The most important success factor in wealth accumulation is regular investing. The easiest way to do this is with a Swiss ETF savings plan. For a long time, there were hardly any acceptable offers in this country due to high fees. Fortunately, thanks to international competition and domestic innovation, the Swiss savings plan desert is now a thing of the past. In this article, we present three savings plan options and show you which providers are particularly suitable.

Short & sweet

- An ETF savings plan Switzerland is probably the smartest and simplest investment strategy you can opt for!

- You regularly invest fixed amounts in one or more ETFs.

- This allows your assets to build up steadily, increases your return through the high-growth asset class “equities” in combination with the compound interest effect and reduces the risk of market turbulence thanks to the “cost-average effect”.

- You can choose from three savings plan variants with different comfort levels:

- Investing manually in one or more ETFs

- Automatic investing in one or more ETFs

- Automatic investing in a diversified investment portfolio

- In principle, you can implement an ETF savings plan Switzerland with all providers. However, most of them are simply too expensive and are therefore not suitable for a Swiss ETF savings plan.

- A suitable securities portfolio should fulfill the following two criteria in particular:

- Attractive product range (passive ETFs or index funds)

- Low fees in relation to the investment rate

Contents

- What is the ETF savings plan Switzerland about?

- Who is an ETF savings plan Switzerland suitable for?

- What are the advantages of an ETF savings plan Switzerland?

- What types of ETF savings plans are there?

- “ETF savings plan Switzerland” variant 1: Manual investment in one or more ETFs

- “ETF savings plan Switzerland” variant 2: Automatic investment in one or more ETFs

- Commission-free ETF savings plans at Saxo Bank

- Savings plans without residual amounts thanks to fractional trading

- Automatic ETF savings plans – costs and benefits at a glance

- ETF savings plan Switzerland – real trades

- ETF Savings Plan Switzerland from Saxo Bank

- ETF savings plan Switzerland from Interactive Brokers

- ETF savings plan Switzerland from Yuh

- ETF savings plan Switzerland from neon

- Conclusion on the “ETF savings plan Switzerland” variant 2

- “ETF savings plan Switzerland” variant 3: Automatic investment in an investment portfolio

- Conclusion on the ETF savings plan Switzerland

- This might also interest you

- Updates

- Disclaimer

What is the ETF savings plan Switzerland about?

Even though there is no generally accepted definition and the term “ETF investment plan” would actually be more accurate, in this article we will use the savings plan term commonly used in the financial world or, as a financial blog focused on Switzerland, the term “ETF savings plan Switzerland”.

An ETF savings plan Switzerland is basically an investment strategy in which regular amounts are invested in one or more exchange-traded funds (ETFs). An ETF is an investment fund that is traded on a stock exchange and tracks a wide range of assets such as shares, bonds or commodities. You can find out more about ETFs in our article ETFs: the investment revolution.

The ETF Savings Plan Switzerland enables investors to invest money continuously in one or more ETFs instead of making a one-off capital investment or irregular investments.

An ETF savings plan Switzerland works very simply: you decide how much money you want to invest on a regular basis and select one or more ETFs in which to invest the money. In the article Best ETFs Switzerland and globally 2025: And the Winner is… you will find a useful guide to choosing an ETF.

Incidentally, in connection with savings plans, accumulating ETFs (i.e. ETFs in which dividends are automatically reinvested) are preferable to distributing ETFs in order to benefit optimally from the compound interest effect.

Such a plan could be formulated as follows: “I always invest 200 francs in my ETF savings plan Switzerland on the first of the month or on the next possible trading day.”

