is now one of Europe’s leading online brokers with an international focus. It serves over 1.2 million clients worldwide with assets under management of over CHF 100 billion in more than 170 countries (as of 2025).

A special feature: Saxo combines access to global markets with a locally regulated infrastructure.

In concrete terms for Swiss investors, this means that Saxo Bank (Schweiz) AG is a legally independent subsidiary based in Zurich and holds a banking license from the Swiss Financial Market Supervisory Authority FINMA. In addition, Saxo was classified as a systemically important financial institution (SIFI) in 2023.

Saxo does not operate any branches in Switzerland – the entire service is provided digitally. The offering is primarily aimed at self-directed investors who value low fees and professional trading opportunities.

Saxo has won several awards in the past, including for its trading platforms, innovation and customer service.

How secure is Saxo as a broker?

The security of the invested capital is key for investors – especially with purely digital providers. The good news is that Saxo meets high security standards in terms of both regulation and technology.

In concrete terms, these standards are reflected for Swiss investors in three key areas:

- Deposit protection at Saxo Bank (Switzerland) Ltd

As mentioned, Saxo is a Swiss bank regulated by FINMA. Client funds are managed in accordance with Swiss law and are protected by the deposit guarantee scheme esisuisse up to CHF 100,000 per client and bank – even in the event of bankruptcy.

- Separate custody of securities (special assets)

Securities such as ETFs and shares are legally considered special assets and are held separately from the bank’s assets. They do not appear on the bank’s balance sheet and remain the full property of the investor even in the event of insolvency. A transfer to another custody account is possible at any time.

- Technical security and protection against cyber risks

Access to the Saxo account is exclusively via two-factor authentication (2FA). In addition, Saxo relies on a modern IT infrastructure with encryption technologies, regular security tests and its own Cyber Security Operation Center (CSOC) to monitor possible attack attempts.

What account models does Saxo offer?

Depending on the invested assets, Saxo Bank clients are automatically assigned to one of the three account models “Classic”, “Platinum” or “VIP”. While no minimum deposit is required for “Classic”, it is CHF 250,000 for “Platinum” and CHF 1 million for “VIP”.

True to the motto “To those who have, shall be given”, you benefit from preferential conditions in terms of prices and services with the two premium models – to put it simply:

- Classic: Standard prices and standard services

- Platinum: lower prices and improved service

- VIP: Lowest prices and best service

But beware: an upgrade to a higher level is only valid for one year – and depends not only on the amount of your deposit, but above all on how many points you collect through trades & co.

Specifically, the more frequently you trade and the higher your trading volume, the more points you earn.

This also means that convinced buy-and-hold investors, who naturally trade infrequently, are unlikely to enjoy the privileges of “Platinum” or “VIP”.

You can find out more about the “Saxo Rewards” points program here.

Fees redefined – attractive after the drop in fees

Previously, we found Saxo Bank less attractive due to its comparatively high prices. However, with the new fee model – in particular the abolition of custody account fees as of February 1, 2025 – this has changed fundamentally: Saxo now offers truly competitive conditions.

We believe that foreign providers without a Swiss banking license, such as DEGIRO or Interactive Brokers, are still ahead in terms of price – not least because they are exempt from Swiss stamp duty. Among the providers regulated in Switzerland, however, Saxo has definitely positioned itself as a potential price/performance winner thanks to its new fee model.

Below we take a closer look at the most important price tags of the three account models.

Custody fees – abolished!

Paying up to CHF 100 in custody account fees plus VAT year after year, regardless of whether you trade or not? That was once upon a time! Saxo has abolished these fixed costs for all its account models and should therefore become really interesting for price-conscious investors for the first time.

In addition, Saxo Bank does not charge any inactivity fees.

Brokerage fees (transaction fees) – depending on volume with minimum costs

Trading commissions or commissions at Saxo depend on the account model – and this depends on your invested assets and other factors, in particular trading frequency and trading volume (see chapter on account models above). The following conditions currently apply:

Classic (custody account up to CHF 250,000)

- Shares/ETFs traded on Swiss stock exchanges: 0.08% of the trading volume, min. 3 CHF per trade. Price example: 8 CHF commission on a trade worth 10,000 CHF

- Shares/ETFs traded on European stock exchanges: 0.08%, min. EUR 3

- Shares/ETFs traded on US stock exchanges: 0.08%, min. USD 1

Platinum (minimum deposit CHF 250,000)

Minimum fees like Classic, but lower brokerage fees of 0,05%. Price example: 5 CHF commission on a trade worth 10,000 CHF

VIP (minimum deposit CHF 1 million)

Minimum fees like Classic, but lower brokerage fees of 0,03%. Price example: 3 CHF commission on a trade worth 10,000 CHF

No purchase commissions for savings plans

Good to know: Saxo does not charge any brokerage fees for regular investments via an ETF savings plan (“AutoInvest”), regardless of how high your tranche is. We will go into more detail about how Saxo’s savings plans work later.

