In the last article, you learned how you can structure your assets according to your individual risk profile using a broadly diversified global portfolio. In this article, we will look at how you can restore your original asset allocation simply and cost-effectively by rebalancing if the individual assets perform differently.

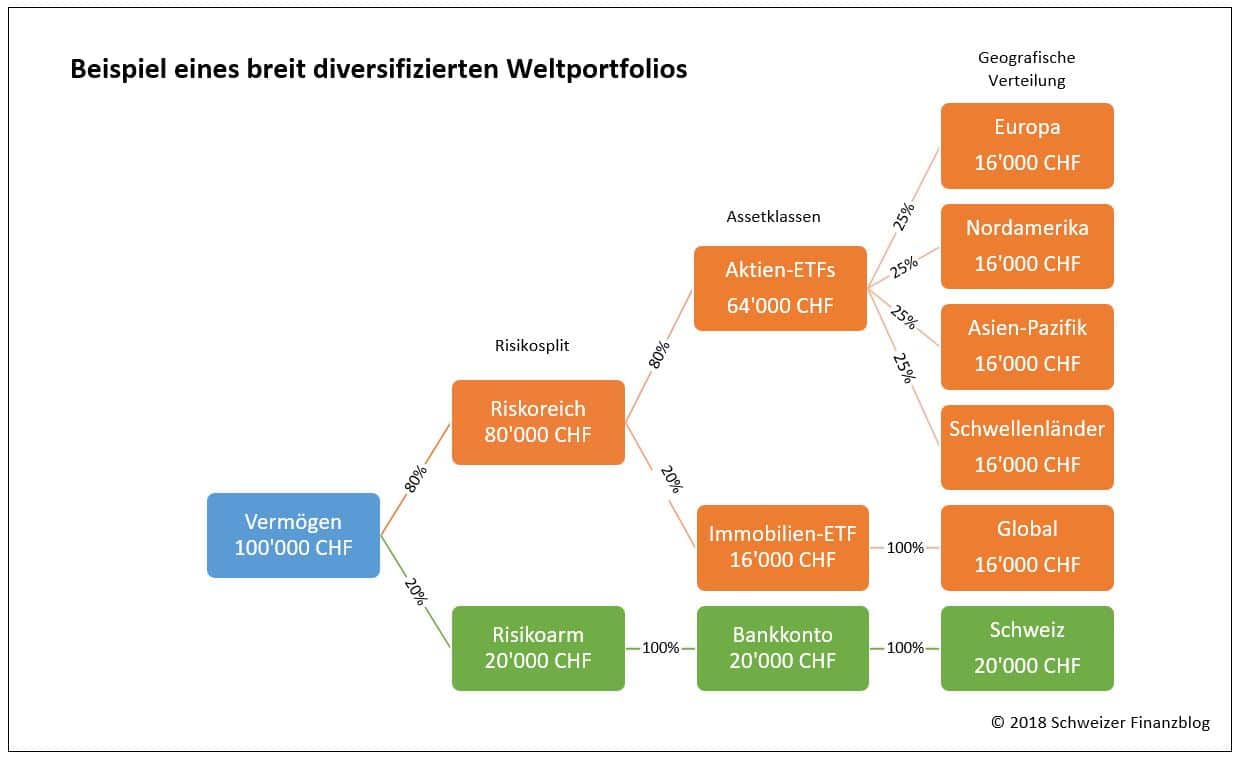

Before we get into the topic, let’s remind ourselves of the initial situation in the last article. We have put together a global portfolio with a risk split of “80% high-risk” and “20% low-risk” (see Figure 1):