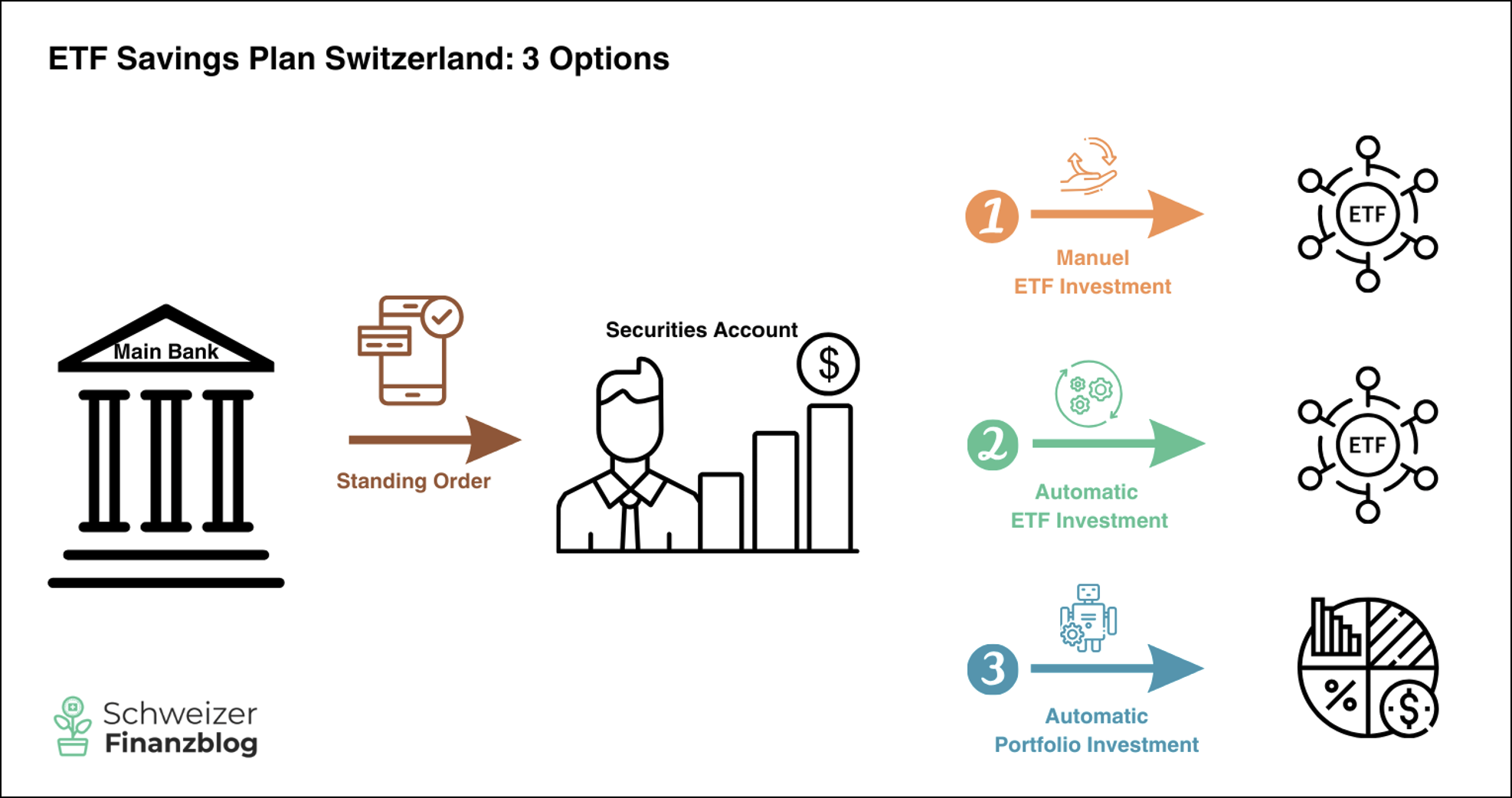

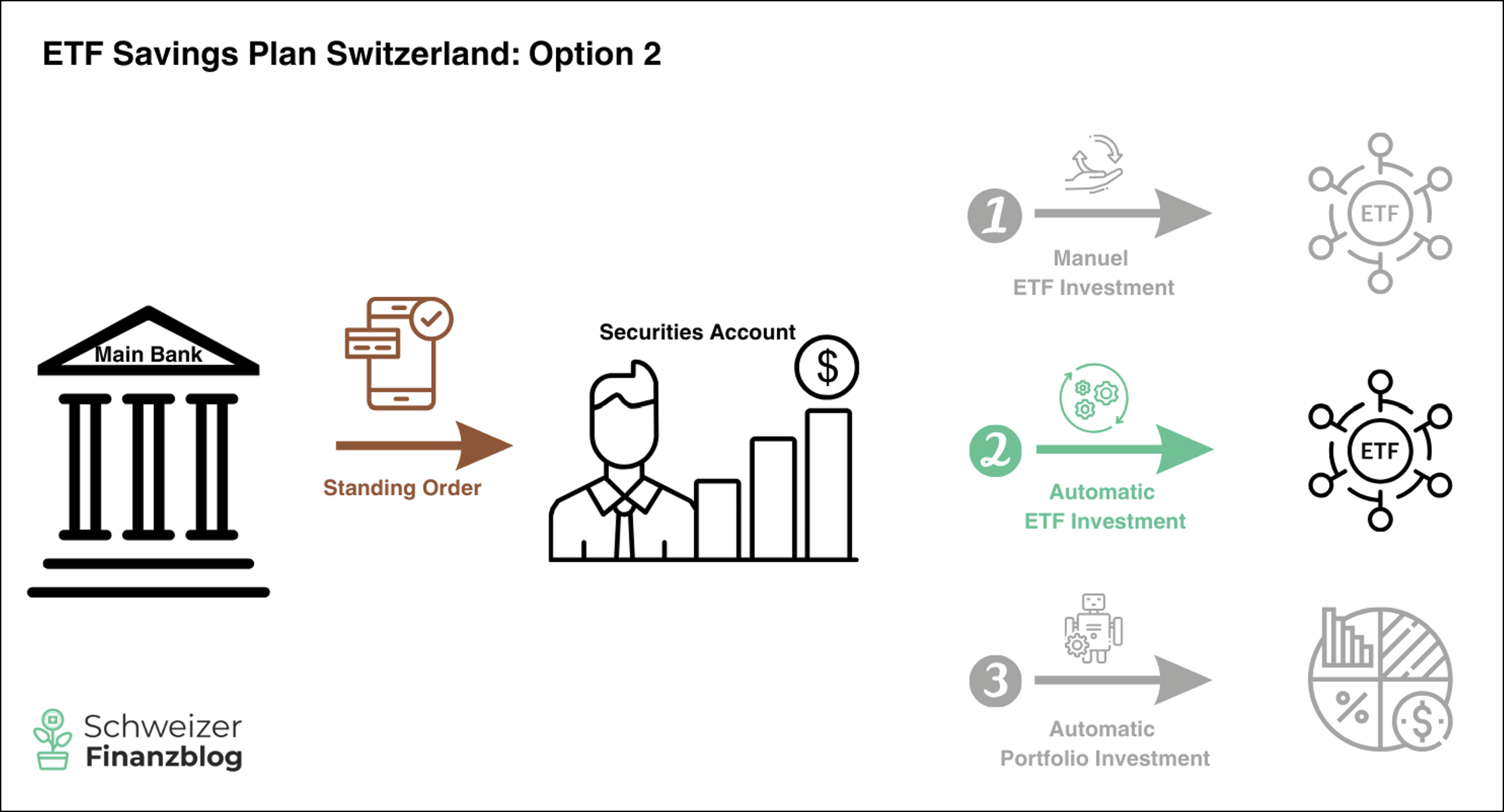

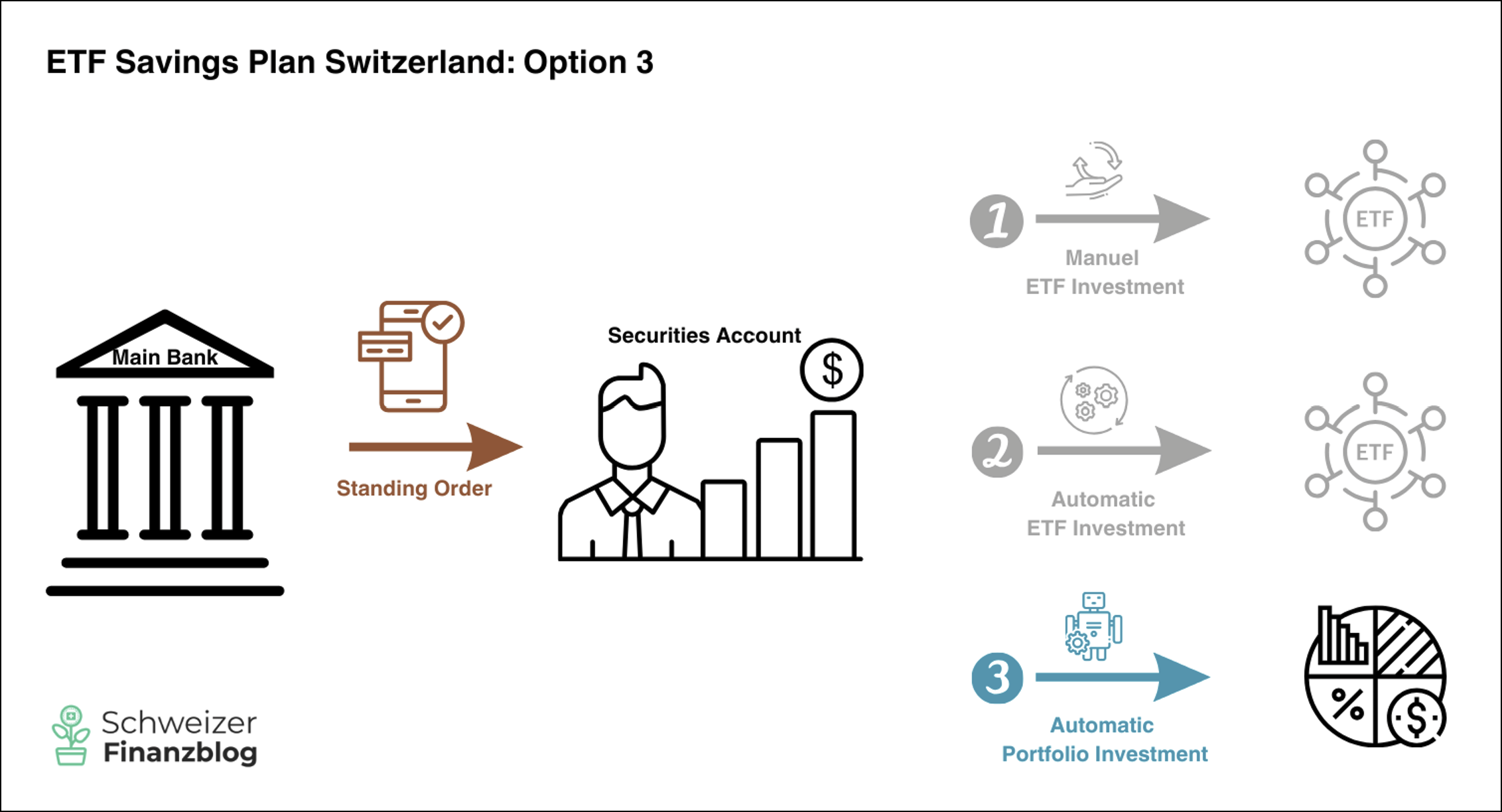

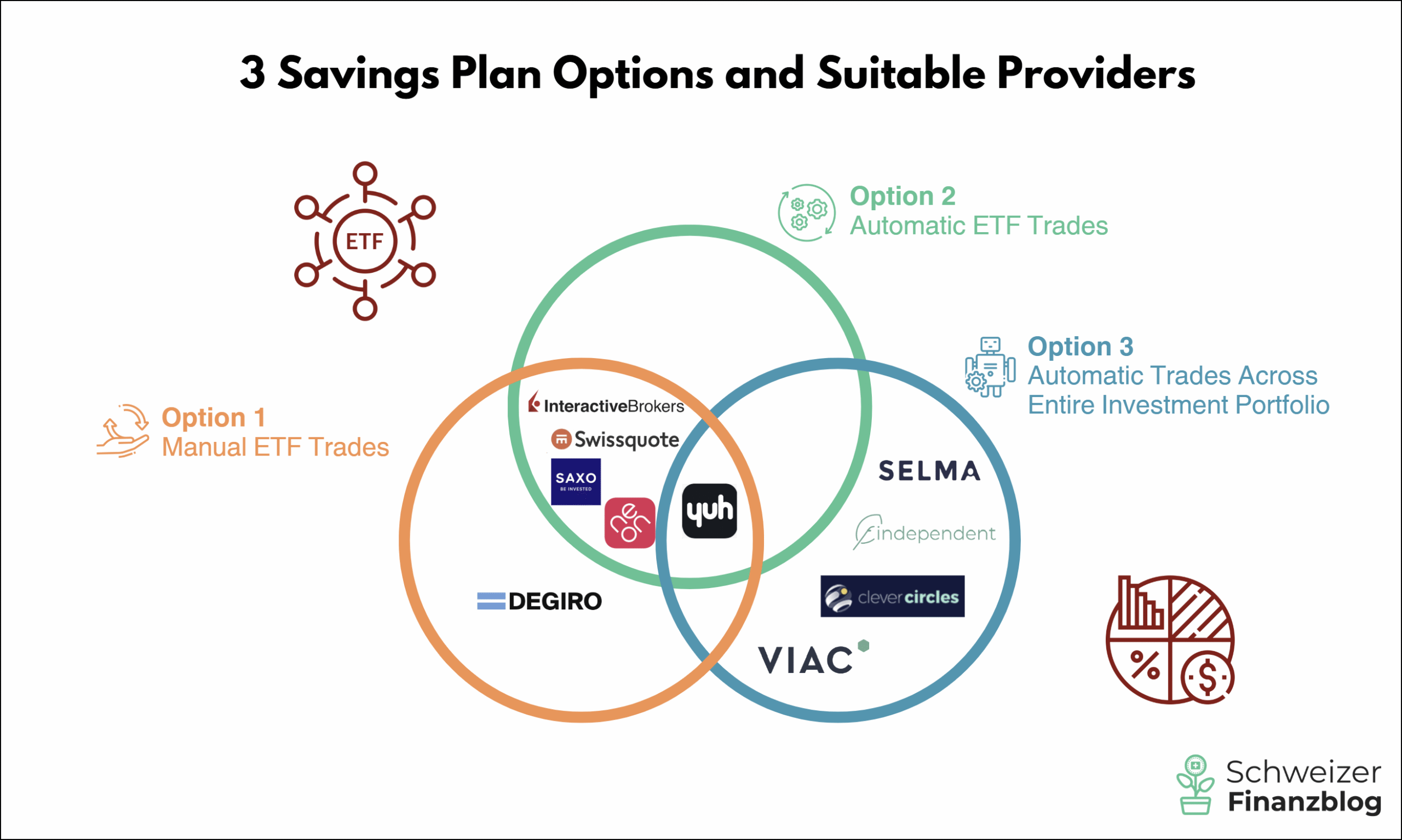

There are three options available to you for implementing this plan: You invest manually (option 1), automatically (option 2) in one or more ETFs or in an entire investment portfolio (option 3).

Whatever your preferred option is, you will always need a suitable securities custody account. You should pay particular attention to the fees. In principle, you can set up an ETF savings plan Switzerland with all providers in one way or another. However, most providers are simply too expensive and therefore unsuitable for savings plans.

Further down in the text, we present the three savings plan variants and the matching custody accounts from various providers.