Note on further transaction costs

The brokerage fees indicated above refer to the trading commissions charged by Saxo for the execution of trades. In addition, any currency exchange fees (see next chapter) and the Swiss federal stamp duty are charged per transaction:

- 0.075% on Swiss securities

- 0.15% on foreign securities

Currency exchange fees

Currency exchange fees are always incurred at Saxo if you trade in a different currency than the one available in your account – for example, if you trade in US equities but only have CHF in your account. In this case, a currency exchange is automatically triggered – a conversion fee of 0.25% is charged on the amount that needs to be exchanged. This margin applies uniformly to all account models (Classic, Platinum, VIP).

To keep these fees as low as possible, it’s worth setting up foreign currency accounts – we’ll show you how this works below in the review.

Interest on Lombard loans

If you want to increase your potential returns, you can use a Lombard loan with Saxo and deposit existing securities as collateral. The current interest rates are graded by account model and are updated on an ongoing basis. They seem attractive to us in a Swiss comparison. You can find out more about how Lombard loans work and the risks involved in our article “Lombard loans when buying ETFs: Boosting your return on equity or playing with fire?”.

Free e-tax statement

From the 2025 tax year, Saxo will make tax statements available to all clients free of charge electronically via the platform’s inbox. The e-tax statement will be delivered by the end of March of the following year at the latest.

This is how good the app & trading platforms are

Saxo provides its clients with a modern and versatile trading environment that can be used on desktop and mobile as required. Below we present the three main platforms with different functionalities:

- SaxoInvestor

- SaxoTraderGO

- SaxoTraderPRO

All platforms are free of charge and available to Swiss customers in three languages: German, French, Italian and English .

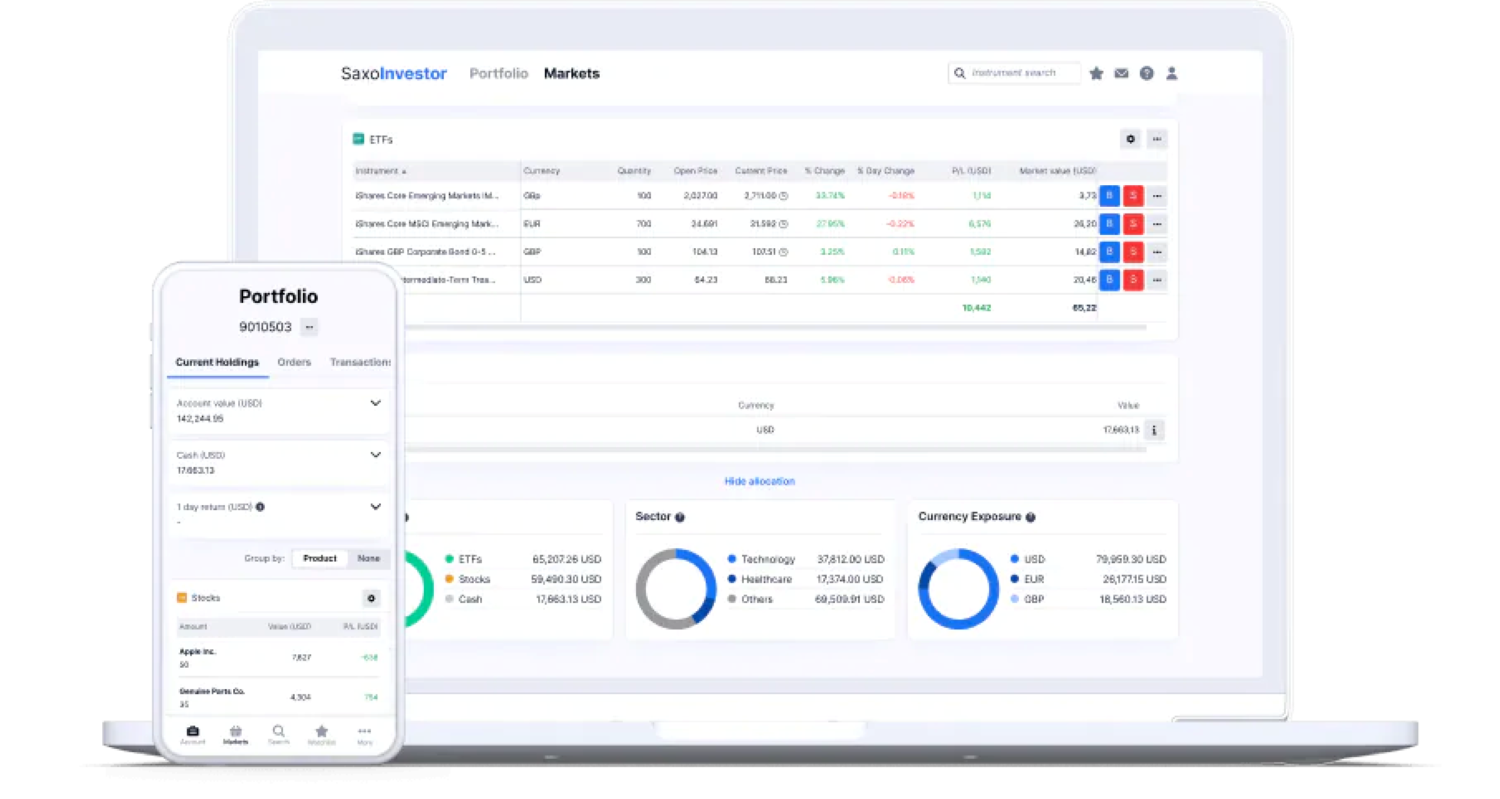

SaxoInvestor

The platform for a quick start – web-based on the desktop or usable as an app on iOS and Android devices. It offers simple, clear operation and is particularly suitable for private investors who want to invest easily in shares, ETFs (with or without a savings plan) and other asset classes.