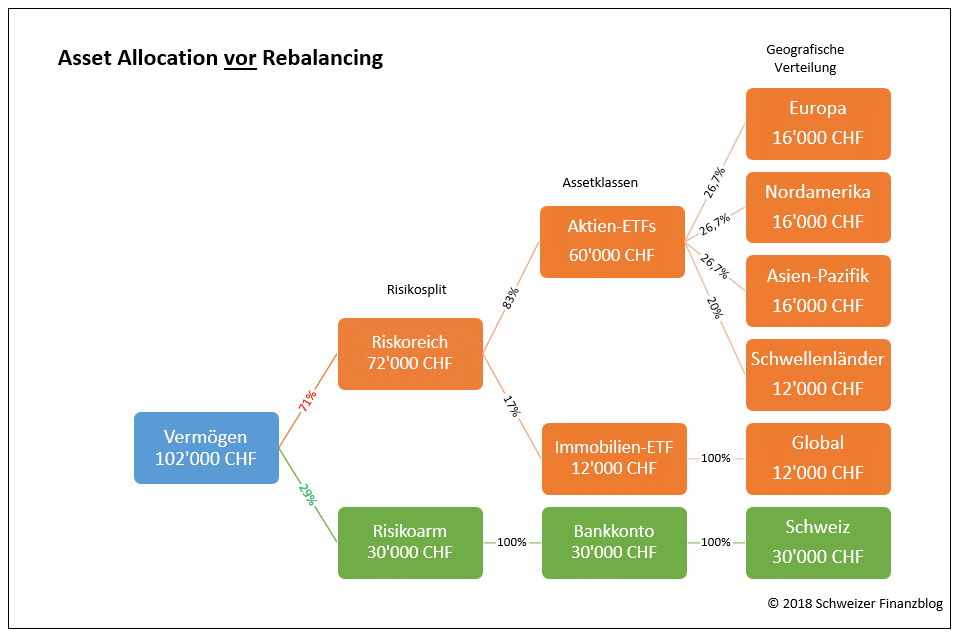

Let’s now assume that your bank account grows by CHF 10,000 to CHF 30,000 thanks to additional income and/or greater savings efforts. At the same time, the market value of your ETF investments is 72,000 francs, which corresponds to a loss of 8,000 francs or 10 percent.

Let’s further assume that only your investments in emerging markets and real estate are affected by the price loss, half each (i.e. minus CHF 4,000 each). The other ETF investments have therefore not changed in value. Figure 2 illustrates the new asset situation.

Your original asset allocation has thus changed significantly, in favor of the low-risk portion. This now amounts to 29% (instead of 20%), while the high-risk portion now only amounts to 71% (instead of 80%).

In other words, your current asset allocation no longer matches your risk profile. We now want to restore the original balance by means of rebalancing.

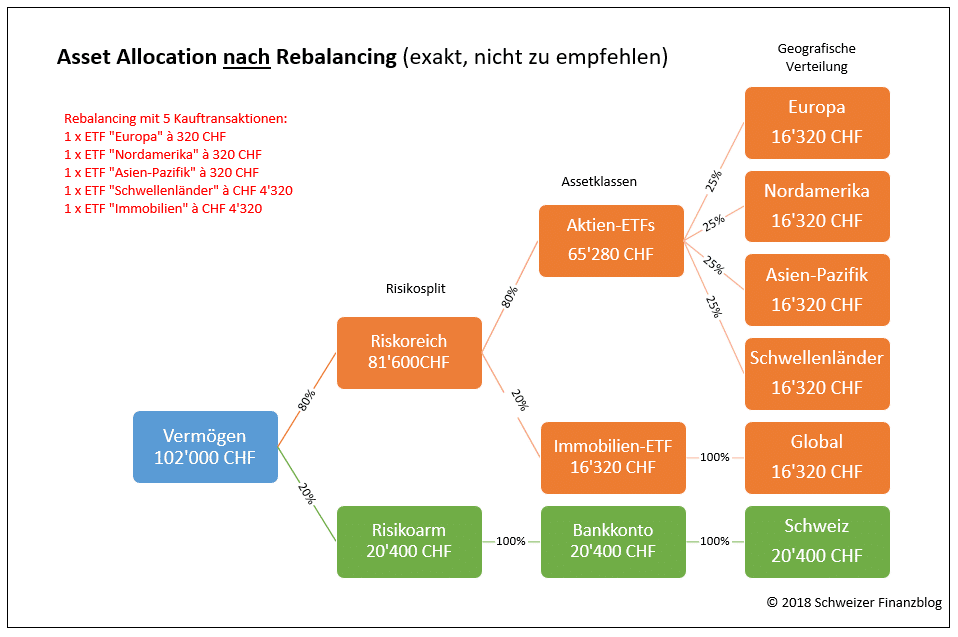

After carrying out an exact rebalancing, your asset allocation would look like Figure 3.

Cool, a precision landing! The weightings match the defined risk profile to the exact franc. On the one hand.

On the other hand, such an approach would probably be too costly due to the high transaction fees. After all, you would have to make five purchases, three of which would only amount to 320 francs each.

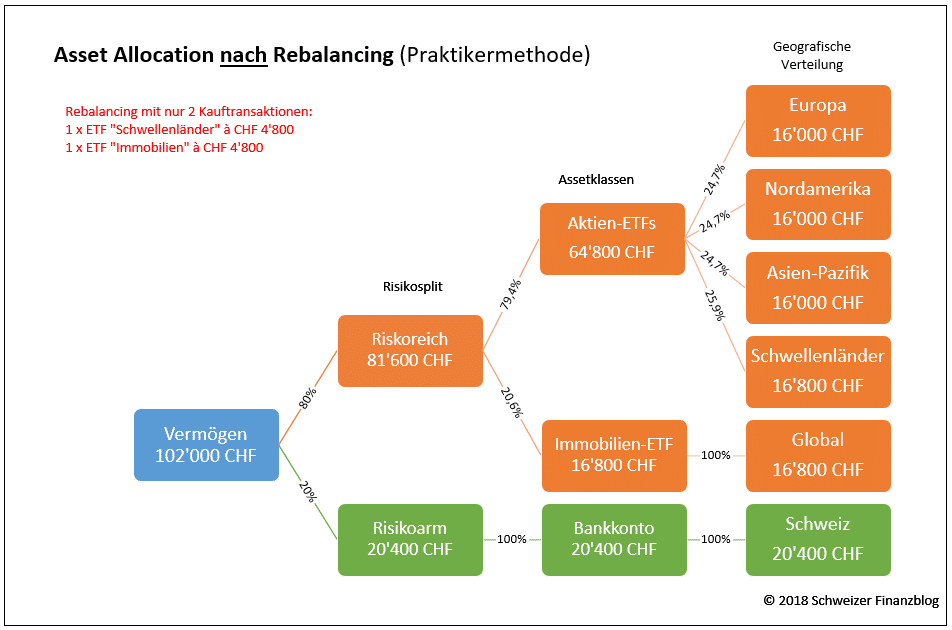

For this reason, a different, more cost-effective approach is preferable in such cases. We suggest the following practical method:

Rebalancing is the reallocation of investments in order to restore your predefined asset allocation.