Who is an ETF savings plan Switzerland suitable for?

Put simply, an ETF savings plan Switzerland is generally suitable for all private investors who are in the wealth accumulation phase . It doesn’t matter what specific goals you are pursuing, be it financial freedom, a longer sabbatical, saving for retirement or material things. The longer your investment horizon and the higher your savings rate, the faster your assets will grow.

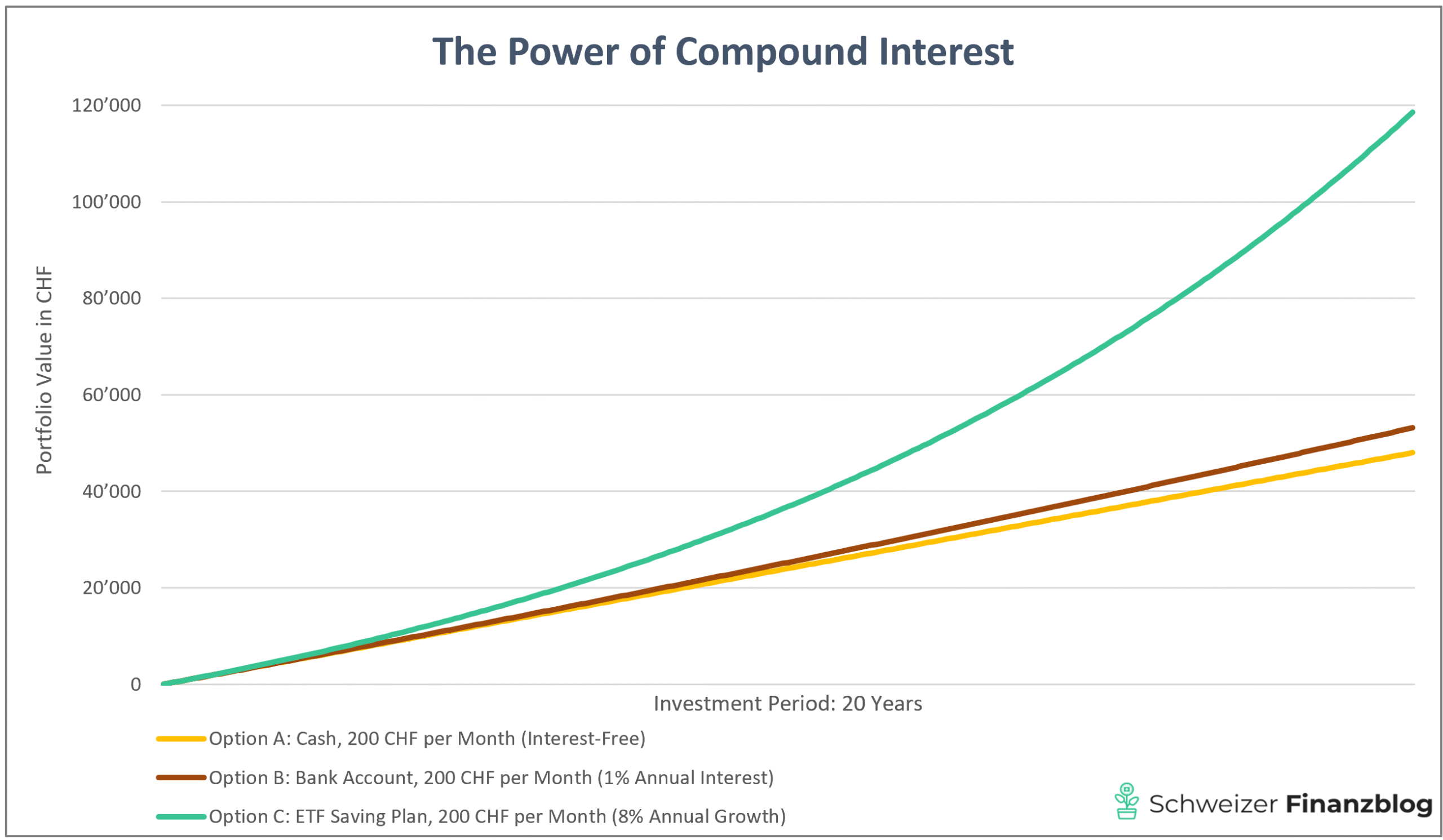

So far so clear. But what many people underestimate is the compound interest effect, which is the ultimate booster for your assets in the long term – provided you invest your assets profitably, e.g. in equity ETFs.

What are the advantages of an ETF savings plan Switzerland?