SaxoTraderGO

The platform is particularly aimed at people who want to trade actively and is also available web-based for desktop and as an app. It offers a wide selection of instruments as well as advanced analysis and order functions. Trading in ETFs, shares, bonds and investment funds is possible as standard.

For more complex products such as Forex, CFDs or futures, an additional appropriateness test is required – this can be carried out directly online.

SaxoTraderPRO

The professional desktop application for active traders with high investment volumes and equally high demands on performance, customizability and extensive tools. Also ideal for multi-screening.

SaxoTraderPRO is the only platform that is available exclusively as software for download – there is no app version.

Our impressions when buying ETFs

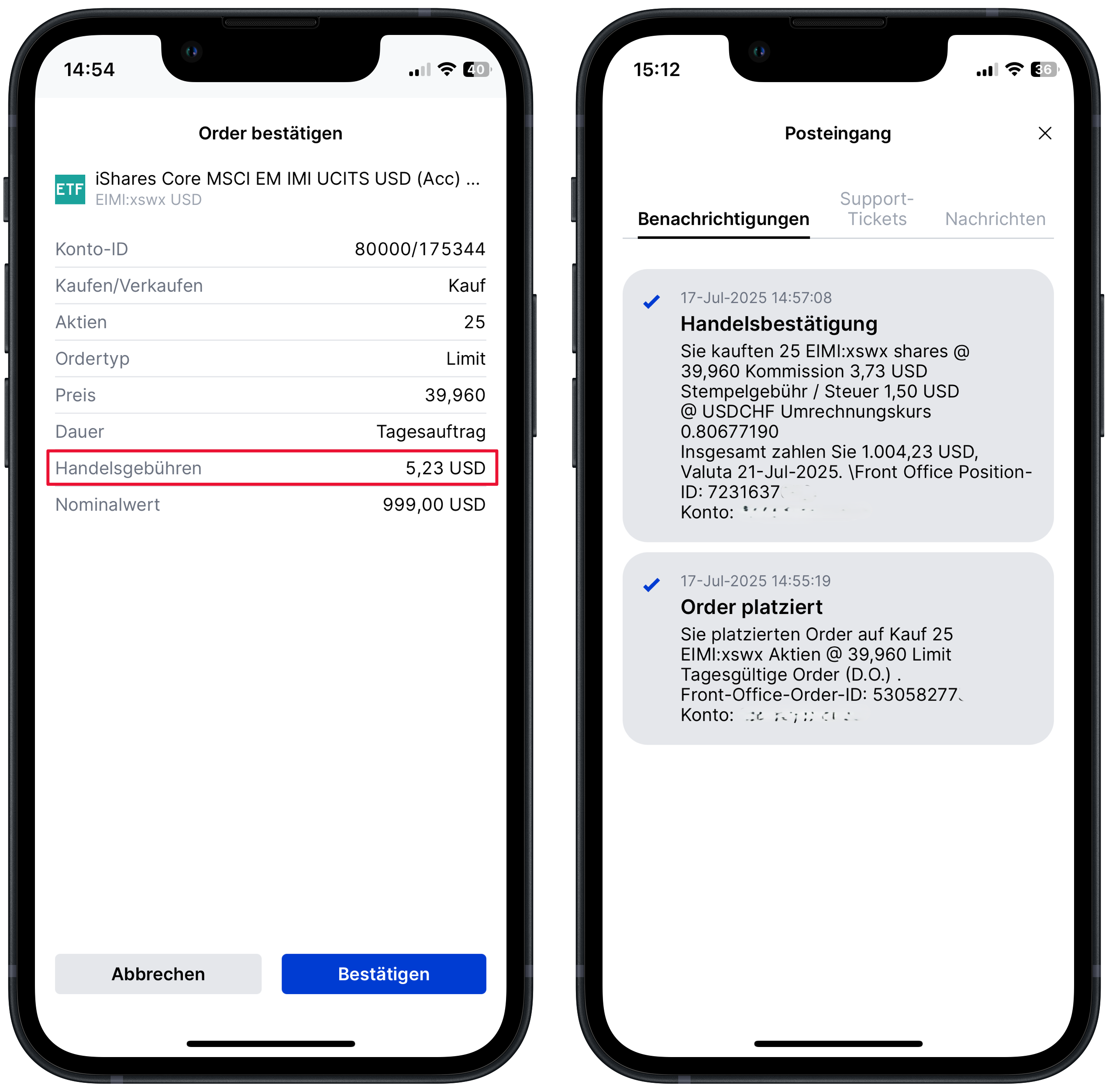

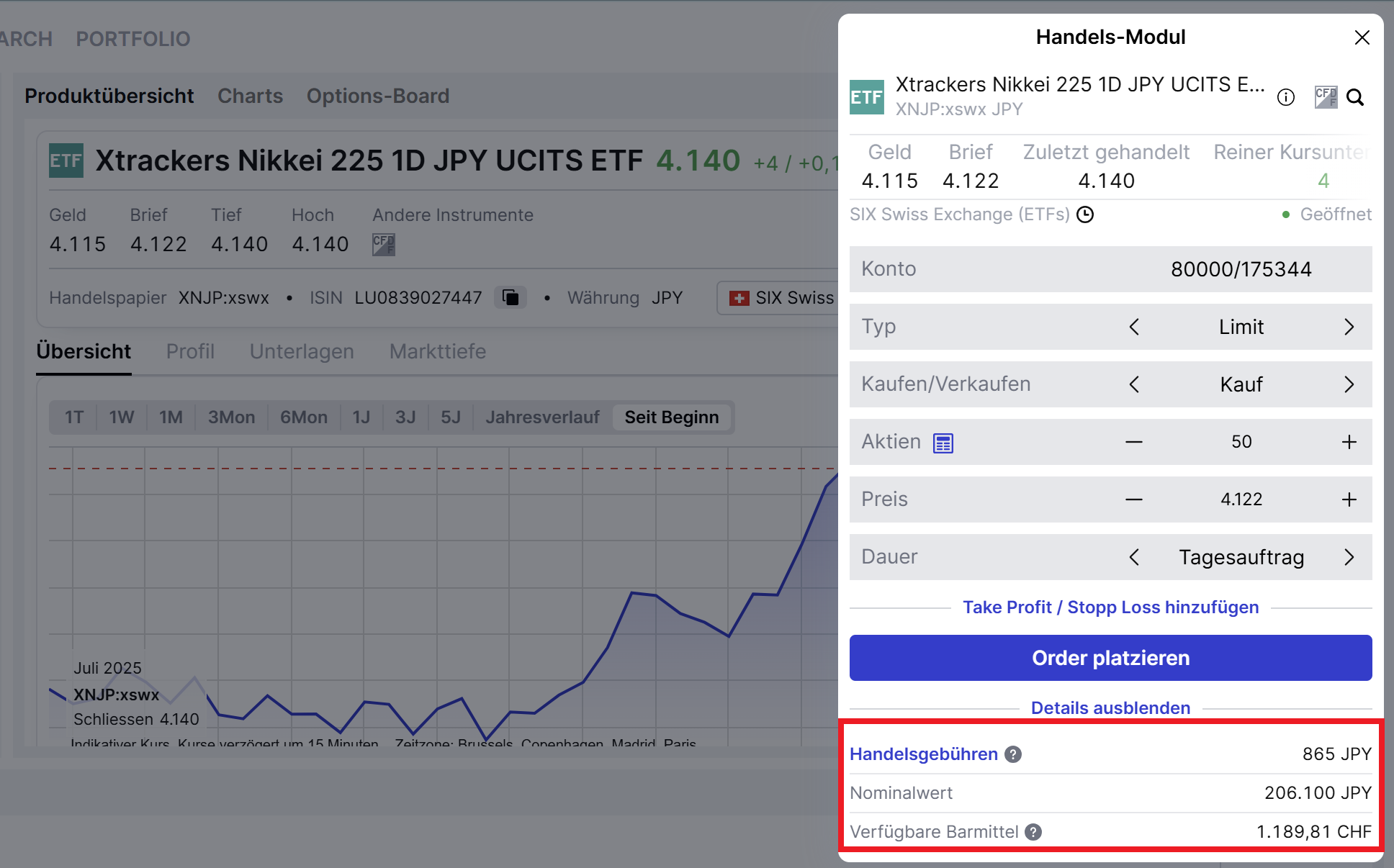

Purchases can be processed smoothly on all three platforms and are displayed consistently. Our first test purchase: 25 shares of the iShares Core MSCI EM IMI UCITS ETF (Acc) – directly from our watchlist, in which we collected all the winning products from our ETF comparison 2025. We made the purchase via the SaxoInvestor app (see screenshots above in the fees section); the position is of course also displayed in SaxoTraderGO:

Note on the display of foreign currency transactions

A small but practical point of criticism: When buying securities in foreign currencies, Saxo does not display an approximate equivalent value in Swiss francs. Especially with less common currencies such as the Japanese yen, this makes it difficult to estimate whether the available balance is sufficient for the purchase. An automatic display of the CHF amount would provide more transparency here and make the purchase decision much easier.

Conclusion on the trading platforms

With its three platforms, Saxo offers tailor-made solutions – for the smart, rule-based investor through to the active heavy trader (or vice versa).