One positive effect after rebalancing is that the asset allocation corresponds to your risk profile again. In addition, you generally do not buy at the highest prices.

A potential disadvantage, on the other hand, is that frequent rebalancing incurs high fees. This reduces your return unnecessarily and runs counter to the scientifically preferred buy-and-hold strategy.

Therefore, our tip: If the weighting of the low-risk part (bank account) grows significantly , as in the example above, rebalance or invest promptly. This will allow you to benefit from equity returns and compound interest, which are likely to be significantly more generous than the bank account in the long term.

If the weightings change only slightly, wait and see or avoid reallocations altogether. This approach will save you transaction costs.

If you are already in the de-savings phase, rebalancing means that you first sell investments whose weight has increased.

Scientific studies show that additional returns can also be expected when rebalancing within asset classes with roughly the same return prospects. The literature also refers to the “rebalancing bonus” in this context.

Gerd Kommer writes in the current 5th edition of his book “Souverän Investieren mit Indexfonds und ETFs”: “Rebalancing increases the annual return of a well-diversified portfolio by up to half a percentage point in the long term, while the risk hardly changes or decreases minimally.”

Rebalancing can be implemented particularly well with a low-cost online broker.

– Partner Offer –

In our experience and due to the low costs for ETFs, a particularly attractive broker at present is “DEGIRO” (link to the DEGIRO Review). Bei Interesse kannst du dich bei DEGIRO über unseren partner link which will give you Trading Credits of 100 CHF (with conditions) and support our blog at the same time.

– – – – –

One of the reasons he gives for this excess return is the so-called regression to the mean value.

If the actual values deviate significantly from the target values, you should rebalance your investments promptly back to the original weighting that corresponds to your risk profile.

This approach is particularly recommended if, for example, the low-risk portion is growing much faster than the high-risk portion thanks to additional income and/or a high savings rate.

With appropriate investments in the risky part, you can expect a higher return in the long term or the risk/return ratio will again correspond to your risk profile.

Rebalancing for small deviations of less than CHF 1,000 is often not worthwhile because the transaction fees are then disproportionately high. In these cases, it is therefore better to wait and avoid rebalancing.

In the next article, we will take a closer look at the (rightly) increasingly popular investment vehicle “ETF”, which in our opinion represents nothing less than a revolution in private investment.

You can get a complete overview of the topic of “Investing” here: Learning to invest – in eight lessons.

Disclaimer: Investing involves risks of loss. You must decide for yourself whether you want to bear these risks or not.

Errors excepted: We have written this article to the best of our knowledge and belief. Our aim is to provide you as a private investor with the most objective and meaningful financial information possible. However, should we have made any errors, forgotten important aspects and/or no longer have up-to-date information, we would be grateful if you could let us know.

In the last article, you learned about the positive effects of smart diversification when investing. In this article, we want to take this topic a step further and focus on asset allocation: the key success factor for your investment! In this article, you will find out how to structure your assets according to your needs and risk profile.

Asset allocation depends on your individual risk profile. This in turn is influenced by the following three factors:

Basically, the longer your investment horizon, the riskier and therefore more profitable you can invest your money. This is because, as we have already shown in this article, price fluctuations and stock market corrections can generally be better balanced out with longer-term investments. You also benefit from the powerful compound interest effect with a long investment horizon.

– Partner Offer –

In our experience and due to the low costs for ETFs, “DEGIRO” is currently a particularly attractive broker (link to DEGIRO review). If you are interested, you can register with DEGIRO via our partner link , which will earn you trading credits worth CHF 100 (with conditions) and support our blog at the same time.

– – – – –

It is also important that you are aware of how much risk you want to take. Even the broadly diversified MSCI World share index with around 1600 shares lost over 57% (= maximum drawdown) in value in the course of the so-called subprime crisis between October 31, 2007 and March 9, 2009 (see MSCI World factsheet).

If you can still sleep peacefully (and don’t sell) even with such heavy price losses, you are clearly the risk-taking investor. But perhaps you are more risk-averse and your primary aim is to preserve the value of your investment.

Risk capacity expresses the fluctuations in value and losses you can cope with without getting into financial difficulties. The less you are dependent on the invested capital to meet your obligations, the greater your risk capacity.

To clarify: a well-off childless dual-earner couple generally has a much higher risk capacity than, for example, a single mother.