Before we go into the savings plan-specific advantages, we would like to remind you of two decisive advantages of ETFs (i.e. regardless of whether with or without a savings plan):

- Low costs: ETFs often have significantly lower fees than many other funds, especially actively managed investment funds. Typically, the ratio of product costs (TER) is around 1:10 (!) in favor of ETFs.

- Broad diversification: In contrast to investments in individual companies, ETFs track an index, which enables broad diversification of the investment and virtually eliminates the cluster risk of a total loss.

We have reported in detail on the many positive (and few negative) aspects of ETFs in the article ETFs: The investment revolution. We have also selected the best ETFs in the article Best ETFs Switzerland and globally: And the Winner is….

Ok, all right, but why should I set up an ETF savings plan Switzerland? We have summarized the three most important advantages for us below:

- Long-term growth: Thanks to regular investments over a longer period of time, a Swiss ETF savings plan offers the best conditions for building up long-term capital growth and benefiting from the powerful compound interest effect.

- More return: The regular execution of a savings plan enables you to invest in equity ETFs in a disciplined manner. This automatic approach has the positive effect that you invest more of your money profitably and consume less of it or hoard it unprofitably in your bank account.

- Less risk: You reduce market volatility and the risk of fluctuating prices not only by choosing a broadly diversified ETF (compared to a single stock), but also by investing regularly using a savings plan. The practice of investing at average prices is known as the “cost-average effect”. This effect occurs when you regularly invest the same amount in an investment, regardless of current market prices. As a result, you buy more units of the investment when prices are low and less of it when prices are high.

What types of ETF savings plans are there?

We distinguish between three savings plan variants (sorted in ascending order according to maturity or comfort level):

- Option 1: Investing manually in one or more ETFs

- Option 2: Automatic investing in one or more ETFs

- Variant 3: Automatic investing in a diversified investment portfolio

All three variants have the regularity of investing in common.

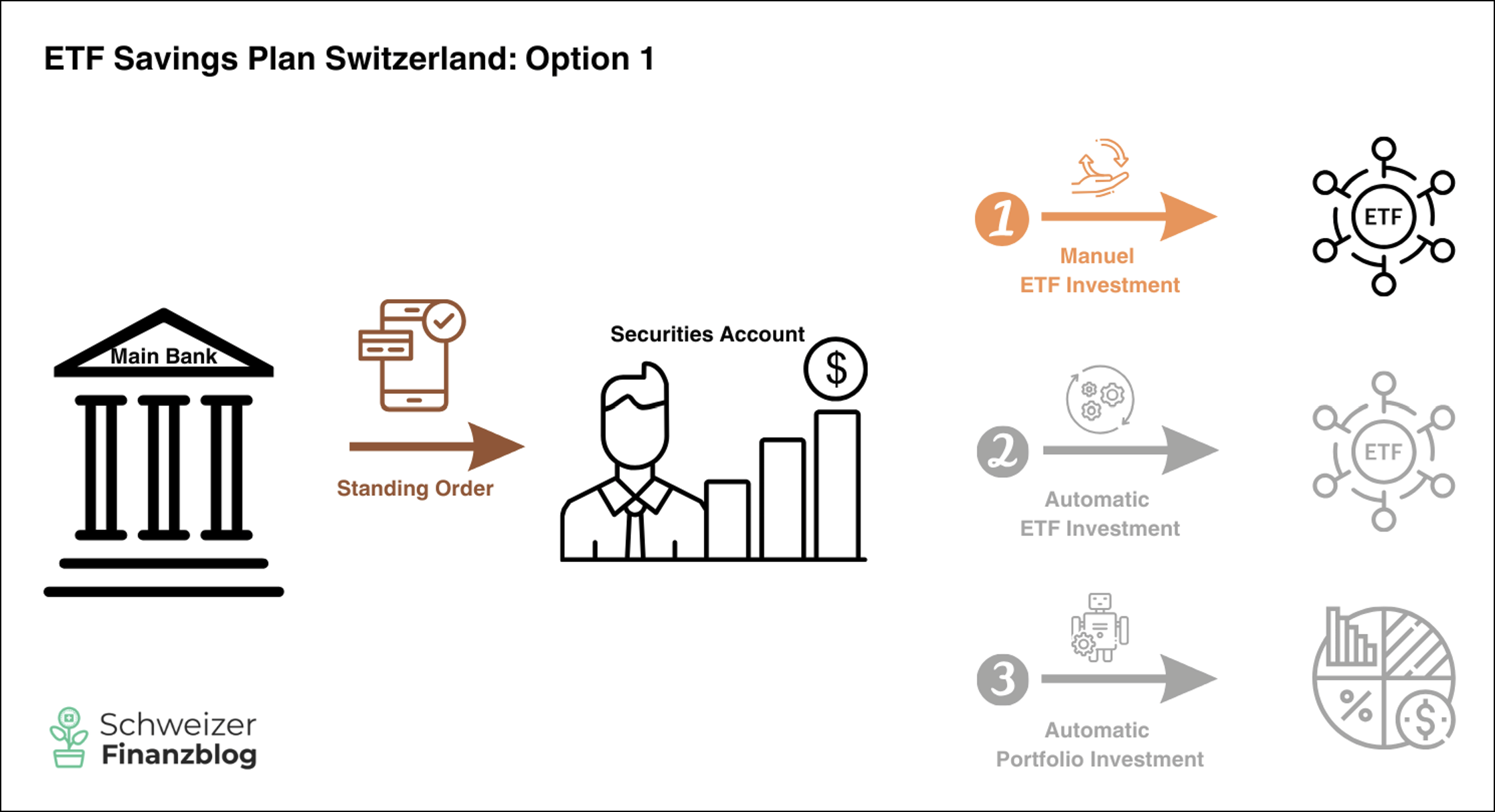

“ETF savings plan Switzerland” variant 1: Manual investment in one or more ETFs

With this option, you have a fixed amount transferred to your securities account on a regular basis by standing order. However, you have to initiate the actual investment manually in a second step. This means that you buy as many ETF units as possible in line with your transferred installment. You invest any remaining amounts the next time.

These residual amounts should of course be as low as possible, which is why you should give preference to so-called “low-priced ETFs” whose individual units are offered at relatively low prices, e.g. at around CHF 10/USD/EUR.

Financially, this option is only worthwhile for you if you have a custody account where the transaction fees are not too high in relation to the invested installment. We apply the rule of thumb that the total transaction costs, i.e. commissions including any stock exchange and exchange fees as well as stamp duty, should not exceed 1% of the invested installment . This is because the fewer fees you are charged, the higher the return on your investment.

Our cooperation partner DEGIRO(review with CHF 100 bonus), Europe’s largest online broker that does not offer automated ETF savings plans, meets this criterion: depending on your choice of ETF, you pay a fixed €1 or €3 per invested installment at DEGIRO. This means that the higher your savings rate, the lower the percentage fee. The low fixed fees make DEGIRO particularly attractive if you invest larger amounts. In addition, as a foreign provider, DEGIRO does not incur any stamp duty.

– Partner Offer –

– – – – –

Important: Providers such as Yuh, neon, Saxo Bank, Swissquote or Interactive Brokers are also suitable for this manual savings plan variant. However, as automated investing is also possible with them, we cover them in detail in savings plan variant 2, which offers a higher level of convenience.

Conclusion on the “ETF savings plan Switzerland” variant 1

This savings plan variant offers you the least convenience. You have to “initiate” all the trades manually. If you forget to do this, it is just cash without any significant return. After all, you can transfer a fixed investment amount to your securities account regularly and automatically (by means of a standing order).

This option is particularly suitable for people who are disciplined and regularly invest manually in their preferred ETF. This gives you full control. For example, you can save in one ETF or another – just as you wish. As with all savings plans, it is also important with this option that you pay attention to the fees and have a securities custody account with low transaction costs.