From our point of view as buy and hold investors, SaxoInvestor is the most convincing choice, as this platform offers a successful combination of a useful range of functions (including ETF savings plans) and user-friendly operation.

However, if you want to trade complex products or simply want even more functions and evaluations, e.g. for stock picking and market timing, SaxoTraderGO or SaxoTraderPRO are definitely the better choice.

Investment products & services

The Saxo Bank investment universe

Saxo Bank offers access to a broad investment universe: over 7,400 ETFs and around 23,000 individual stocks are tradable on more than 50 global exchanges – including the Swiss stock exchange SIX.

Unsurprisingly, all of the winning ETFs from our “Best ETFs Switzerland and globally” review are also available according to our Saxo Bank experience.

The basic offering is supplemented by bonds, investment funds and crypto ETPs.

Those who also wish to invest in margin products will also find a large selection at Saxo: These include exchange-traded options and futures, foreign exchange, currency options and crypto currencies, CFDs and commodities.

However, these more complex products are only activated after an additional suitability test.

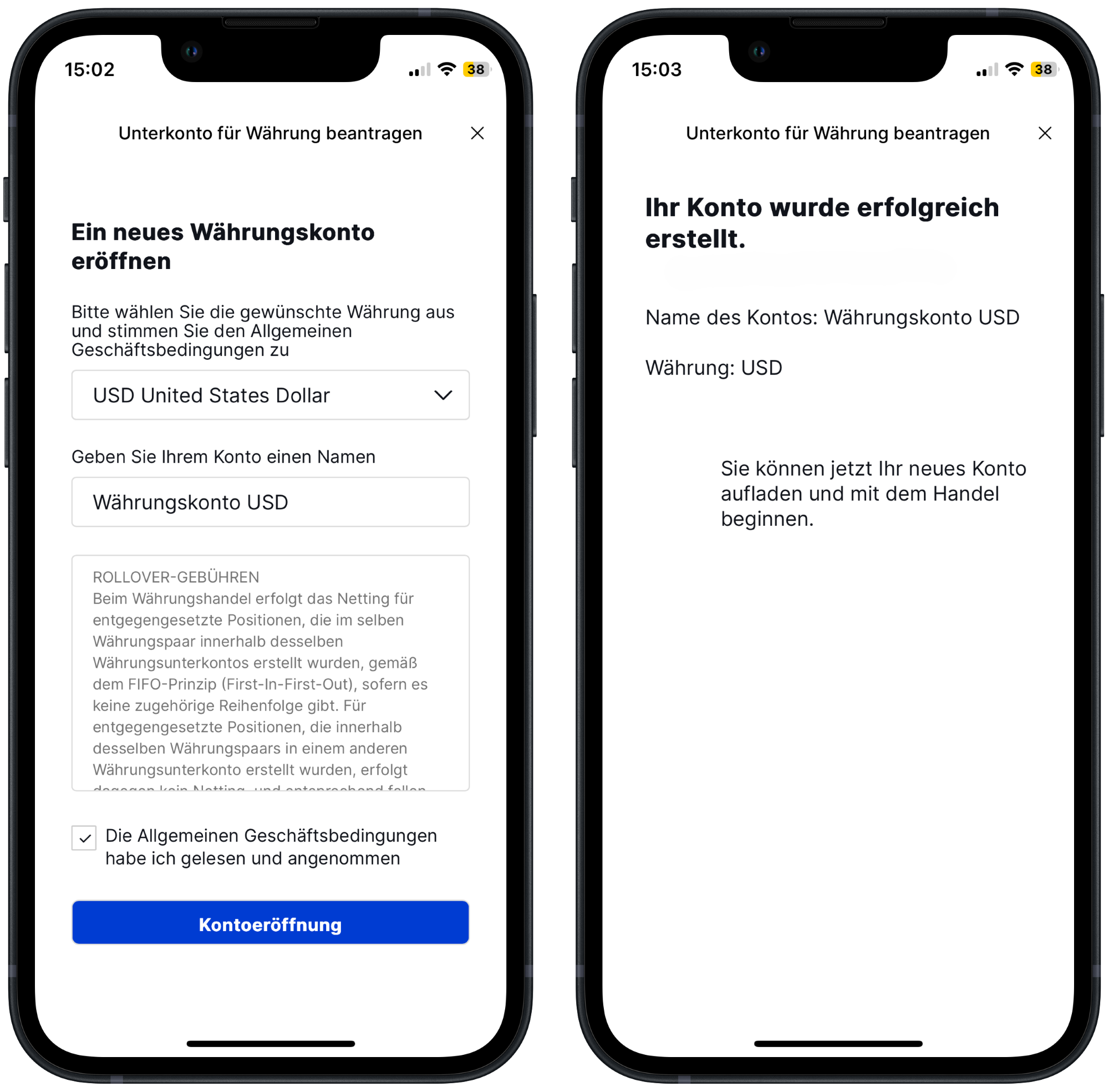

Foreign currency accounts with Saxo

If you regularly trade in foreign currencies, a foreign currency account is worthwhile – because this way you avoid repeated currency changes and save on fees. At Saxo, you can set up additional currency accounts (so-called sub-accounts with their own IBAN) in addition to the reference currency CHF. However, these must be activated individually for each desired currency.