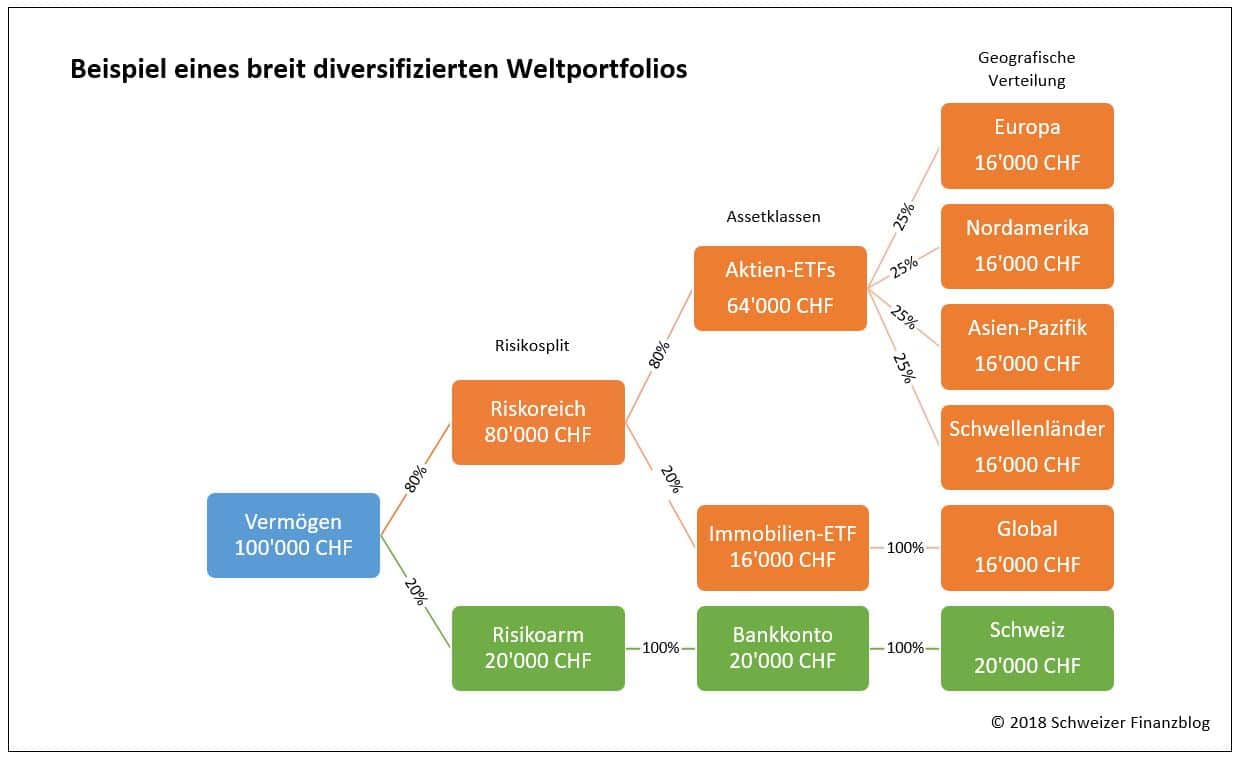

Let’s assume that you have fictitious assets of CHF 100,000, which are interest-free and available at all times in your private account. We also assume that you have a regular income and that you have your running costs under control. Finally, you are not planning any major purchases for the next 10 years, such as buying a home.