“ETF savings plan Switzerland” variant 2: Automatic investment in one or more ETFs

This variant is the classic savings plan. Once the ETF to be saved in, the installment amount, start date and interval have been selected, the trades are executed automatically. As the value of the ETF fluctuates constantly, you always invest the same amount, but receive different numbers of ETF units or fractions thereof, depending on the price. The latter is called fractional trading and is a prerequisite for investing a recurring fixed amount.

Before we take a look at which providers support this useful feature, we first come to the crucial question of price – because the lower the fees, the more is left over for your wealth accumulation.

Commission-free ETF savings plans at Saxo Bank

In the savings plan discipline, Saxo Bank, which is regulated in Switzerland, deserves a special mention(review plus CHF 200 bonus by clicking on the partner offer below): Since 2024, all over 100 ETFs eligible for savings plans can be purchased here without purchase commissions, which makes them particularly attractive for cost-conscious investors.

– Partner Offer –

– – – – –

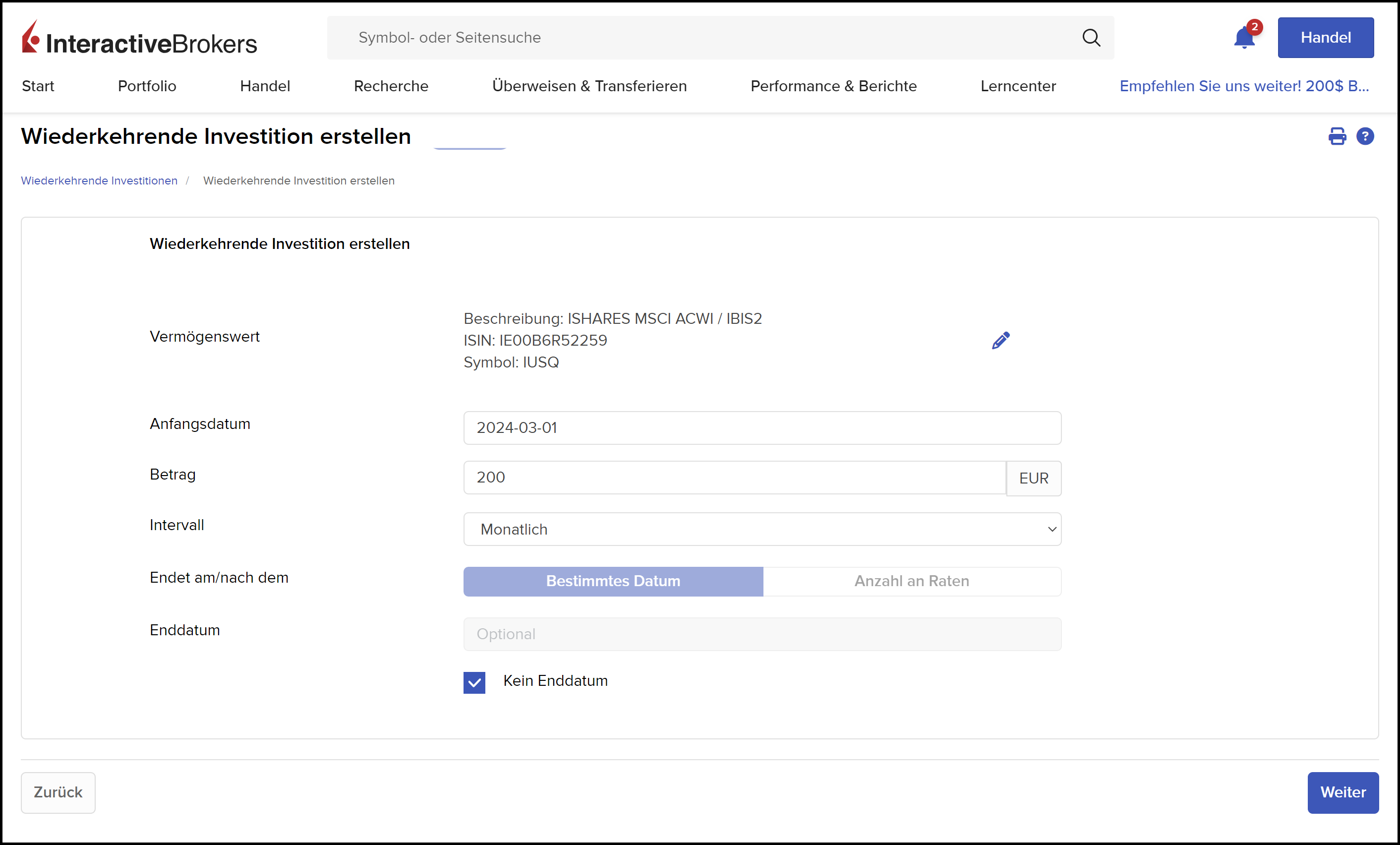

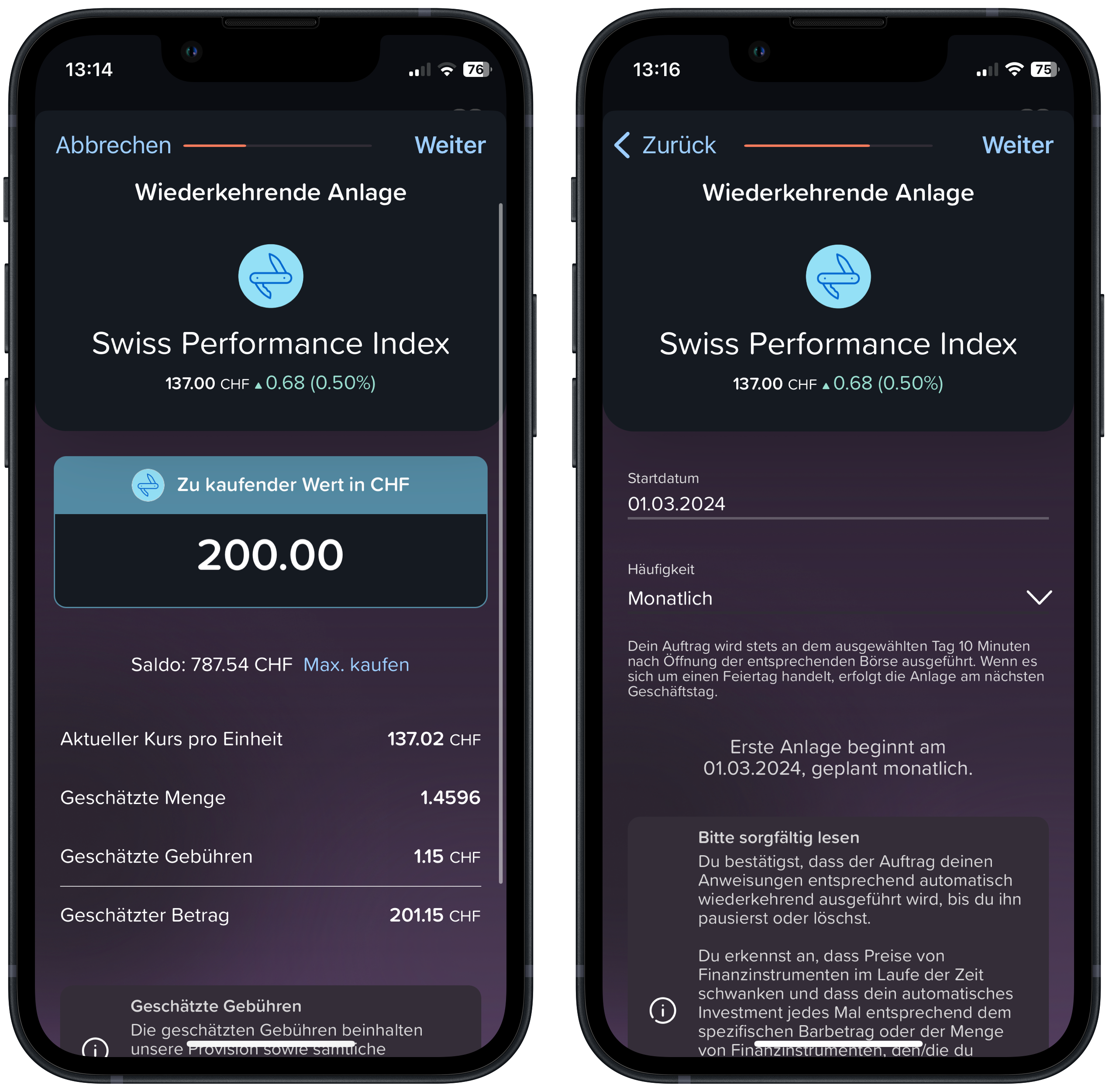

At Interactive Brokers(Review), commissions are a low 0.05%, but at least CHF 1.50, €1.25 or $1.70 depending on the trading currency. Yuh(Review with CHF 50 bonus) and neon(Review with CHF 20 bonus) charge a flat rate of 0.5% per savings plan installment, but also offer selected ETFs without purchase commissions. Thanks to the reduction in entry prices to CHF 3 for amounts up to CHF 500, Swissquote(review with CHF 100 bonus) is also eligible for savings plans.