The sticking point: As the telephone support team confirmed when we asked, currency exchange fees can be avoided if purchases in foreign currency are made specifically via the appropriate sub-account. This must not only be set up manually beforehand, but must also have sufficient cash – as there is no automatic settlement with the main CHF account.

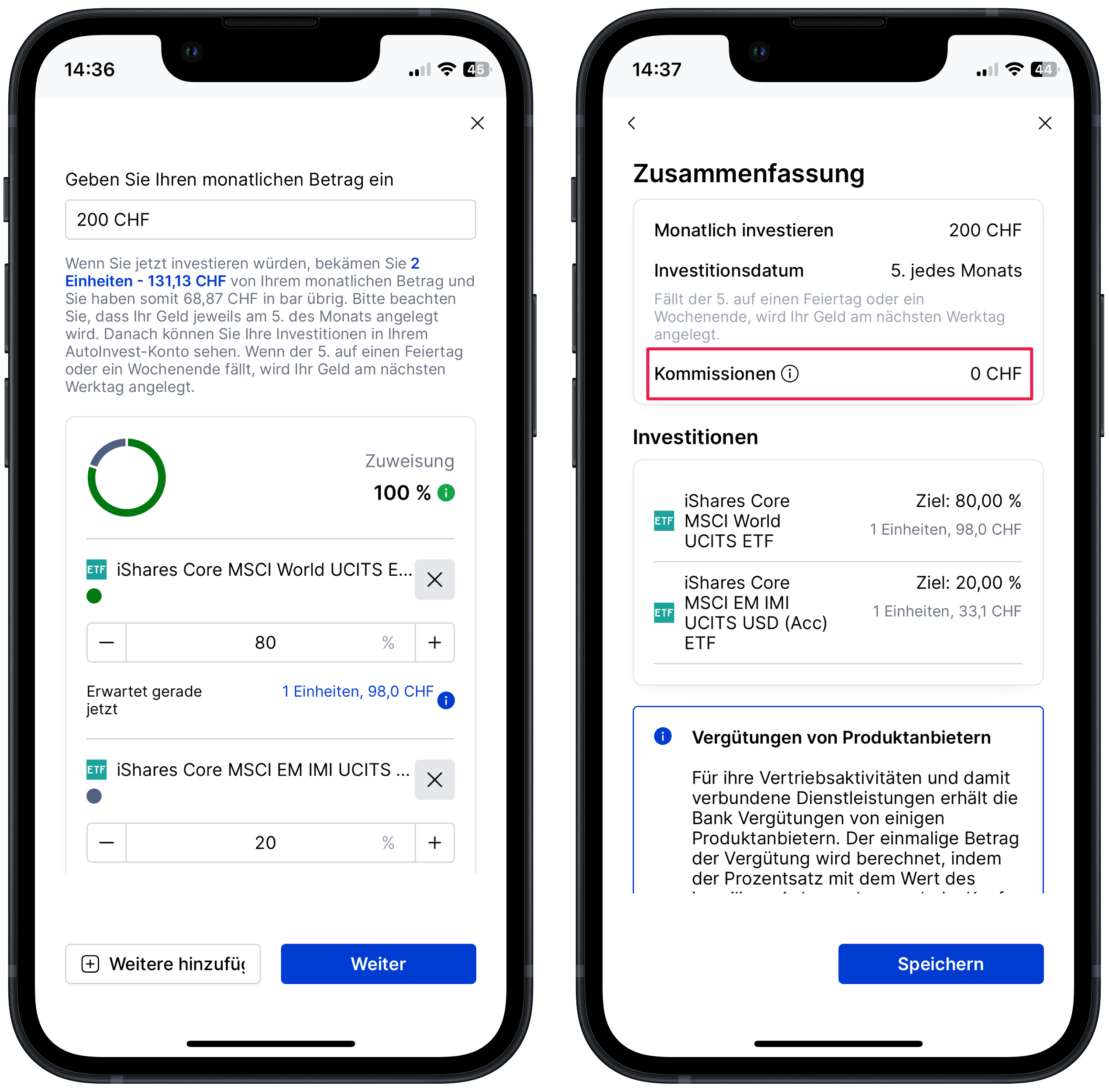

AutoInvest: Saxo’s ETF savings plan

With AutoInvest, Saxo offers a simple and commission-free way to invest regularly in ETFs. We were particularly impressed by the fact that several ETFs can be invested in at the same time, which allows for broad diversification – without any purchase fees.

Execution takes place on the 5th of each month, which increases predictability but limits flexibility. Only whole ETF units are invested, i.e. no fractional trading. As a result, a relatively high residual amount may remain uninvested in the case of small savings amounts or expensive ETFs. However, this is automatically reserved for the following month.

Important: Each savings plan is managed via a separate sub-account with its own IBAN. Deposits should ideally be made by standing order from an external account (e.g. your house bank), as automatic debiting from the main account at Saxo is not possible. This special feature was confirmed to us by Saxo Bank’s telephone support on request.