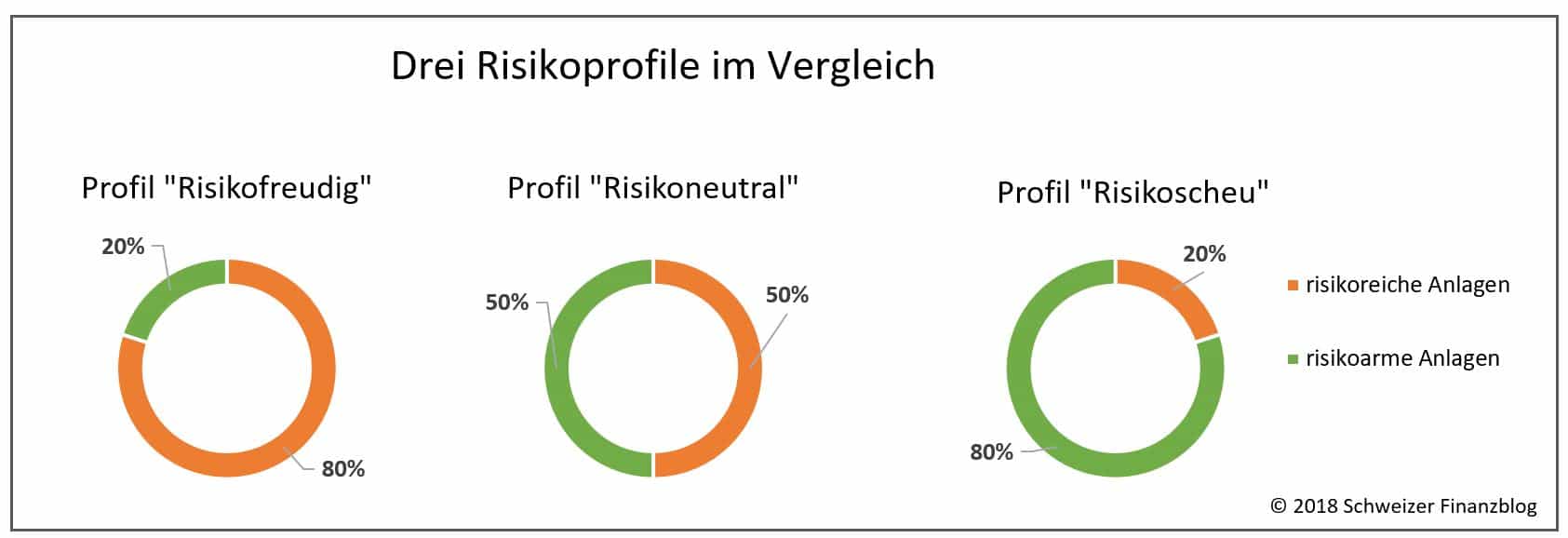

Based on Markowitz’s scientifically oriented portfolio model (see also this article), we recommend first dividing the CHF 100,000 into a low-risk and a high-risk portion based on your risk profile (see Figure 1).

Important: No matter what type of risk you are, within the “low-risk” and “high-risk” investment categories mentioned above, the composition of the investments is basically the same.

“You can’t avoid equities in the risky part.”

Figure 2 shows an example of a broadly diversified global portfolio for the risk-averse or yield-oriented investor with a long investment horizon.

In the risky part, you cannot avoid equities. ETFs, which track broad market indices from all regions of the world, are very suitable investment vehicles. You can find out why we consider ETFs to be particularly attractive when investing in a separate article.

For an even broader diversification or a more advantageous risk/return ratio, real estate as an additional asset class is an interesting option. But here too, instead of taking on unnecessary bulk risk with individual securities or even individual properties (“concrete money”), it is better to invest in an ETF that contains numerous real estate companies or real estate investment trusts (REITs) worldwide.

In the low-risk part, on the other hand, your money will primarily be in your private account, which you can access at any time. We do not consider bonds to be an interesting option in times of historically low interest rates.

“Defining your individual asset allocation tailored to your risk profile is the be-all and end-all of your investment.”

Determining your individual asset allocation tailored to your risk profile is the be-all and end-all for a successful investment.

Based on your risk profile, your assets are first divided into a “high-risk” and “low-risk” part. The individual asset classes are then weighted.

The high-risk portion corresponds to a broadly diversified global portfolio consisting of the asset classes “equities” and, for example, “real estate”.

The investment vehicle“ETF” (exchange-traded fund) is particularly suitable for these asset classes.

The low-risk portion essentially corresponds to bank balances (“private account” investment vehicle).

In the next article, we will look at the topic of “rebalancing” and the question of how you can easily and cost-effectively restore your original asset allocation if the individual asset classes perform differently.

You can get a complete overview of the topic of “Investing” here: Learning to invest – in eight lessons.

Disclaimer: Investing involves risks of loss. You must decide for yourself whether you want to bear these risks or not.

Errors excepted: We have written this article to the best of our knowledge and belief. Our aim is to provide you as a private investor with the most objective and meaningful financial information possible. However, should we have made any errors, forgotten important aspects and/or no longer have up-to-date information, we would be grateful if you could let us know.

In the last article, you learned about the magic triangle and the mutually influencing investment goals of return, availability and security. We now want to delve deeper into the investment topic. In this article, you will find out how you can achieve an optimum risk/return ratio in your investment thanks to intelligent diversification.

Admittedly: It’s not easy to resist the supposedly safe stock tip with rosy profit prospects from a trusted acquaintance. But it’s definitely necessary!

If you invest in a single stock, substantial price losses with no prospect of a sustained recovery are unfortunately an all too realistic scenario.

“The hunt for individual stocks, also known as stock picking, can backfire badly.”

And it is not just exotic stocks that are affected, but also well-known and established Swiss brands, as the Zurich Insurance chart below clearly shows.

Incidentally, the two top dogs in the domestic banking sector, UBS and CS, are showing similarly disastrous share price trends.

– Partner Offer –

In our experience and due to the low costs for ETFs, “DEGIRO” is currently a particularly attractive broker (link to DEGIRO review). If you are interested, you can register with DEGIRO via our partner link, which will earn you up to CHF 100 trading credits and support our blog at the same time.

– – – – –

But things could get even worse for you. In the worst-case scenario of “bankruptcy”, you are literally left empty-handed: total loss!

The hunt for individual stocks, also known as stock-picking, can therefore backfire badly. So let’s look around for a better alternative.

And that brings us to the so-called Modern Portfolio Theory according to Harry Markowitz. He was awarded the Nobel Prize in Economics in 1990 for his groundbreaking doctoral thesis.