Savings plans without residual amounts thanks to fractional trading

The convenient “fractional trading” feature in combination with automatic investing is offered by our three cooperation partners Interactive Brokers, the smartphone bank Yuh and, since 2024, the domestic market leader Swissquote.

With competitors Saxo Bank and neon, you can also set up a savings plan with a fixed amount. However, these two providers do not allow you to invest fractions (fractional trading), which leaves a residual amount available for the next tranche.

Automatic ETF savings plans – costs and benefits at a glance

| Provider | Fees per savings plan installment | Positive special features |

| Interactive Brokers | 0.05%, min. 1.50 CHF / 1.25€ / 1.70$ | Fractional trading, no stamp duty |

| neon | Flat rate 0.5% | Selected ETFs without purchase commission |

| Saxo Bank | Flat rate 0.0% | All savings plan ETFs (>100) without purchase commission, several ETFs possible in one savings plan |

| Swissquote | from CHF 3 for installments ≤ CHF 500 | Fractional Trading |

| Yuh | Flat rate 0.5% | Fractional trading, selected ETFs without purchase commission |

ETF savings plan Switzerland – real trades

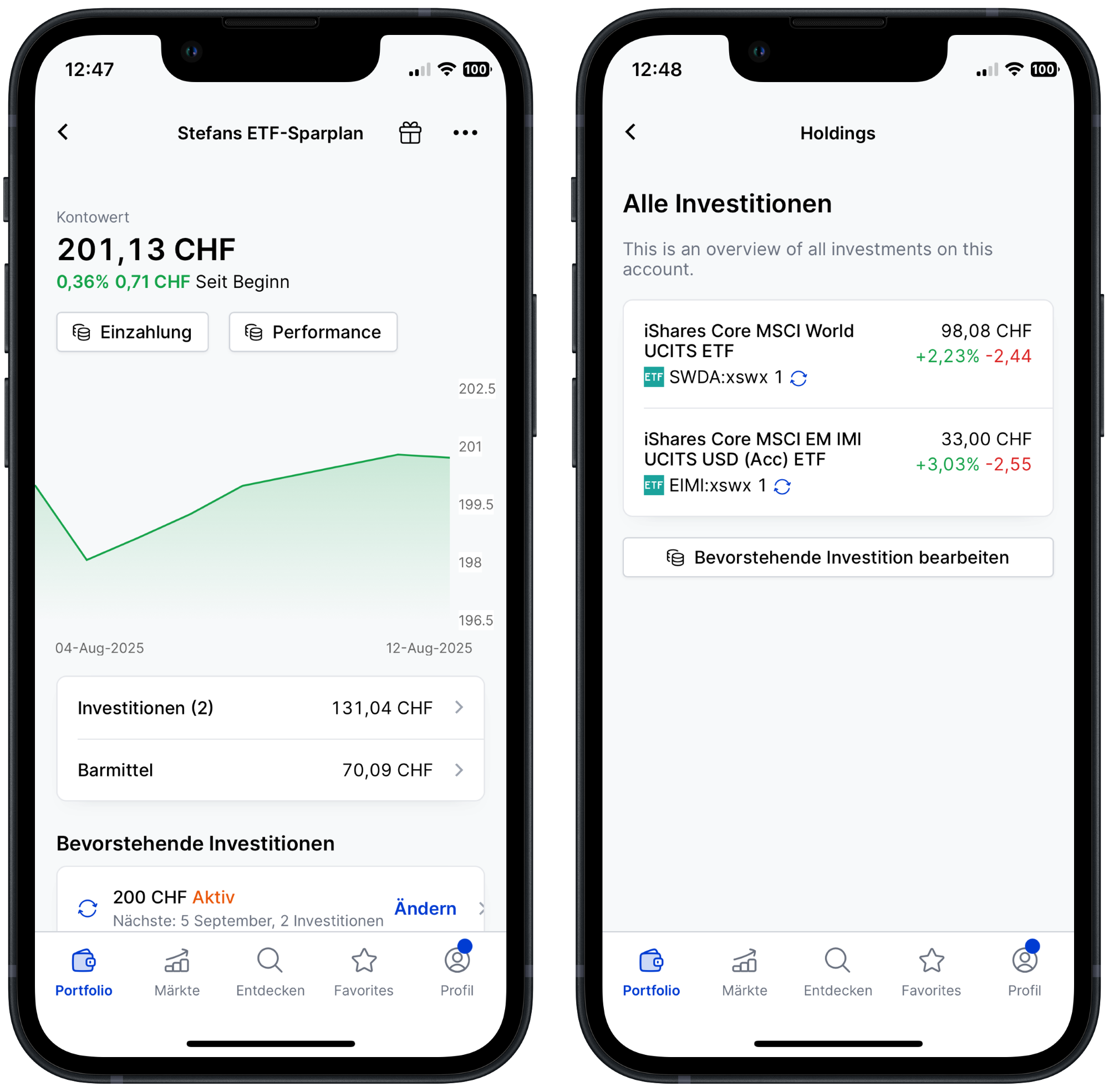

Below we have set up an ETF savings plan with the providers Saxo Bank, Interactive Brokers, Yuh and neon. We have selected one or more of our winning ETFs from the years 2024 or 2025: A piece of cake that can be done in a few seconds and can secure you automatic investments for many years to come!

ETF Savings Plan Switzerland from Saxo Bank

ETF savings plan Switzerland from Interactive Brokers

ETF savings plan Switzerland from Yuh

ETF savings plan Switzerland from neon

Conclusion on the “ETF savings plan Switzerland” variant 2

This simple and flexible option is likely to be the preferred choice for many. The prerequisite for this is low or – as with Saxo Bank since 2025 – no purchase fees on ETFs eligible for the savings plan. It is also important that your desired ETF is available in the savings plan at all. Our experience with the providers examined shows that the range of ETFs eligible for savings plans is still limited in some cases – however, attractive ETFs are already available for savings plans with all of them. Providers with the “fractional trading” feature also ensure that the full savings amount is invested – without any residual amounts.

Is a savings plan solution like this not yet convenient enough for you? Then variant 3 in the next chapter might be just right for you.