Saxo’s savings plans currently include ETFs from iShares and Amundi – two renowned providers, even if the product range can still be expanded. You can find the ETFs currently available for savings plans at Saxo Bank here.

Despite the weaknesses mentioned, we consider AutoInvest to be a successful introduction to regular investing – especially as Saxo waives the usual trading commissions.

Passive income through securities lending

Optionally, Saxo allows you to activate the lending of your securities directly via the platform and thus secure a passive income.

The deal: you receive 50% of the income, the bank keeps the other half. This ensures that high-quality collateral with an equivalent value of at least 102% is deposited in a separate Swiss custody account.

Important: Your trading freedom remains unrestricted – you can buy or sell your securities at any time as usual.

Our Saxo Bank experience with support

Saxo Bank offers you five support channels:

- FAQs with video tutorials

The so-called quick start FAQs, which also explain basic functions via video, are particularly helpful for newcomers. - Email

If you prefer the classic email, you can send your request to sales.ch@saxobank.com. This channel is particularly aimed at potential new customers who still have questions about opening an account, for example. - Chatbot

This channel is naturally the most efficient – and is promoted accordingly. The chatbot answers standard questions quickly and to a satisfactory standard. However, answers to more specific questions – such as whether deposits must be made from an external account for a savings plan – are often imprecise or incomplete. - Telephone support

Saxo customer service is available in German and French during office hours and in English around the clock: +41 58 317 95 00.

We contacted Saxo’s German-speaking support team with some tricky questions about platforms, AutoInvest and foreign currency accounts – and received competent information after a short wait.

While waiting, a voice message informs us of the current position in the queue and points out the possibility of switching directly to the (even more efficient) English-language support. - Ticket system

The ticket system directly on the platform is suitable for non-urgent but more complex inquiries. Users are guided through thematic categories so that the request ends up with the relevant specialist team.

Conclusion

According to our Saxo Bank experience, the support is very solid overall and offers suitable channels for various concerns – from quick answers via chatbot to personal advice on the phone. We were particularly impressed by the competent German-speaking telephone support. Even if the chatbot still has room for improvement for more complex questions, the combination of help documentation, videos, personal support and a structured ticket system with good accessibility and a clear focus on customer satisfaction is impressive.

How does the custody account opening process work?

Opening an account with Saxo is completely digital – and comes with a bonus on top.

Important: Open your account via our partner linkto save up to CHF 200 on trading fees .

Have your smartphone, a valid passport or ID and a few minutes ready for the process. Then continue step by step:

- Start via partner link

You will be taken directly to the Saxo registration form and enter your e-mail address and name. - Beneficial owner

You confirm that you are the beneficial owner of the account. - Personal details

Now enter your gender, date of birth and country of birth. - Proof of identity

You upload a scan of your passport or identity card. - Occupation & income

Information on your employment relationship, employer, job title, income, assets and source of funds is required. - Investment experience & usage

Saxo asks you about your experience with financial instruments and how you would like to use the account. - Tax information

You enter your tax domicile and confirm that you are not politically exposed and not a US person. - Contact details

Now enter your home address and telephone number. - Legal & access data

You accept the terms and conditions, set your password – and confirm everything with an electronic signature. - Selfie & conclusion

Finally, take a quick selfie with your smartphone or webcam to check your identity. - Check by Saxo

According to our Saxo Bank experience, the check took only a short time: just five minutes after completing the application, the account approval was sent by e-mail – including the new account details and the Saxo User ID.

Saxo vs. Swissquote: The direct comparison

In this overview, we compare the challenger Saxo with the established market leader Swissquote – two Swiss providers with a different focus: Saxo on investing and trading, Swissquote as a comprehensive full-service provider with additional banking services such as cards and payment transactions.

| Saxo | Swissquote | |

| CH banking license | Yes | Yes |

| Deposit protection | Up to CHF 100,000 | Up to CHF 100,000 |

| Product range | Focus on investing and trading | Very broad (everything from a single source: trading, cards, payments, etc.) |

| Custody fees | None | CHF 60 – 200 per year (graduated according to deposit value) |

| Trading fees Price examples for ETF trades: 10,000 CHF on CH stock exchange 10,000 USD on US stock exchange | 3 – 8 CHF* 3 – 8 USD* | 9 CHF** 30 USD |

| Currency exchange | 0,25% | 0,95% |

| Savings plans | Without purchase fees | With purchase fees from CHF 3 |

| Fractional trading (Fractional Trading) | No | Yes |

Conclusion

Saxo offers significantly lower fees overall and is aimed at investors with a focus on investing and active trading.

Swissquote is an established full-service provider with innovative features such as fractional trading and a particularly broad offering – from investments and cards to comprehensive banking services.

Both platforms guarantee a high level of security, reliable regulation and competent support. Which one suits you better depends on your individual requirements and goals.

Conclusion and recommendations on our Saxo Bank experience

Saxo has established itself as a serious player among Swiss online brokers with its revised fee model without ongoing costs and a clear focus on digitalized, self-determined investing.