Markowitz was the first to provide theoretical proof of the positive effect of diversification on the risk and return of an overall portfolio.

The core of his theory is the distinction between systematic and unsystematic risk.

All securities on the market are subject to systematic risk (i.e. market risks such as interest rate rises, recessions, political instability), so it cannot be diversified and is the risk of the investment itself.

“The company-specific risk can be reduced through diversification.”

The unsystematic risk, on the other hand, is the company-specific risk (e.g. management errors such as in the VW emissions scandal). This risk can be reduced through diversification, i.e. by increasing the number of different securities.

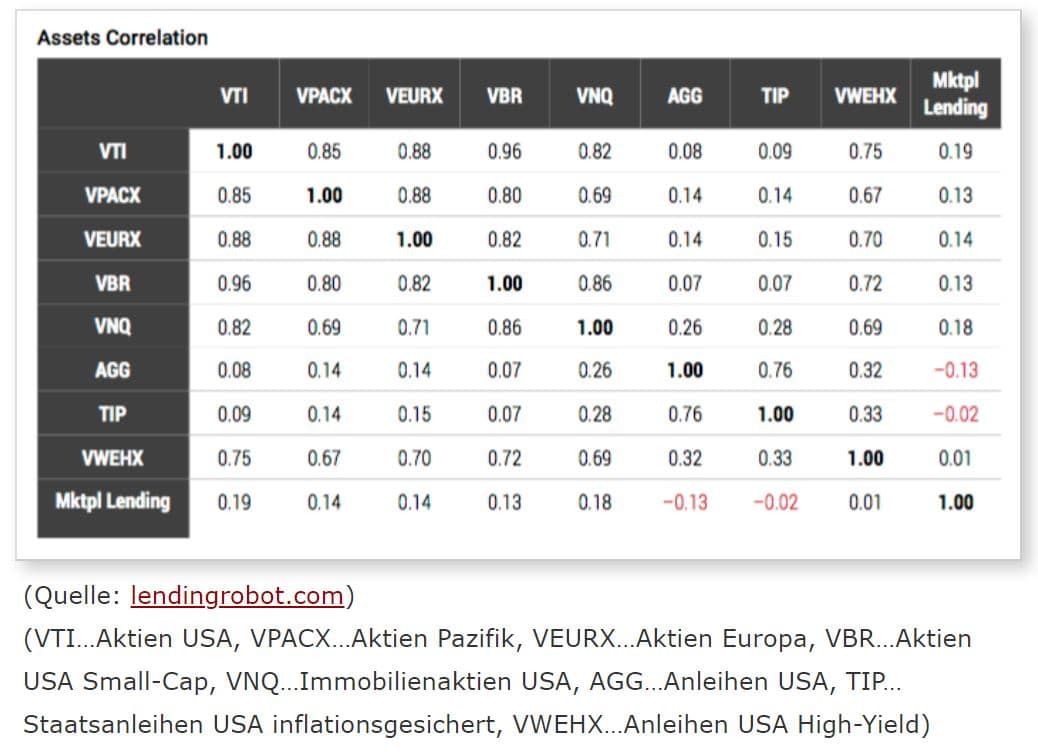

You will achieve the strongest effects if you mix different shares with the lowest possible correlation or with the lowest possible correlation coefficient. The bandwidth ranges from +1 (same development) to 0 (independent development) to -1 (opposite development).

If you want to understand the underlying formula and be reminded of the good old school days, we recommend this explanatory video, which was not produced by us.

Another, less theoretical video, which is unfortunately no longer available, illustrates the positive effect of buying two fictitious shares (umbrella and umbrella company) whose prices move in exactly the opposite direction (i.e. correlation coefficient of -1).

Note: Correlation coefficients within the asset class “equities” of 0.70 to 0.95 are more realistic. Further below in Figure 3 we show correlations between different equity investments and asset classes.

We recommend aiming for a broadly diversified investment. This means you are not taking any unnecessary risks. By unnecessary risks, we mean company-specific risks (see above) for which you are not compensated by a higher return on the market.

This means that a lack of diversification exposes your portfolio to excessive fluctuations (= volatility as a measure of risk) without giving you a higher return. Efficient portfolios, on the other hand, have an optimal risk/return ratio.

To answer the question of whether your portfolio is efficient, you can use the following rule of thumb.