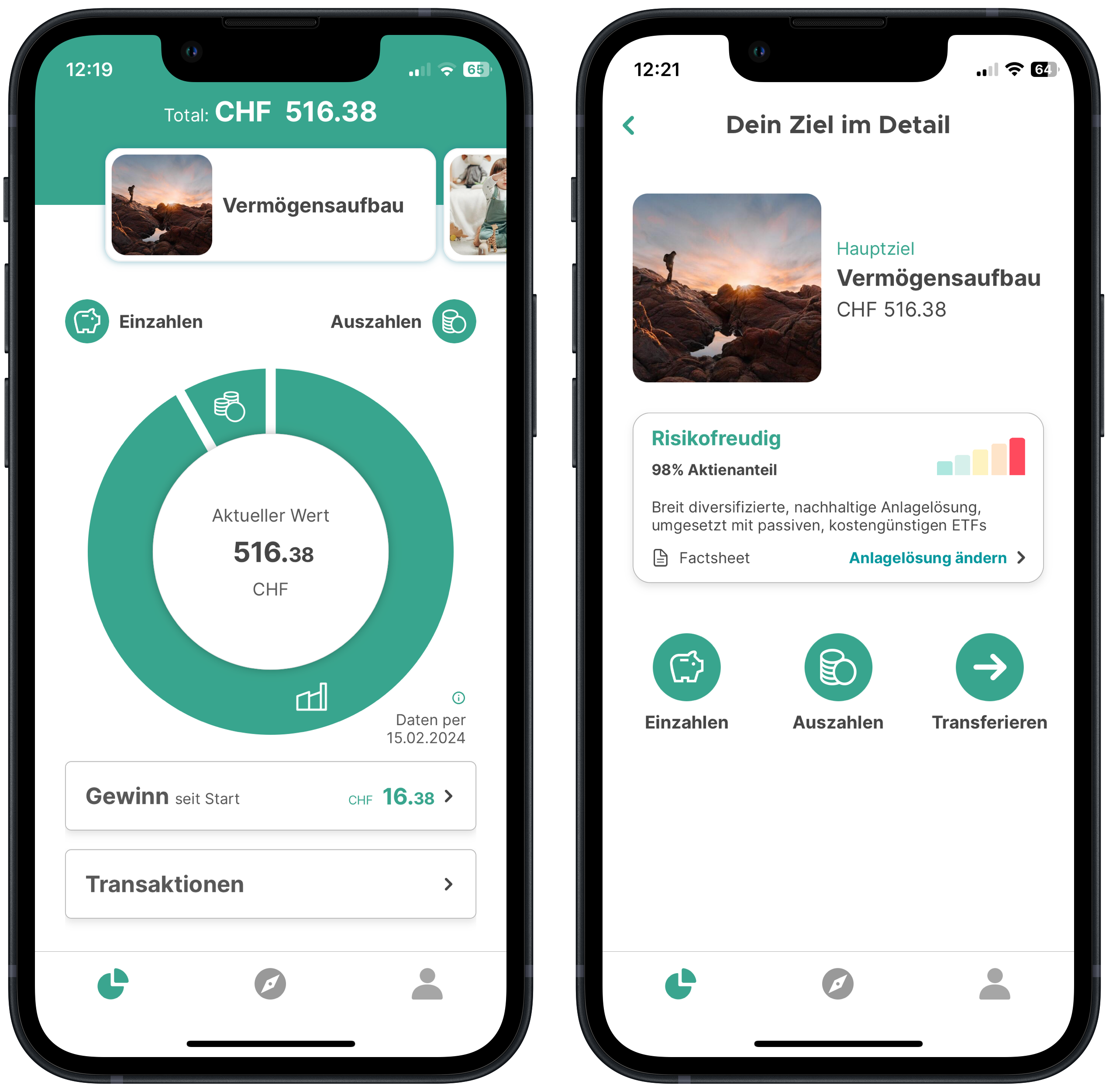

“ETF savings plan Switzerland” variant 3: Automatic investment in an investment portfolio

Providers of such “all-round carefree packages” are usually so-called robo-advisors. Their key advantage over variant 2 described above is that you not only invest regularly and automatically in individual ETFs, but also in an entire investment portfolio – consisting of several ETFs or index funds and, depending on the strategy, spread across traditional asset classes such as equities and bonds as well as alternative investments such as real estate, commodities or cryptocurrencies.

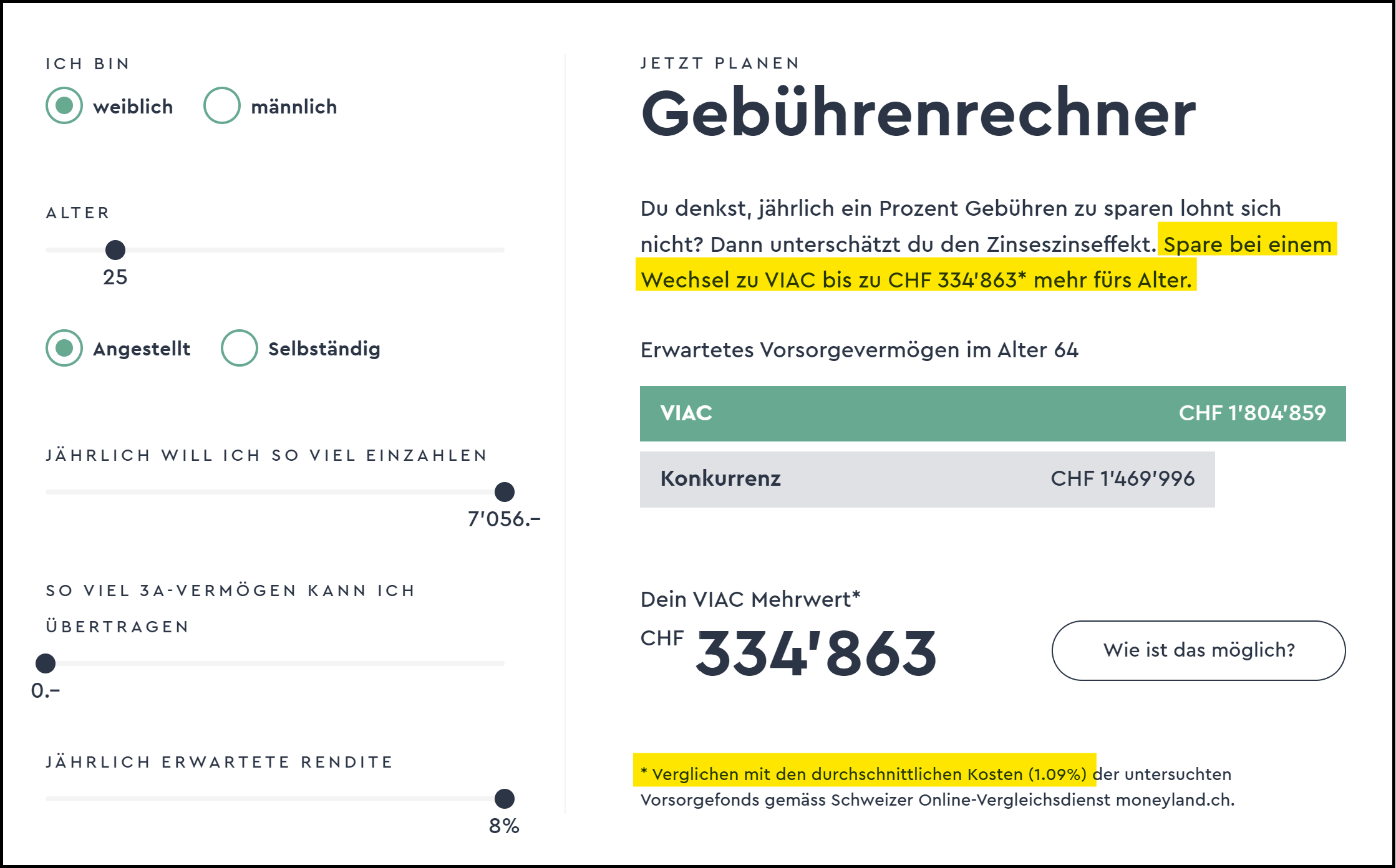

In terms of the pricing model, robo-advisors differ significantly from the savings plans described above. This is because the fees are generally not charged per trade, but in the form of management and custody fees based on the invested assets. We set the “pain threshold” in this respect at 0.5% p.a., which the majority of providers cannot keep up with.

The composition of such a savings plan portfolio essentially depends on your risk profile and – once defined – applies to every investment until you withdraw or change your investment strategy. This means that every time you transfer money, your portfolio is increased based on the rules. However, if you do not transfer any money, nothing is invested. So even with a robo-advisor, you are not obliged to invest regularly.