According to our Saxo Bank experience and as passive ETF investors, the following points stand out particularly positively for us:

- No custody account fees – a big plus for long-term investors

- Transparent and fair brokerage fees from USD 1 / CHF 3 – especially in comparison with other Swiss providers

- Moderate currency exchange fees of 0.25% – with no minimum fee

- ETF savings plans without purchase commissions – ideal for regular investing without additional costs

- Modern trading platforms – intuitive and tailored to different needs

- High regulatory security – FINMA license and deposit protection up to CHF 100,000

- Broad investment universe – including over 7,400 ETFs and more than 23,000 equities worldwide

- Efficient support – multilingual by phone, email, chatbot or ticket system

Of course, there is also room for improvement – we noticed this in particular in connection with the savings plan (AutoInvest): As laudable as the waiver of purchase commissions is, the technical implementation still seems capable of improvement in detail: no automatic debiting of the main account, no fractional trading and no flexible execution intervals.

Our recommendation

Our Saxo Bank experience shows: The platform is very suitable for investors who want to invest regularly, long-term and cost-efficiently in ETFs – and rely on a provider regulated in Switzerland.

The overall package is particularly convincing for passive investors with a buy-and-hold strategy: the combination of regulatory security, commission-free ETF savings plans and modern platforms results in a strong offering.

Active traders should also find Saxo exciting due to its broad product universe and professional tools – however, this area was not part of our test.

To come back to the question posed in the title: Does Saxo deserve the title of “Best Swiss Broker” after the fee slash? For many long-term ETF investors, the answer is probably a resounding yes. The new fee model, combined with a broad product offering, modern technology and Swiss regulation, currently makes Saxo one of the most attractive brokers on the market.

And the best for last: Anyone who opens a free investment account now via our partner link in the ad below will receive CHF 200 in trading fees – an attractive bonus to get you started.

This might also interest you

Update

2025-07-24: Clarified that an upgrade to the “Platinum” and “VIP” account models is limited to one year in each case and depends not only on the amount of the deposit, but also on other factors such as trading frequency and trading volume.

Disclaimer

Disclaimer: Investing involves risks of loss. You must decide for yourself whether you want to bear these risks or not.

Errors excepted: We have written this article about our Saxo Bank experience to the best of our knowledge and belief. Our aim is to provide you as a private investor with the most objective and meaningful financial information possible. However, should we have made any errors, forgotten important aspects and/or no longer have up-to-date information, we would be grateful if you could let us know.

Transparency note: We are convinced by the offer of the up-and-coming Swiss online bank and have therefore entered into a commission-based cooperation with Saxo Bank. Nevertheless, our assessments remain independent and are based on our own experience and objective criteria.

6 Kommentare

Seit bald zwei Jahren bin ich Kunde bei SAXO. Nun erhielt ich die Nachricht, dass SAXO meinem amtlichen CH-Ausweis (ID) nicht traut und mich dementsprechend blockiert. Antworten aus Dänemark sind leider nicht konkret, nur, dass Abklärungen pendent sind. Ich bin seit Wochen blockiert.

Ich nutze Saxo auch schön längere um bin eigentlich sehr zufrieden. Plattform ist gut und ich konnte auch ohne Probleme eine ETF Position übertragen.

Ich frage mich nur, wie Saxo genügend Geld macht mit diesen Preisen? Sie haben ja auch Infrastruktur und Mitarbeiter in der Schweiz die einiges kosten

Hallo

Danke für das Review. Ist es bei Saxobank möglich Namensaktien zu halten?

Gemäss Auskunft des Saxo Supports ist es zur Zeit nicht möglich, Schweizer Aktien auf den eigenen Namen im Aktienregister einzutragen. Kunden haben aber die Möglichkeit, an Aktionärsversammlungen teilzunehmen und/oder ihre Stimme digital abzugeben. Mehr dazu findest du hier: Stimmrechtsvertretung (Proxy Voting)

Ich nutze Saxo nun schon einige Zeit und die Zufriedenheit würde ich mit ok bewerten.

1. Die Kontomodelle basieren eben nicht auf dem investierten Vermögen, wie ich auch dachte, denn als ich gemäss Vermögen eine Stufe höher hätte kommen sollen und ich nachfragte, hiess es, dass ich zuwenig Umsätze, als zuwenig gehandelt hätte.

2. Der Support empfinde ich als eher schwach, Antworten sind oft nicht befriedigend und auch lange Wartezeiten.

Ansonsten aber ist Saxo sicher das günstigste in der CH und darum gehts mir.

Vielen Dank für deinen wertvollen Input, Phil. Bezüglich der Kontomodelle haben wir den Artikel dahingehend präzisiert, dass ein Upgrade auf die Kontomodelle «Platinum» und «VIP» jeweils auf ein Jahr befristet ist und nicht nur von der Höhe der Einlage abhängt, sondern auch von anderen Faktoren wie Handelshäufigkeit und Handelsvolumen basierend auf dem Reward-Programm von Saxo.