An equity portfolio consisting of…

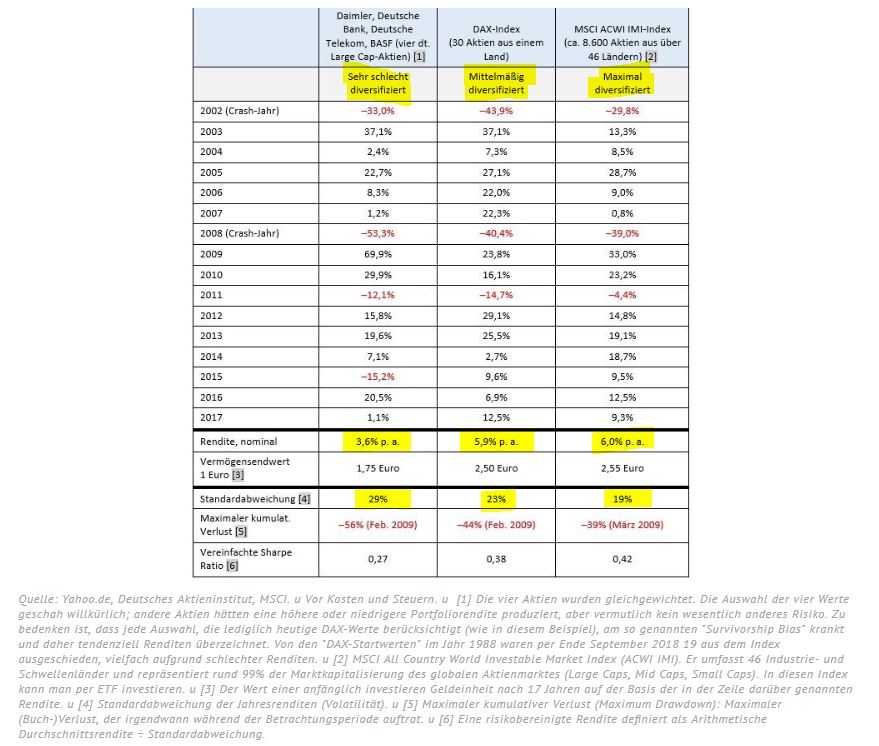

Gerd Kommer, author of the standard work “Souverän Investieren mit Indexfonds und ETFs” (“Investing confidently with index funds and ETFs”) and others, compared the return and risk of three equity portfolios with different degrees of diversification over a 16-year period from 2002 to 2017 in his article published on September 27, 2018 at www.dasinvestment.com using the table below.

The table illustrates that systematic, broad diversification significantly reduces the risk (= standard deviation, highlighted in yellow) in an equity portfolio – without sacrificing returns (= yield, highlighted in yellow).

“The globally and cross-sector diversified equity portfolio combined with other asset classes represents the premier class.”

Finally, the top class consists of combining the globally and cross-sector diversified equity portfolio with other asset classes such as real estate, P2P lending, bonds and/or commodities. This is because different asset classes generally correlate significantly less than investments within the same asset class, as illustrated in the table below.

It is striking that P2P lending and bonds with values close to 0 fluctuate practically independently of equity investments and therefore have a high diversification effect.

While Swiss government or corporate bonds hardly yield any interest in the current low interest rate environment and are therefore not very attractive as an addition to an equity portfolio, we consider P2P lending to be an option worth considering. We will discuss this relatively new and rapidly growing asset class in detail in a separate article.

Note: The calculated values are based on historical data, which is no guarantee for future development.

Stock-picking has more to do with gambling than with serious investing. After all, making big bets on individual stocks and putting all your eggs in the same basket only increases the risk, but not the expected return.

With clever diversification, on the other hand, you can change the risk/return ratio to your advantage. In other words, you take a lower risk while the return remains the same.

You will achieve the greatest diversification effects if you take different asset classes into account when investing.

“Thanks to diversification, you get a free lunch”.

In stock market jargon, this is referred to as a “free lunch”, which is offered to you thanks to diversification. Incidentally, there are no other “free lunches” when it comes to investing. Returns and risk are inseparable siblings. So take advantage of this wonderful diversification effect!

In the next article, we will look at the topic of asset allocation and how you can diversify your assets easily and in line with your individual risk profile using a global portfolio.

You can get a complete overview of the topic of “Investing” here: Learning to invest – in eight lessons.

Disclaimer: Investing involves risks of loss. You must decide for yourself whether you want to bear these risks or not.

Errors excepted: We have written this article to the best of our knowledge and belief. Our aim is to provide you as a private investor with the most objective and meaningful financial information possible. However, should we have made any errors, forgotten important aspects and/or no longer have up-to-date information, we would be grateful if you could let us know.

In the last article, you learned how differently savings accounts and equity investments have performed over the last 30 years, but also how they have fluctuated. Why is this the case? The so-called magic triangle of investing is a very good explanation. Which three factors are decisive for your investment? How do they depend on each other? As a private investor, what goals can you pursue for your investment at the same time? And which ones can’t? You will find the answers in this article.