Our three robo-advisor cooperation partners findependent, Selma and clevercircles not only offer low-cost savings plans from as little as CHF 100, but also a passive investment universe with ETFs and/or index funds. In addition to these two must-have criteria (for us), they are positioned quite differently. We have summarized their most important features in these profiles (including promotional codes).

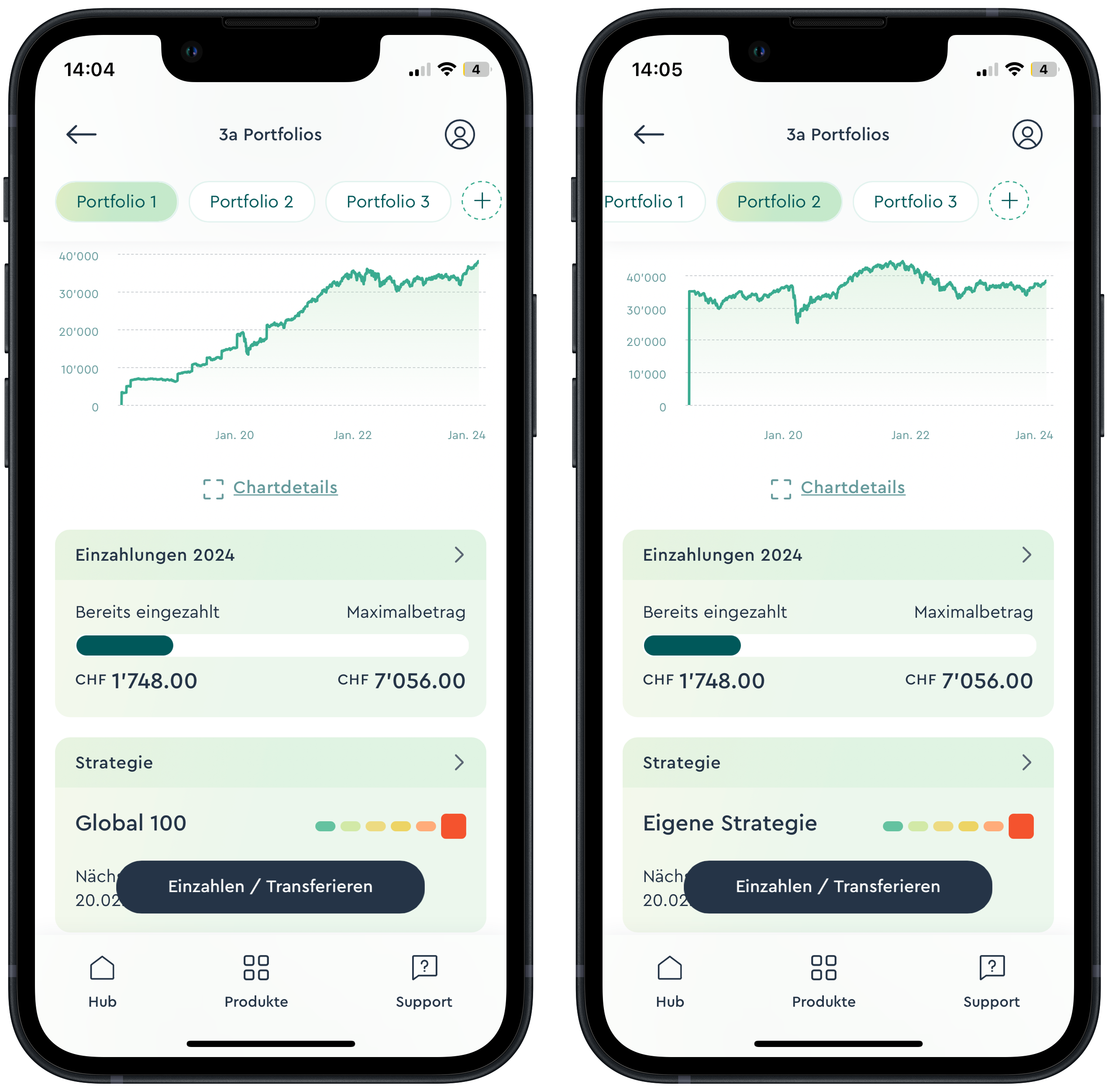

While do-it-yourself portfolios are still popular for private investing, automatic investing in an entire investment portfolio is the obvious choice for 3a retirement savings. The reasons for this are the easily plannable, state-prescribed maximum amounts per year, which you can divide into monthly installments, for example, the often long investment horizon depending on age and, of course, the tax advantages.

Toni and Stefan hold several 3a securities custody accounts with the digital pension pioneer VIAC (see review with bonus offer) and have been saving in these regularly since it was founded in 2015. Viac’s comparatively low fees are between 0.00% and 0.44% , depending on the investment amount and equity component.

There are now numerous digital 3a products on the market. Another of the cheaper providers of 3a solutions is the smartphone bank Yuh, which charges a flat fee of 0.5% per year for all its passive Swisscanto investment solutions. You can find out more in our Yuh Review incl. Star bonus of CHF 50 .

Conclusion on the “ETF savings plan Switzerland” variant 3

This variant is the gold standard among savings plans – it couldn’t be more convenient! With literally one click, you can invest in a portfolio tailored to your needs, consisting of traditional asset classes such as equities and bonds as well as optional alternative investments such as real estate or commodities.

In addition to 3a pension savings, this option should also be your first choice for free or non-state-regulated asset accumulation if you

- attach particular importance to a holistic investment solution in autopilot mode,

- you are comfortable with the (ETF) product selection pre-selected by the robo-advisor and

- accept the somewhat higher costs for the comfort offered.

Conclusion on the ETF savings plan Switzerland

Regardless of whether you are saving freely or using a regulated 3a pension plan: an ETF savings plan Switzerland can be your biggest helper in building up your wealth! But that’s not all: With the strategy of regular investing, you also benefit optimally from the powerful compound interest effect, especially if you invest in accumulating ETFs – i.e. ETFs where the dividends are reinvested on an ongoing basis.

Once set up and regularly “fed” with money, savings plans will serve you faithfully for many years. The prerequisite for this, however, is that you set up a standing order with your bank, whereby, for example, a fixed sum is transferred to your securities account every month.

Depending on your preferences, you can choose from three savings plan variants with different levels of convenience and flexibility. Flexibility means how easily and quickly you can adjust your investment – for example, change the savings rate, sell shares or add new ETFs.

Savings plan variant 1: Manual ETF trades

- Comfort: low

- Flexibility: high

- Suitable providers: DEGIRO – hard to beat for high savings rates thanks to low fixed prices; all providers according to savings plan variant 2

Savings plan variant 2: Automatic ETF trades

- Comfort: high

- Flexibility: medium

- Suitable providers: Saxo Bank, Interactive Brokers, Yuh, neon, Swissquote

Savings plan variant 3: Automatic trades in an entire investment portfolio

- Comfort: maximum

- Flexibility: rather low

- Suitable providers:

- free savings: findependent, VIAC, Selma, clevercircles (Swissquote also offers an all-round package with “Invest Easy”, but we do not recommend it due to the comparatively high prices).

- tied 3a savings: VIAC, Yuh

You can find informative profiles including attractive bonus offers for all the savings plan providers mentioned in this article on our recommendations page.

This might also interest you

Updates

2025-08-18: Comprehensive update including the addition of Saxo Bank’s new commission-free ETF savings plans.

2024-11-19: New savings plans from Swissquote explained.

2024-07-26: Note that neobanks Yuh and neon also offer commission-free ETFs in the savings plan.

2024-06-10 Smartphone-Bank neon also added to savings plan variant 2, as neon now offers automated savings plans.

Disclaimer

Disclaimer: Investing involves risks of loss. You must decide for yourself whether you want to bear these risks or not.

Errors excepted: We have written this article about the ETF savings plan Switzerland to the best of our knowledge and belief. Our aim is to provide you as a private investor with the most objective and meaningful financial information possible. However, if we have made any mistakes, forgotten important aspects and/or are no longer up to date, we would be grateful if you could let us know.