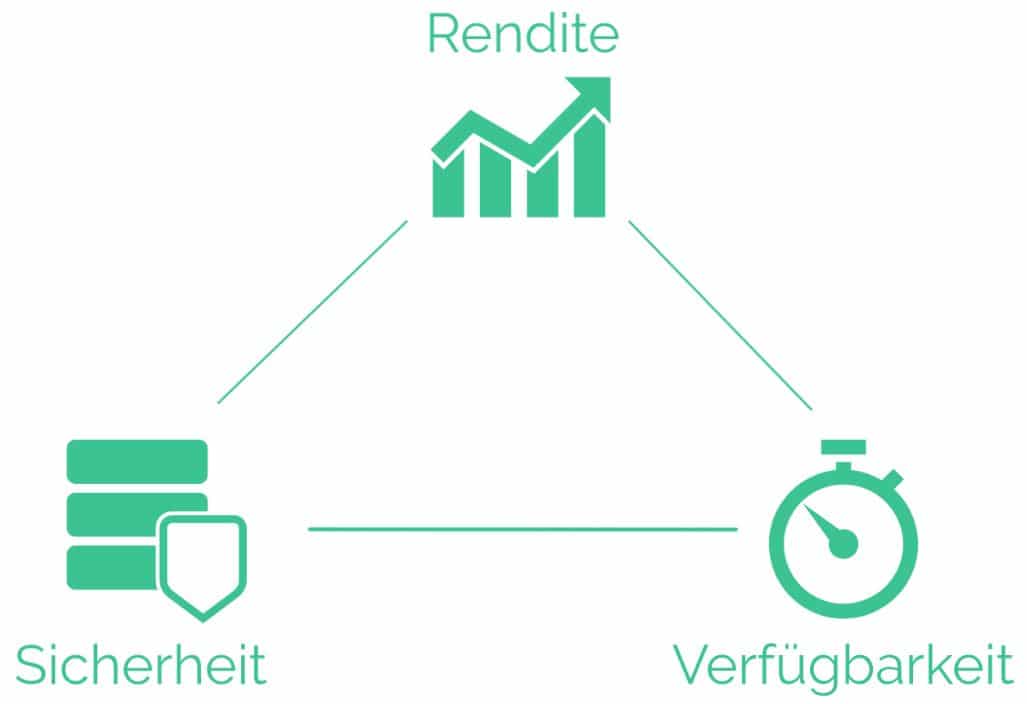

The magic triangle of investment refers to the competing goals of return, availability and security when investing. The illustration below symbolizes these three goals with the corner points of the triangle.

Yield: The yield describes the return that results from an investment in an asset. Income can usually be generated through dividend payments, interest payments or increases in value (price gains).

Availability: The availability, often also referred to as liquidity, of an investment expresses how quickly an invested amount can be “liquefied” back into cash or bank deposits. The shorter this conversion period is, the more liquid the investment is. Any (penalty) costs resulting from the conversion must also be taken into account.

Security: Security refers to the preservation of assets. Greater security can be achieved, for example, by spreading the assets (diversification).

– Partner Offer –

According to our experience and due to the low costs for ETFs, “DEGIRO” is currently a particularly attractive broker (link to DEGIRO review). If you are interested, you can register with DEGIRO via our partner link , which supports our blog.

–– – – – –

The magic triangle illustrates that only two of three goals can be pursued at any one time. Or in other words: the third goal must be neglected.

You can choose from the following three options:

Example “shares”: Shares can yield a high return and can generally be traded daily (high availability). However, the risk of strong price fluctuations significantly reduces the security of these investments.

Example “Bank account”: Cash can be withdrawn daily from a private account. In Switzerland, there is also deposit protection for deposits of up to CHF 100,000 per person and bank. However, as the bank’s assets are not available for a fixed period of time, it can only manage them to a limited extent. This is why the return in the form of interest is low or currently tends towards zero.

Example “medium-term notes”: These fixed-interest securities (also known as bonds) also benefit from deposit protection. However, the interest rates are higher than for private or savings accounts. This is because the investor “parks” his money for a longer term (usually three to ten years) and thus accepts limited availability. This in turn enables the bank to act economically over a fixed period, which it rewards with higher interest rates. Note: We currently consider this option to be less attractive, as the (meagre) interest bonus is disproportionate to the limited availability.

We see crowdlending or P2P lending to borrowers with a high credit rating as an alternative worth considering.

What your personal magic triangle looks like ultimately depends on your risk profile and the following two questions:

How much risk do you want to take (risk appetite)? And how much risk can you take (risk capacity)?

The first factor is subjective (and influenced by your financial education). The second factor is objective and depends on your financial situation.

An example: If you are planning major expenditure in the next two or three years, e.g. for a home, you will ideally prioritize high availability and security (wealth preservation) for your assets. Even if you are a risk-taker or have a high appetite for risk, it would be unwise to invest riskily in such a situation.

“The dream of a highly profitable, super-fast and 100% secure investment is therefore over. Unfortunately.”

The dream of a highly profitable, super-fast and 100% secure investment is therefore over. Unfortunately. As in other areas of life, we cannot avoid compromises when it comes to investing.

This means that if you want to generate a high return, you either have to have a long investment horizon or accept major compromises in terms of security or take high risks.

In our next article, you will find out how it is still possible to optimize the risk/return ratio by cleverly diversifying your investment. Our series of articles, Learning to invest in eight lessons, offers you a comprehensive introduction to the topic of investing.

Disclaimer: Investing involves risks of loss. You must decide for yourself whether you want to bear these risks or not.

Errors excepted: We have written this article to the best of our knowledge and belief. Our aim is to provide you as a private investor with the most objective and meaningful financial information possible. However, should we have made any errors, forgotten important aspects and/or no longer have up-to-date information, we would be grateful if you could let us know.